Global Financial risks have never been higher

Global policy-makers, never more incompetent

Central Banks, never more depleted

Zombies, never more stoned...

Global policy-makers, never more incompetent

Central Banks, never more depleted

Zombies, never more stoned...

"This is not 1997 in broad daylight"

The Yen/Yuan carry trade unwind.

Pressuring Yuan lower and Yen higher, now in an accelerating momentum feedback loop imploding China, Japan, and global risk assets all at the same time

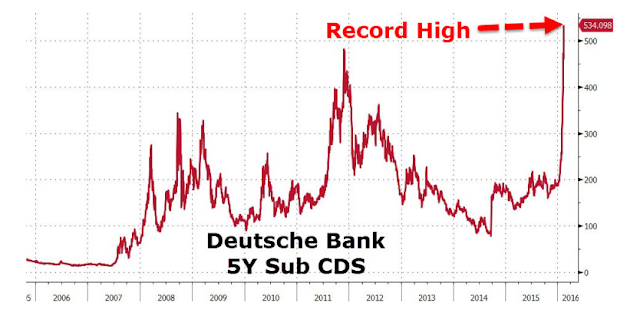

"This is not Lehman deja vu, although it certainly looks like it"

Central Banks' final act of desperation - paying people to borrow money, while obliterating global banks with negative interest rates

The Yen/Yuan carry trade unwind.

Pressuring Yuan lower and Yen higher, now in an accelerating momentum feedback loop imploding China, Japan, and global risk assets all at the same time

"This is not Lehman deja vu, although it certainly looks like it"

Central Banks' final act of desperation - paying people to borrow money, while obliterating global banks with negative interest rates

"Hang tight, an OPEC deal is imminent"

The daily oil implosion, featuring record high inventories, Lehman high volatility, and lowest daily close since 2003:

The daily oil implosion, featuring record high inventories, Lehman high volatility, and lowest daily close since 2003:

"This is a rare buying opportunity, last seen in October 2008"

Stock market technicals the weakest since 2008

Stock market technicals the weakest since 2008

"We've seen this before, I just can't remember when"

Implied volatility at the highest closing levels since the day before the August Flash Crash

Implied volatility at the highest closing levels since the day before the August Flash Crash

Sector rotation into the most defensive stocks in the market

"Anyone claiming that America's economy is in decline is peddling fiction"

GDP "Growth" highest in 10 years, all funded by borrowing - meaning de facto recession attended with Ponzi borrowing

GDP "Growth" highest in 10 years, all funded by borrowing - meaning de facto recession attended with Ponzi borrowing

Junk bonds and leveraged loans at lowest level since 2008

The daily Skynet gap and crap with liquidity at all time lows

The Average American $1,000 away from financial crisis

Generation Madoff leaning ALL IN on stocks

Team Groupthink aka. Wall Street/CNBS, blowing smoke up everyone's asses non-stop

A Federal Reserve "pausing" rate hikes at .25% until the economy floats back from China

Stoned zombies preoccupied with which game show host will be the next captain of the Titanic

Stock buybacks propping up a worthless stock market, while insiders cash out to the Cayman Islands, just like they did in 2007: