Global risk assets have had their steepest short-covering rally since 2009. The bullshit flows non-stop. Stoned zombies focus on irrelevant political nuances while the real issues are totally ignored.

The monkeys have taken a good hammering, but nothing compared to what comes next...

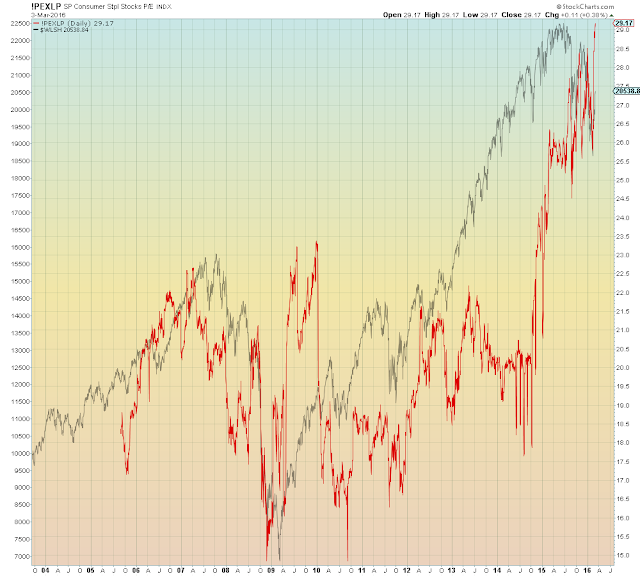

Risk aversion is rising, and the defensive consumer stocks are back above the rising wedge in a weekly overthrow:

The Price/Earnings ratio for defensive stocks is at an asinine extreme:

Corporate profits are already declining and forward earnings expectations are plunging...

ZH: March 1, 2016

The Great Corporate Earnings Fraud

"The increasing desperation of corporate CEOs is clear, as accounting gimmicks and attempts to manipulate earnings in 2015 has resulted in the 2nd largest discrepancy between reported results and GAAP results in history, only surpassed in 2008. The gaping 25% fissure between fantasy and reality means the S&P 500 PE ratio is actually 21.2 and not the falsified 16.5 propagated by Wall Street and their CNBC mouthpieces. True S&P 500 earnings are the lowest since 2010. Corporate profits only decline at this rate in the midst of recessions."

The monthly oil ground and pound, 100% correlated to global risk assets, has been scheduled for the foreseeable future...

USO ETF/Front-month contract ratio:

"Where's the dumb money when you need it?"

Global financials are getting obliterated compliments of negative interest rates, a dead IPO market, risk aversion, and receding trading revenue...

The League of Extraordinary money printers, who sponsored this entire party, finally admitted that they're out of ammo and their competitive debasement schemes are a zero sum game...

Global currencies have been in sideways mode during the entire global risk rally. No doubt due to the relentless Chinese FX reserve liquidation and sovereign wealth fund liquidations...

"What rally?"

Dollar/Yen:

Complacency and Groupthink:

Current bearish sentiment at 29% is slightly below the long-term average of 30.32%

When comparing (Bulls + Neutral) / Bears:

Growing risk aversion is evident in the rotation to defensive stocks, the growth/value ratio, and Semiconductors:

Shorts have covered in the steepest short covering rally since 2009...

Transports:

Bonus chart:

European Stoxx600 testing the neckline...