At the last two market tops the Fed was actively lowering interest rates as the stock market fell. This time, the Fed is planning to raise interest rates as the market rolls over...

Value Line Geometric Index with interest rates

The Fed is removing liquidity at the exact same time as investors reduce risk, buybacks are peaking, mergers are peaking and global carry trades are RISK OFF. We've never seen this confluence of liquidity removal before...

Weekly Money Flow:

Fed Balance Sheet with Russell 2000

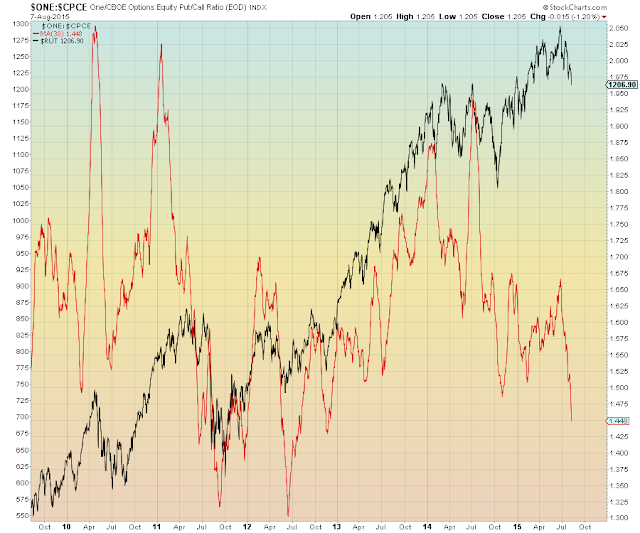

Liquidity is no longer expanding

Etrader Enthusiasm Index aka. Equity Call / Put (CPCE inverted)

Peak buybacks

Stock buyback Index (Companies with largest buybacks)

Momentum / High Beta Trades (Biotech etc.)

Russell / Dow Ratio (Small caps / large caps):

A "Black Swan Event" called everyone on the same side of the boat.