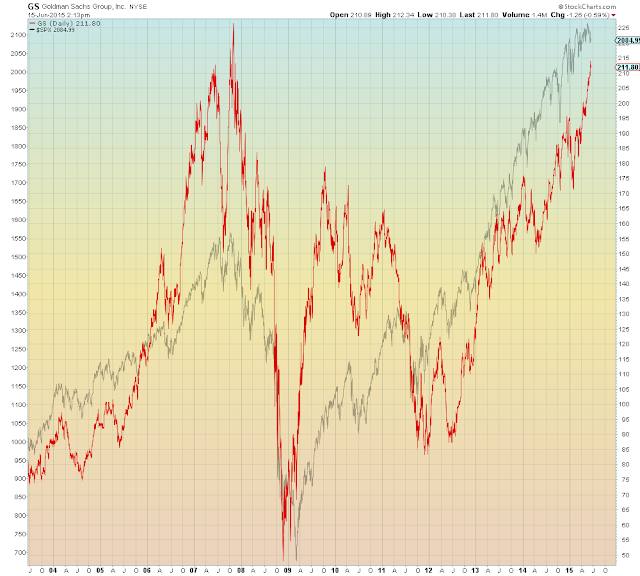

It's covered, like 2008. The Casino Risk Index is at the same level as 2007

Goldman manages global systemic risk the same way they managed subprime - for maximum profit. It's managed in one direction: ever-higher, by whatever PhD invented alchemy is necessary. Working in lockstep coordination with their network of alumni croupiers, running the global Central Banks.

While the economy gets monetized.

Until it all implodes. Then it's all handed back to taxpayers. You know, the ones being monetized.

It's their hen house, we just live in it:

The Las Vegas Sands "Stress" Index

As we see from 2007, implosion risk is highest when "stress" aka. volatility is lowest because risk is binary: Low today, off the charts tomorrow. None of which is predicted by the (In)Efficient Market Hypothesis for Blind Men, which assumes that markets are perfect and never wrong - despite constantly mispricing assets at their highest levels right before they collapse.

"Risk" is lowest when the maximum amount of borrowed money has been thrown away at the casino:

Markets are always priced the highest right before they collapse. Finance isn't scientific and it's not "rational", it's legalized gambling with other people's money. All legitimized by PhDs and Nobel Prizes.

It's Dumbfuckistan on steroids.