0% GDP growth at 0% interest rate

Global banks imploding

Oil/Energy sector imploding

Oil/Energy sector imploding

Carry trade unwind accelerating

Defensive stocks rolling over

Nasdaq/breadth lagging

Institutions bailing

Momentum to the downside

Treasury yields falling

Corporate profits imploding

Mass complacency

ZERO LIQUIDITY

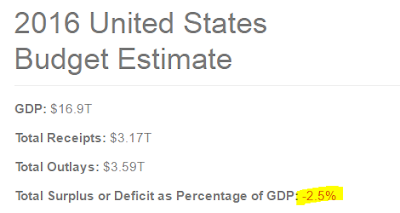

The U.S. is heading for 0% 1st quarter GDP "growth" by borrowing 2.5% from the grandchildren. Any honest generation would call that a recession, but this generation doesn't trust anyone who's honest...

"Anyone claiming that America’s economy is in decline is peddling fiction. (Applause.)"

ZERO LIQUIDITY

The U.S. is heading for 0% 1st quarter GDP "growth" by borrowing 2.5% from the grandchildren. Any honest generation would call that a recession, but this generation doesn't trust anyone who's honest...

"Anyone claiming that America’s economy is in decline is peddling fiction. (Applause.)"

This chart sums up the imploding state of Globalization, it's U.S. deflation (Treasury/TIP ratio) with Oil:

The U.S. is importing poverty which is deflating everything, including oil:

Global Dow with China's FX reserves

Global Financials

The Nasdaq (% of stocks above 200dma) is back in 2008:

Global Financials

The Nasdaq (% of stocks above 200dma) is back in 2008:

Recession stocks got hit hard today...

Brewers -3%: