Globalization's margin call is underway, as sovereign reserves get liquidated at an accelerating rate...

Thanks to securitization, Globalized risk markets are 100% correlated and are unwinding at the push of a button. When a butterfly takes a shit in Thailand, the S&P drops 100 points. When China sells Treasuries in size, overleveraged hedge funds puke out Netflix. "Conditions tightening" means risk multiples are falling. Multiple compression is obliterating growth stocks, and it's just starting...

Securitization packaged and sold the future. Instead of having an economy based upon long-term investment, we have a pseudo-economy based upon incremental product gimmickry, financial engineering, rent-seeking, and worst of all liquidation.

Without securitization, investors would have to hold their positions for the long-term, providing stewardship and taking a vested interest in long-term outcomes. In other words, they wouldn't focus all of their efforts on foisting packaged shit on unsuspecting dunces, which is Wall Street's entire business model. Via securitization, all future cash flows can be packaged and sold at the push of a button. It's a rent-seeker's paradise. Pay off some politicians, get some rules changed, and move on to the next "investment".

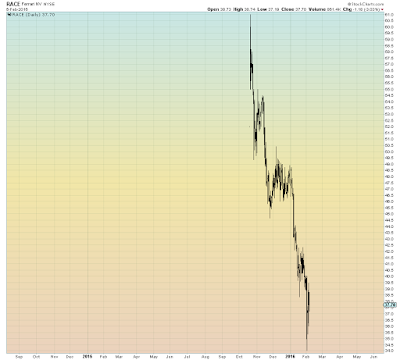

As it was in 2008, the shelf life of Wall Street's packaged garbage is getting shorter and shorter. This overpriced piece of shit (Ferrari) peaked on day one and has been vertical down ever since...

Securitization is what caused subprime, because banks stopped carrying the loans they originated on their own balance sheet, instead they originated shit loans and then sold them as "triple A" to Fannie Mae, which had to be bailed out by taxpayers (more on that below). Banks had no incentive to ensure that the borrowers were viable because they weren't holding the risk.

Speaking of subprime, the exodus out of China will make 2008 seem like a picnic. Two decades of imbalanced trade are unwinding, practically overnight...

Securitization has created an ocean of "hot money" circling the globe jumping in and out of local markets on microsecond boundaries to arbitrage differences in currencies and interest rates. Tourist money that is visiting secondary markets so that it can be sold at a moment's notice and then move on to scalp the next opportunity. In other words the money never enters the real economy. And now that hot money is flowing out of China at a staggering rate which is obliterating global risk markets. The global financial system can't handle two decades of imbalanced trade unwinding at the push of a button.

One year of China reserve outflow is almost double the size of subprime:

As it was in 2008, the shelf life of Wall Street's packaged garbage is getting shorter and shorter. This overpriced piece of shit (Ferrari) peaked on day one and has been vertical down ever since...

Securitization is what caused subprime, because banks stopped carrying the loans they originated on their own balance sheet, instead they originated shit loans and then sold them as "triple A" to Fannie Mae, which had to be bailed out by taxpayers (more on that below). Banks had no incentive to ensure that the borrowers were viable because they weren't holding the risk.

Speaking of subprime, the exodus out of China will make 2008 seem like a picnic. Two decades of imbalanced trade are unwinding, practically overnight...

Securitization has created an ocean of "hot money" circling the globe jumping in and out of local markets on microsecond boundaries to arbitrage differences in currencies and interest rates. Tourist money that is visiting secondary markets so that it can be sold at a moment's notice and then move on to scalp the next opportunity. In other words the money never enters the real economy. And now that hot money is flowing out of China at a staggering rate which is obliterating global risk markets. The global financial system can't handle two decades of imbalanced trade unwinding at the push of a button.

One year of China reserve outflow is almost double the size of subprime:

Securitization discounts all future cash flow into one price, hence giving extreme incentive to distort, warp, rent-seek perceptions about the future cash flow stream which of course is inherently unknowable. The S&P 500 today trades at the current level based upon assumptions of future cash flows which are fundamentally asinine and unfounded. Revenue streams are already declining at an accelerating rate. Profit streams are declining, but earnings per share is supported via stock buyback alchemy while insiders sell at a staggering rate. The usual bagholders have been conned into believing that current valuations are sound. It's the biggest fucking con game in human history.

Insiders have been cashing out for years...

The casino is a lawyer's paradise: in 2008, the U.S. government bailed out Fannie Mae, world's largest securitization machine, at the cost of $187 billion (and a doubling in U.S. debt, which will never be "paid back"). But for some reason the stock was still listed, so hedge funds bought it up for $.10 and sued the U.S. government saying that the bailout - without which the company would no longer exist - was "illegal".

Fortunately sanity in the courts has prevailed, so far. This fucking stock should be delisted forever. The same thing happened to AIG and that stock is still trading...

Insiders have been cashing out for years...

The casino is a lawyer's paradise: in 2008, the U.S. government bailed out Fannie Mae, world's largest securitization machine, at the cost of $187 billion (and a doubling in U.S. debt, which will never be "paid back"). But for some reason the stock was still listed, so hedge funds bought it up for $.10 and sued the U.S. government saying that the bailout - without which the company would no longer exist - was "illegal".

Fortunately sanity in the courts has prevailed, so far. This fucking stock should be delisted forever. The same thing happened to AIG and that stock is still trading...

Worst of all, this money is never invested in anything real. It's strictly in the casino side of the market i.e the secondary market which represents already issued securities.

Dec. 11, 2011 John Bogle:

"our financial system has gone off the rails. It's something we think of as providing capital for new businesses, that will enable people to finance new companies or add to the capital of existing companies. We do that to the tune of about $200 billion a year in financing through Wall Street, or through the financial system. And yet we do some $40 trillion worth of trading every year. I'm selling my investment to you, and you're buying it from me, and it creates no value for society."