Throughout the "wreckovery" there has been an ever-growing divergence between the real economy and financial risk-seeking. Central Banks have incentivized investors to ignore every type of economic risk.

Chasmic Economic Divergences

Debt Per Capita

Debt-adjusted GDP growth

Jobs Per Capita

Middle Class wealth

Middle Class income

Commodities

Global Trade

Global deflation

Global debt levels

Global debt levels

Have all steadily deteriorated and are now reaching stall speed.

Shock Doctrine Visualized

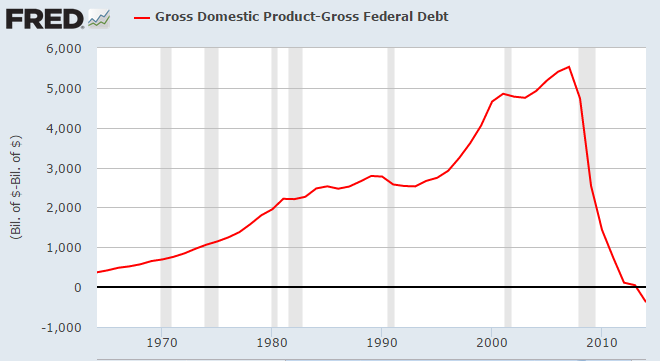

The first massive divergence between economic and financial risk was evident immediately in 2009 when sovereign debt accumulation exploded with minimal economic effect.

GDP - Debt: This figure had been rising for forty years straight, but then 'something' changed in 2008. Due to the massive (8 million) job losses, all of the new debt fell straight to the corporate bottom line. It bypassed the economy. The vaunted counter-cyclical 'Keynesian' multiplier which had been squandered for 30 years straight on tax cuts and military adventures, was no longer working. Like taking antibiotics for 30 years straight and then acting like a stunned dunce when they stop working:

Velocity of Impact

As the divergence between risk-seeking and economic fundamentals grows with each passing day, so too does the velocity of impact. To say that Central Banks don't have an exit strategy is to miss the point - that would entail a lessening of risk-seeking behaviour in the face of growing risk. Quite the contrary, what Central Banks have created is an accelerated impact strategy by which investors are slammed into the brick wall of economic reality at terminal velocity.