Data mining 101:

This is what financial Bernie Madoffs tell clients to keep them from selling i.e. there are a magical 25 days and if you miss those ones, you'll never retire...

It's called data mining - you selectively pick out the best days and then recalculate the returns without those massive rallies, leaving in the biggest down days of course. This would be true if the market was always trending, but the majority of the time the market is not trending, therefore big up days are followed by big down days etc. In last year's example, the Dow traversed 50,000 points and ended down on the year. If you only held the market on the up days, you would be up several hundred percent.

It gets much worse, ALL of the biggest up days are in bear markets. Meaning, to get the mega-rallies you first have to have the mega-collapse. The mathematically challenged constantly forget that a -50% loss (aka. 2009) requires a 100% gain to break-even.

The biggest up days are in bear markets, because that is when realized volatility is highest. Like now:

30 day standard deviation: If you miss out on the big up days it means you're not a bagholder...

Those who bought at the top in 1929, took 25 years to break-even. The Dow was down 90% from the top in 1929 to the bottom in 1932, and then and was up 100% in 1933 - it's biggest year EVER. Let's see, 10-9=1. 1x2 = 2. Third grade fucking math.

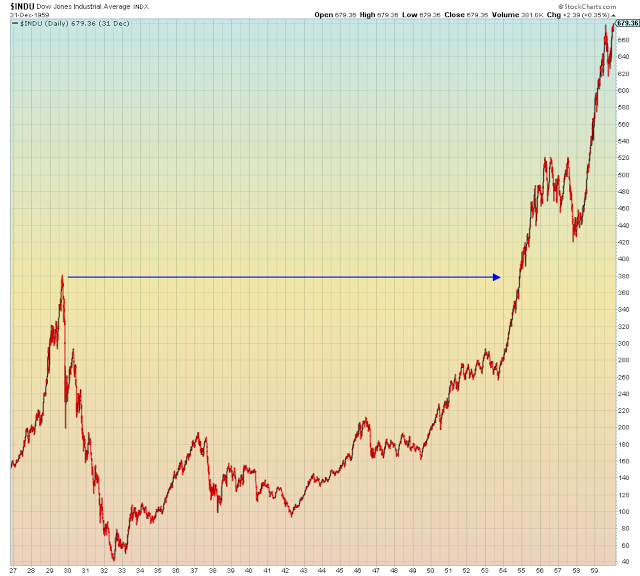

The Dow circa 1929.

Break-even was in 1955. Most had puked out their stocks long before that time...

Our grandparents learned their lesson in 1929, the Idiocracy has been through this two times already...

"My investment advisor tells me this is another buying opportunity..."

At the low last week, the Dow was 11% higher than it was in 2007, which is 1.4% compounded annually with a -50% drawdown in the middle, just to listen to eight years of CNBS...

This will be the lesson they don't forget...