Those who own stocks right now have no fucking clue how the economy works, how markets work, and even less clue about reality. They are the lucky dunces who assume everyone else will get fucked over but not them. 2008 was a "once in a lifetime" debt crisis, fixed by borrowing more money...

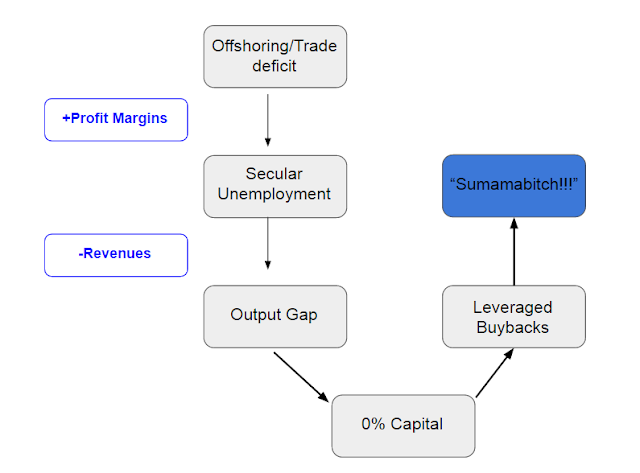

The corporate self-implosion process:

Jan. 27, 2016

The $29 Trillion Global Corporate Debt Binge

"Much of the cheap credit accumulated by companies was spent on a $3.8 trillion M&A binge, and to fund share buybacks and dividend payments."

One third of global companies are already Ponzi borrowers...

"The cost of raising and servicing capital is outweighing the returns companies get from it, a problem that Citigroup’s Financial Strategy and Solutions Group said has affected one third of all companies -- the majority of which posted shortfalls in each of the past three years. "

Musical chairs visualized

The cost of 1% in terms of jobs:

The 15 P/E S&P "Fair Value"

GAAP fair value is currently 35% below the market, and that's at current level of economic output. The stock market has never been more leveraged than it is now...all thanks to *Free* Trade...

We can safely assume there won't be any bailouts this time around...