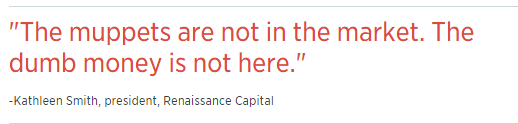

It's taken six years, but the 0%-binging reality skeptics are being hunted into extinction one asset class at a time: The super crash is a Y2K Tech bubble, a 1929 fake consumption euphoria, a 1997 EM Crisis, and a 2008 credit binge, all rolled into one. Generation Madoff can't admit that the Globalized Ponzi scheme is the root cause of the problem, because it's the source of their fake wealth. That's a problem that is in the process of fixing itself one muppet show at a time...

This just in:

The IPO market is dead and private technology venture companies are now stranded at all time high valuations...Silicon Valley is shitting a brick...

The Y2K/1929 countdown has been confirmed:

Another generation of IPO muppets slain...

"Sixty-five IPO deals have been canceled this year, the most since 2012...The market is likely to see as few as 180 initial public offerings in the U.S. by the end of the year...a 35 percent decline from last year's deal flow."

"The average third-quarter IPO fell 19 percent after its initial pop, with 87 percent of companies going public losing ground after the dust cleared"

Dead Unicorns

Among those unicorns is ride-hailing company Uber, worth $51 billion; electronics company Xiaomi, worth $46 billion; and short-term apartment rental site Airbnb, worth $25.5 billion, according to a recent Fortune ranking.