The main drawback to being a reality skeptic is you never know when you're about to be clubbed like a baby seal. Again.

A triple hurricane is bearing down on the markets and the straw hut CasinoConomy. The reality skeptics have identified a fantastic buying opportunity...

The peak in ALL risk assets has ALREADY occurred over the past weeks, months and years. An event that passed totally unnoticed by stoned zombies. The only risk asset yet to peak are machine guns which always peak last. (As always, invest at your own risk).

The initial slow stair-step lower was to keep the sheeple from panicking. The first sign of acceleration came with the Yuan devaluation, August 11th. Momentum is building to the downside with each passing moment. All risk assets had a dead cat bounce last week, meaning that everything is in synch to the downside...

Aside from the straw hut economy - albeit the most important factor - the gathering storms weighing on stocks right now are:

1. Extreme divergences in breadth

"Buy the fucking dip"

Which equates to this asinine Skynet chicanery:

2. Declining Social Mood aka. Risk aversion...

Rydex asset allocation bull:bear

3. Yen Carry Trade Unwind

The Yuan devaluation hammered commodity currencies, forcing the Yen carry trade to reverse for the first time since Lehman. And before that the Asian currency crisis.

Yen and S&P are tracking 1:1:

The third Aussie / Yen Carry Unwind in 15 years:

There hasn't been a reversal like this since Lehman. The Yen is strengthening against all commodity currencies...

4. Volatility short squeeze

Last week's spike in the spot VIX inverted the futures curve. Now those who shorted volatility are getting squeezed harder with each passing day as front month futures converge with the higher spot VIX...

Black line is the spot VIX 10 DMA, Red line is the ratio of spot/futures i.e. the spike that caused the curve to invert...

5. Totally Ignored Flash Crash last week aka. "buying opportunity"

Nasdaq 100 -15% in 1 minute

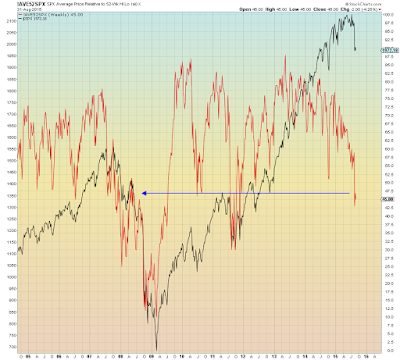

6. Decoupling from reality

The greatest risk faced, is that the fantasy narrative of the U.S. being "decoupled" from Emerging Markets, is a fantasy narrative, and there's no one around to warn the sheeple...

Dow with Shanghai Comp: