U.S. stocks are at unprecedented overvaluation based upon profits/GDP, current GAAP PE ratios, and stock buyback chicanery which accounts for all of the profit "growth", now negative. Despite $500b in annual buybacks, per-share profits are at 2010 levels.

Flight to obliteration visualized:

Herein lies the problem - stoned zombies rotated out of 80 P/E Facebook into 45 P/E Special K. Based upon growth rate, the former is far less overvalued than the latter.

Flight to obliteration visualized

P/E ratio of the Consumer Staples sector:

Consumer Staples stocks / S&P ratio

The most overvalued stock market in human history:

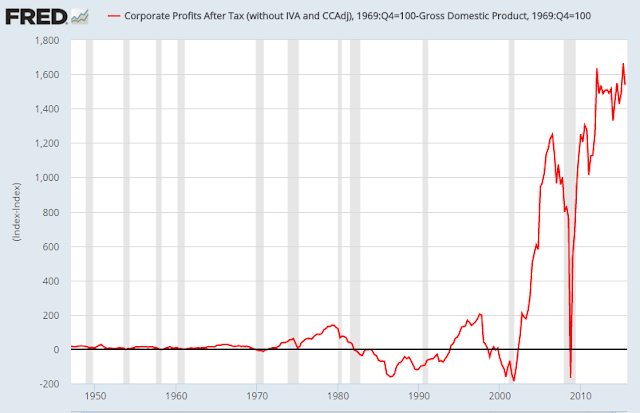

Bush Jr. looked the other way to corporate Shock Doctrine after 9/11. Post-Lehman, Obama looked the other way as Shock Doctrine 2.0 took profits to Level 11...

Corporate profits baselined to GDP:

This indexes profits and GDP to 1969 levels and then takes CP-GDP to show the difference in growth rates:

Apple has the biggest stock buyback program in the world...

Thanks to price decline AND stock buyback (share reduction), the company's market cap is down $200 billion since the peak...

"iPhoney11++ will fix this"

Companies with the biggest stock buybacks:

The hardest landing

S&P profits with Fed Funds rate