The Fed gazed into their magic 8 ball today and couldn't locate the economy. They'll try again next month, as they've been doing for the past six years - human history's largest circle jerk. In the meantime, they will provide free financing for stock buybacks and jobs automation projects.

As usual, the stock market was euphoric at news of the still-missing economy, Dow up 120. Skynet used the occasion to force all shorts to cover in the most beaten down real-economic sectors: energy, transports, resources etc. While the casino stocks (Biotech, momentum etc.) lagged.

Thanks to the Fed's short-covering rally, all sectors are now CYNK'd to the downside.

Casino and 'Conomy now pointing down:

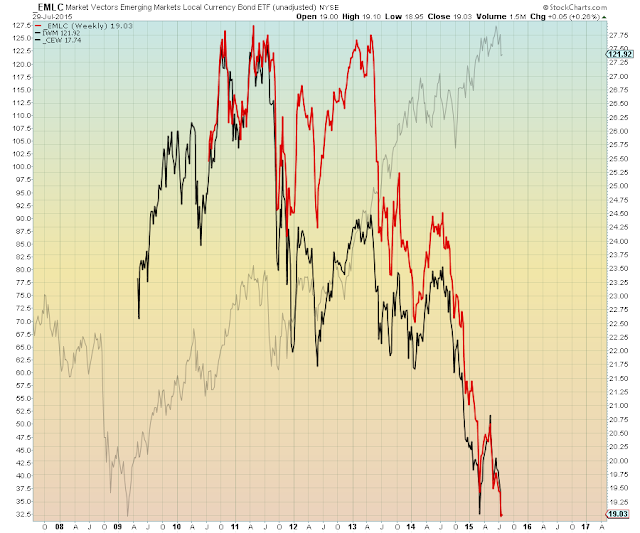

EM Credit and EM Currencies

Oil and oil stocks

Commodities and Global GDP

Global Stock markets:

Shanghai and U.S. Dow:

Small Cap stocks with NYSE Composite Internals:

Dow back tests the 200 day...

Prechter is ~CYNK'd with this Dow count (STU: July 29, 2015):

"...it may be a series of first and second waves lower that will morph into an larger impulse wave lower"...

(but overall still clusterfucked)...

Fortunately Skynet gave us some clues as to what comes next, because those two bottom gaps are below the 200 DMA, which is where this shit show gets interesting...