The "2 + 2 = 5" denialistic self-implosion

This just in...

"Cash-out refinances jumped 68 percent in the second quarter from a year ago...This is the highest volume of this type of refinance in five years."

The biggest rallies are in bear markets. It's a sign that bears are capitulating while bulls hang themselves with false hope...

50 week moving average:

Monthly momentum:

Breadth: Stocks (not) participating in the rally:

52 week price range of average stock...

Relative Strength (RSI)

Measures the strength of recent rallies to recent declines:

Global market alignment deja vu 2008:

NYSE: highs-lows:

No capitulation

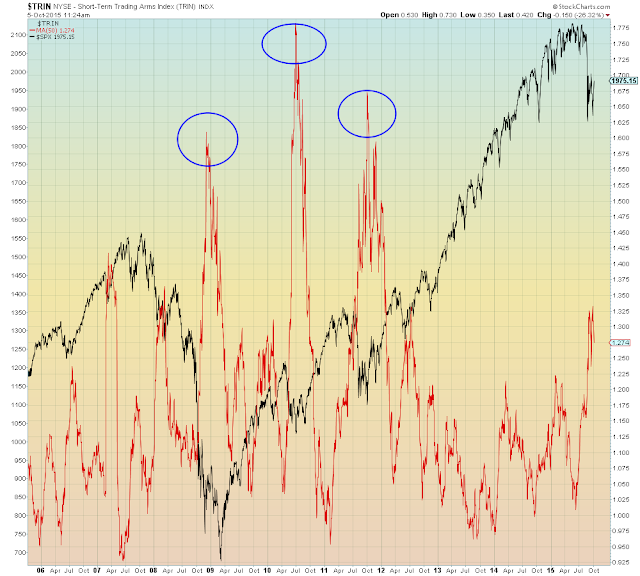

TRIN: Trading Index (Selling intensity)