The Academy Awards are Feb. 28, and a leading contender for Best Picture, is the Big Short. It's the "comedy" about Wall Street profiting from mass bankruptcy and foreclosure, and then getting a free bailout. Oblivious dumbfucks laugh at these things because they assume it was a one-time event and that the system was "fixed" so it won't happen again. Imagine their surprise when meltdown takes place while they're watching a comedy about getting obliterated last time.

Utilities are leading the market right now. So I charted the S&P / Utility ratio. Per Idiocratic logic, I'm sure it will be different this time...

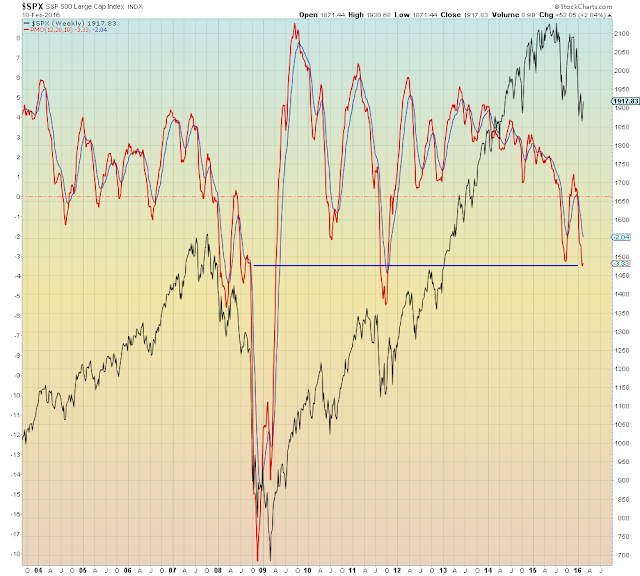

The Big Short 2.0:

The top performing hedge fund is up 16% year-to-date. It's a quantitative (computer/algorithm based) fund whose models have them ALL IN short right now...[2:40]