The globalized economy is a colossal Ponzi Scheme in which the vast majority survive on the bread crumbs falling off the table. The possibility of 7 billion people achieving a consumption-oriented lifestyle is zero, so the World Bank conveniently set the poverty line at $1.25/day to legalize global slavery. As long as someone else's children are doing the suffering, it's "all good". Post-2008, this illusion was extended merely by plundering all future generations.

Saturday, January 30, 2016

All Aboard. Aye.

The red line is the ISE Call/Put ratio (5 dma). It measures the desire of gamblers to get monkey hammered. Again. It's almost back to the wave 2 top in risk seeking.

Thanks BOJ!!!

The 2014 Maginot Line was defended for the fourth time in two years.

At all costs...

This looks better...

Inverse volatility confirms the count...

Nasdaq 100 and oil 94% downside correlation...

Most shorted aka. "Frackers"

Up 30% in 6 days...

Jan. 30, 2016

Barron's: Five Tech Bargains to Buy now:

The economy's weakening, so double down on Western digital:

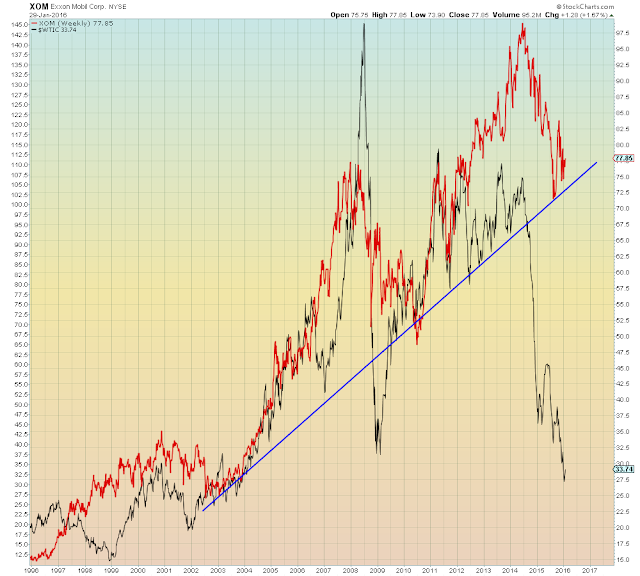

Exxon

Exxon long-term:

Apple

Aussie / Yen aka. Carry trades...

aka. Overnight risk (Aussies call it day risk):