The Ayn Randists are about to be buried by *free markets". When you don't give a fuck about anyone else, don't be surprised when no one gives a fuck about you...

Today's Ponzi Schemers don't really believe in free markets - they believe in minimal government intervention when times are good and maximum bailouts when their bets go sideways.

"Great news, oil is now a *free* market: Everyone is free to go bankrupt..."

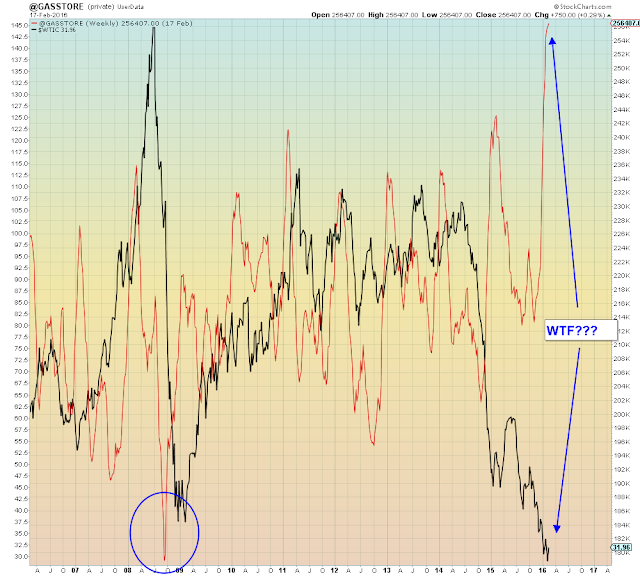

Oil price with gasoline inventories aka. "Channel stuffing"

Globalized poverty at 0% subsidized a 30 year oversupply in oil, creating a *free market* in oil. Meaning that all of the global oil producers are now "price takers", which in text book terms means they sell at marginal cost of production. When most of the costs are already sunk, that can be mighty low...

"over the past five years, the world has found a trillion extra barrels of oil—the equivalent of 30 years of extra supply—with a third of it coming from shale, a third from deep water, and a third from oil sands. Over the past year, the costs of recovery from these sources has noticeably fallen"

In real world terms, what this means is that trillions of dollars of poverty capital were overinvested in capacity, and then to Dumbfuckistan's surprise demand never showed up. Thereby rendering the vast majority of oil producing companies and nations insolvent.

For an insolvent entity, being a price taker means that marginal cost = variable cost. Fixed costs and sunk costs are no factor, because there are zero degrees of freedom. Debt payments don't wait.

Hyperbole around 'OPEC deals' is just that - oil gamblers and "investors" desperate to remain solvent for one. More. Day.

Price-taking visualized: The Saudis are in no position to cut production, they have zero degrees of freedom...

Saudi Riyal Devaluation Bets