ZH: Feb. 9, 2015

Meet the $25 million grilled cheese truck

It only lost half its value in a month:

And Straight From the WTF? File...

The globalized economy is a colossal Ponzi Scheme in which the vast majority survive on the bread crumbs falling off the table. The possibility of 7 billion people achieving a consumption-oriented lifestyle is zero, so the World Bank conveniently set the poverty line at $1.25/day to legalize global slavery. As long as someone else's children are doing the suffering, it's "all good". Post-2008, this illusion was extended merely by plundering all future generations.

Saturday, February 28, 2015

Cage of Fear: The Cost of Faux News Is Freedom

The NSA, CIA, FBI, ATF, DEA, DHS were all created in the past 80 years. Government is no longer accountable to the people, the people are now accountable to Government.

John Locke on Government Accountability

"According to Locke all legitimate political power derives solely from the consent of the governed to entrust their "lives, liberties, and possessions" to the oversight of the community as a whole, as expressed in the majority of its legislative body"

"When great mistakes are made in the governance of a commonwealth, only rebellion holds any promise of the restoration of fundamental rights. Who is to be the judge of whether or not this has actually occurred? Only the people can decide"

"On Locke's view, then, the possibility of revolution is a permanent feature of any properly-formed civil society."

"Terrorism" is a statistically de minimis threat to most Americans, yet it has given Big Brother full rein.

Faux News is fascist Pravda for comfort-seeking morons.

"Terrorism" is a statistically de minimis threat to most Americans, yet it has given Big Brother full rein.

Faux News is fascist Pravda for comfort-seeking morons.

A Corrupt Society Can't Recognize Corruption

There 's only accountability at the bottom of this Ponzi Scheme. Zero accountability at the top. If an inner city youth steals a chocolate bar, he pays a heavy price. If Goldman Sachs invents a "synthetic" debt obligation, packs it full of the worst subprime mortgages in the country and sells it with a AAA rating only to watch it implode mere months later, they get bailed out for $13 billion at 100 cents on the dollar.

And six years later, they get another $2 billion:

Success in any endeavour, requires three key factors: luck, capability, and hard work. Absent any one of those factors and failure is inevitable. This society right now is running solely on luck. Capability and hard work have left the building.

And luck is running out.

The Vampire Squid Visualized:

Let's see how the gamblers like their bailouts when this shit show collapses.

A Centrally Planned Stampede From Risk

The bear market in U.S. stocks began 8 months ago

The major indices are merely held up by the last few mega-cap stocks like Apple (which we learned today gets 85% of its profits from the iPhoney NSA location tracking device).

Therefore, the next leg down will be the "unforeseen" crash:

NYSE Composite with percent of stocks above 200 Day Moving Average. We haven't seen this since right at the last peak in 2007:

Nasdaq 5000 and bust:

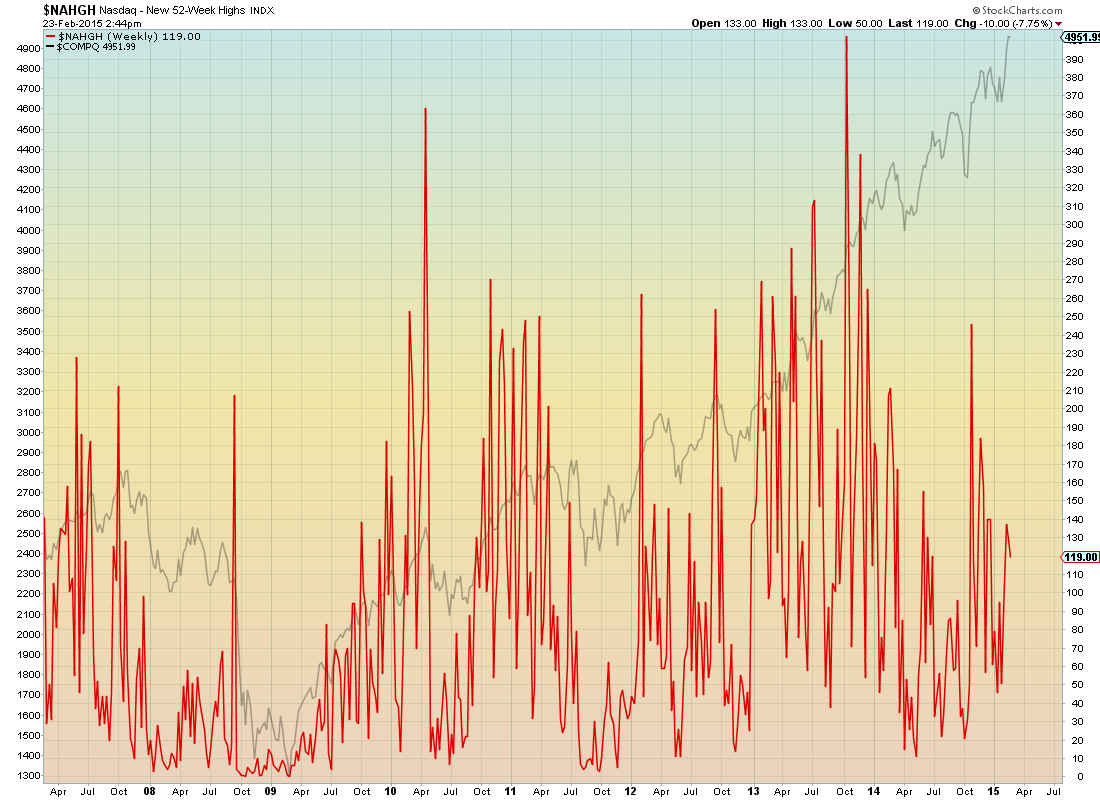

New 52 week highs

The True Dow

52 week range of the average Dow stock (correlation bottom pane):

The major indices are merely held up by the last few mega-cap stocks like Apple (which we learned today gets 85% of its profits from the iPhoney NSA location tracking device).

Therefore, the next leg down will be the "unforeseen" crash:

NYSE Composite with percent of stocks above 200 Day Moving Average. We haven't seen this since right at the last peak in 2007:

Nasdaq 5000 and bust:

New 52 week highs

The True Dow

52 week range of the average Dow stock (correlation bottom pane):

Friday, February 27, 2015

The Facade Is Crumbling

Plausible deniability has left the building

There was a brief time during this six year clusterfuck, well after the bailout was shoved up the ass of taxpayers, after it became clear that there would be no accountability for 2008, but between recurring European debt crises, after the Flash Crash and Occupy Wall Street, but before grilled cheese food trucks went public, and prior to Dodd-Frank being rolled back by Congress - WHEN we could all just stick our heads up our asses and pretend that this was all just business as usual. It was a brief time, granted. It may have been a Sunday in 2013.

There was a brief time during this six year clusterfuck, well after the bailout was shoved up the ass of taxpayers, after it became clear that there would be no accountability for 2008, but between recurring European debt crises, after the Flash Crash and Occupy Wall Street, but before grilled cheese food trucks went public, and prior to Dodd-Frank being rolled back by Congress - WHEN we could all just stick our heads up our asses and pretend that this was all just business as usual. It was a brief time, granted. It may have been a Sunday in 2013.

However, unfortunately, that time has passed. Because this is not a canary in the coal mine, this is a multi-trillion dollar lit fuse in a coal mine:

All Commodities:

All Commodities:

Which leads us to the next question: How fucking stoned is the Idiocracy right now? There's the Prozac, the cheeseburgers, the ESPN, the Kardashians, the CNN, the Faux News, the Learning Channel devoid of learning, the History Channel devoid of history. Plenty of ways to get baked.

Too stoned to see it coming.

Getting to Crash Via Centrally Planned Capitalism

We have no right to believe that this won't all end catastrophically. Sooner rather than later.

Central bank money printing has driven all of the global risk markets to varying degrees for six years straight, however, currently a few markets are in the manic grip of Central Bank delirium. We've been dealing with this insane bullshit for so long now, that everyone just assumes it can go on forever. Which is exactly why it won't i.e. the seeds of panic have been sown.

The Land of the Setting Sun:

German DAX

European composite stock market

Never cry "inevitable collapse". Inevitable is not a timeframe that the Idiocracy understands.

Bad News Bulls

Straight from the "no shit" file:

CNBC: Feb. 26, 2015

The U.S. Wreckovery is a Fraud

"The downturn in U.S. profits is accelerating and it is not just an energy or U.S. dollar phenomenon – a broad swathe of U.S. economic data has disappointed in February"

How to generate a stock market crash

Combine a market at all time highs with collapsing profits. There will be no buyers under this steaming pile:

Combine a market at all time highs with collapsing profits. There will be no buyers under this steaming pile:

Peak Carbon Visualized

The oil industry is the new subprime. And it's on the verge of implosion

Both the supply and demand for oil have been massively subsidized by globalization, which supported $100/bbl oil for a relatively short period of time. That paradigm ended extremely abruptly and "out of nowhere" in mid-2014. 0% interest rates and historically low cost of capital for both consumers and producers allowed the market to clear at the higher price level. As those financing incentives are now being systematically removed, the market ultimately will only clear at a much lower level of output.

Futures-based arbitrage is artificially supporting oil prices

SUV owners are currently enjoying low oil prices AND ample supply, merely because frackers and other marginal producers are over-producing in a futile bid to forestall bankruptcy as long as possible. In doing so, collectively, of course, they are only expediting the process.

Both the supply and demand for oil have been massively subsidized by globalization, which supported $100/bbl oil for a relatively short period of time. That paradigm ended extremely abruptly and "out of nowhere" in mid-2014. 0% interest rates and historically low cost of capital for both consumers and producers allowed the market to clear at the higher price level. As those financing incentives are now being systematically removed, the market ultimately will only clear at a much lower level of output.

The Long-term Supply/Demand for Oil:

The trillions in exploration investments now being shelved, represent an exogenous leftward shift to the long-term supply curve (dotted). The exogenous reduction in demand that initiated the current price collapse, represents a leftward shift in the demand curve (dotted line). Short-term, supply and demand are currently still clearing at the lower price level and the higher output rate (Q0), however, once readily accessible reserves are exhausted, the long-term supply constraint will take effect due to lack of investment. We know that the demand curve shifted because the halving in price has lowered demand not increased it.

Price will be extremely volatile in this future paradigm as represented by the question mark, however, oil production will be unambiguously lower:

Futures-based arbitrage is artificially supporting oil prices

SUV owners are currently enjoying low oil prices AND ample supply, merely because frackers and other marginal producers are over-producing in a futile bid to forestall bankruptcy as long as possible. In doing so, collectively, of course, they are only expediting the process.

CNBC: Feb. 25, 2015

The ability to store unprecedented amounts of oil onshore and in offshore ships is financed by the upward sloping futures curve (contango), which has artificially supported spot oil prices via arbitrage. On the other (long) side of the trade, oil buyers (refiners etc.) have been taking advantage of low oil prices to lock in future prices going out several months into the future. Nevertheless, as available storage space dwindles and tanker shipping rates go up, the full extent of downward pressure will be finally exerted on spot and future oil prices:

"We're going to see pretty fast inventory builds over the next few weeks," Francisco Blanch, head of commodity research at Bank of America-Merrill Lynch, told CNBC Wednesday, noting that global supply is running around 1.4 million barrels a day above demand."

"both WTI and Brent will fall toward $30 a barrel."

"As much as 80 percent of the commercially available storage in the U.S. may already be utilized"

"Tanker prices and lease rates have doubled over the past 18 months"

"Citigroup is forecasting oil prices to fall toward $20 a barrel before recovering."

There Will Be Blood

So far, the financial markets have artificially cushioned the downside collapse in oil, but that support is about to be removed.

The locus of risk: Junk bonds i.e. the funding source for fracking:

a-b-c:

Generation Liquidation

NYT: Feb. 27, 2015

"Rational self-interest" taken to its inevitable conclusion, by monetizing the future.

Carlyle founders were paid $800 million in 2014 to dismantle the U.S. economy and otherwise leverage it 10x

Their take from 2013 was $750 million.

Ten U.S. generations built the economy, and the last one sold it off. A generation of buffoons, too lazy to build and sustain a real economy.

This will be known as the generation that laid itself off, while worshipping false idols all the way to collapse:

"Rational self-interest" taken to its inevitable conclusion, by monetizing the future.

Thursday, February 26, 2015

This is All A Test. Of Honesty and Humility

Pass or Fail.

Those who assume that "we" are better than "them", didn't show up for the exam.

Those Who Don't Learn From History. Lose Everything.

"Stocks have reached a permanently high plateau" - Irving Fisher, 1929

"Irving Kahn, who shorted the 1929 crash, dies at 109"

(a lot of Irvings in those days)

(a lot of Irvings in those days)

MAX COMPLACENCY: The new permanent plateau

Greenspan: "Effective demand is as weak as the late 1930s"

"The way I measure it, it's probably tantamount to what we saw in the later stages of the Great Depression,"

Forty years ago, a 20% output gap was called a severe recession:

Pax Americana Visualized

U.S. overseas military power is primarily projected via aircraft carriers

Peter Coyote: Actor and 1960s activist:

"The failure to curb personal indulgence was a major collective error. Our journeys down the path along with Verlaine and Rimbaud, disordered our senses, senselessly wasted young lives, and often sabotaged what we labored so diligently to construct. ... It is the artist's responsibility to manifest sanity and health—something we did not fully understand."

Substitute acid for Prozac. Nothing's changed.

So the Iranian military spent the week training on how to blow them up:

The draft dodging Hippy-crite generation that vehemently refused to go to war, sent its children to war instead, and the result has been nothing less than a total fucking disaster.

Peter Coyote: Actor and 1960s activist:

"The failure to curb personal indulgence was a major collective error. Our journeys down the path along with Verlaine and Rimbaud, disordered our senses, senselessly wasted young lives, and often sabotaged what we labored so diligently to construct. ... It is the artist's responsibility to manifest sanity and health—something we did not fully understand."

Substitute acid for Prozac. Nothing's changed.

Houston, You Have a Fucking Problem

The stored supply of U.S. crude

The weekly production of U.S. crude

Highest level since 1973

This is demand (red line) with the price of West Texas Intermediate (black line)

This is for all of the denialists who have to believe that this isn't a demand problem

According to this chart, if exogenous demand hasn't fallen, then the U.S. elasticity of demand would have to be negative i.e. lower prices make people want to consume less. Which is total fucking bullshit.

So far, the effects of low oil prices has been to kill future oil exploration projects, measuring in the trillions of dollars. However, short-term, daily oil production has steadily increased as oil suppliers attempt to offset low prices with increased volume, to maintain overall revenue and "maintain market share". A strategy that works great when one entity tries it, but fails catastrophically when everyone tries it.

Kind of like outsourcing.

Wednesday, February 25, 2015

The House Always Wins

Wall Street is monetizing the last few gamblers

This is the NYSE - not the NYSE composite index - the actual holding company that owns the New York Stock exchange:

This is the Nasdaq holding company

I think we all see where I'm going with this...

Tuesday, February 24, 2015

The New Rome: Collapse By The Book

Hubris, strategic overreach, military adventurism, energy depletion, depletion of the Treasury, monetary debasement, spectacle, moral decay

ZH: Feb. 23th, 2015

In the story of the week, Russians painted "To be delivered to Obama" on a mocked-up nuclear missile and paraded it through town. Fortunately, Faux News and CNN were too busy blowing smoke up everyone's ass to notice. If you really squint, in the lower right it says this is the "Optimistic Channel"...

ZH: Feb. 23th, 2015

In the story of the week, Russians painted "To be delivered to Obama" on a mocked-up nuclear missile and paraded it through town. Fortunately, Faux News and CNN were too busy blowing smoke up everyone's ass to notice. If you really squint, in the lower right it says this is the "Optimistic Channel"...

"What ISIS Really Wants":

One centrally dictated version of ancient gibberish for everyone

ISIS has decided that there shall be only one version of subjectively interpreted gibberish for everyone on the planet, which shall be centrally dictated by the caliphate which was established in 2014. Anyone who deviates from that centrally dictated singular version of 700 A.D. derived 'truth' will be stoned, crucified, burned to death, beheaded or enslaved, depending upon various religious criteria that I've already forgotten. 'Apostate' Muslims in many cases will be treated worse than Christians and (yes) Jews, if they don't instantly repent and submit to the caliphate. The order of annihilation will be Iran/Shia, Saudi/Apostate Sunni, and finally Israel - more on that below. The U.S. 'Crusaders' will be dealt with at Dabiq, a city in Syria.

Therefore, as for the U.S., basically ISIS just wants Johnny McCain & the merry band of NeoCons to keep blundering around like stoned sailors on leave i.e. maintain status quo. According to their own glossy online magazine "Dabiq", ISIS wants the "Crusader" armies to re-invade Iraq and Syria culminating in a great battle at Dabiq Syria:

Serial blunderer Johnny McCain, the Donald Trump of the U.S. Senate, gets special mention in the second issue of Dabiq:

http://media.clarionproject.org/files/09-2014/isis-isil-islamic-state-magazine-Issue-2-the-flood.pdf

"On 12 June 2014, the crusader John McCain came to the senate floor to rant irritably about the victories the Islamic State was achieving in Iraq. He forgot that he himself participated in the invasion of Iraq that led to the blessed events unfolding today by Allah’s bounty and justice."

It gets better, or worse, depending upon how much you like crazy shit. Following upon the resounding inevitable defeat of the infidel crusaders at Dabiq, the dwindled Islamic State will then face the Anti-Christ in Jerusalem. At the brink of defeat, the Islamic State will be rescued by the second coming of Jesus. I'm not making this shit up.

For their part, the NeoCons were just today debating whether or not to re-invade Iraq:

"We Won't Get Fooled Again". Yes you did...

The irony of a monetary crack dealer warning its junkies of overdose...

Feb. 24th, 2015: Federal Reserve via ZH

"New (junk bond) deals continue to show signs of weak underwriting terms and heightened leverage that are close to levels preceding the financial crisis."

Mission O'Complished.

Overdosed dopium junkies visualized i.e. Junk bonds:

CNBC: Feb. 22, 2015

Nasdaq 5000: This time is different?

"Are we in another bubble? It's certainly possible"

"Say what you will about the hefty losses recorded by companies going public today..." ???

"If the Federal Reserve raises rates, or the economy shows signs of strain, or investors lose their appetite for risk, what happens to all those money-losing businesses that were counting on heavy doses of future financing to keep the lights on? The result will surely be painful,.."

The main difference between now and Y2K, is that today, profits as a % of GDP are at all time record high and 2.5x higher than they were 15 years ago, making any (P/E) valuation comparisons between then and now, wholly specious. Of course that doesn't stop the psychopaths from making them.

Introducing "Box". This one goes to "11"

Box lost $165 million on sales of $192 million i.e. they sell dollar bills for fourteen cents. They have 1.5 years of cash left at the current burn rate. The market's price/sales ratio is 1.83, for Box it's 11.

The European version of this widely embraced delusion

Stoxx600 European stock market composite. How pathetic is this shit?

Y2K[Dotcom] x 2008[Lehman] x 1998[LTCM] = $Everything

Fools fooling themselves.

Feb. 24th, 2015: Federal Reserve via ZH

"New (junk bond) deals continue to show signs of weak underwriting terms and heightened leverage that are close to levels preceding the financial crisis."

Mission O'Complished.

Overdosed dopium junkies visualized i.e. Junk bonds:

CNBC: Feb. 22, 2015

Nasdaq 5000: This time is different?

"Are we in another bubble? It's certainly possible"

"Say what you will about the hefty losses recorded by companies going public today..." ???

"If the Federal Reserve raises rates, or the economy shows signs of strain, or investors lose their appetite for risk, what happens to all those money-losing businesses that were counting on heavy doses of future financing to keep the lights on? The result will surely be painful,.."

The main difference between now and Y2K, is that today, profits as a % of GDP are at all time record high and 2.5x higher than they were 15 years ago, making any (P/E) valuation comparisons between then and now, wholly specious. Of course that doesn't stop the psychopaths from making them.

Introducing "Box". This one goes to "11"

Box lost $165 million on sales of $192 million i.e. they sell dollar bills for fourteen cents. They have 1.5 years of cash left at the current burn rate. The market's price/sales ratio is 1.83, for Box it's 11.

The European version of this widely embraced delusion

Stoxx600 European stock market composite. How pathetic is this shit?

Y2K[Dotcom] x 2008[Lehman] x 1998[LTCM] = $Everything

Fools fooling themselves.

Fools and Their Money. Are Soon Parted

Quick: Which sector peaked first leading up to 2008? Housing. Which sector is playing catch-up now? Housing

Sad. But true.

What does lumber know that housing Etraders don't know?

What do housing starts know that housing stocks don't know"

i.e. that housing starts are at 1960s recession levels and the U.S. population has since grown by 100 million...

Clearly, this is more archaeology than blogging.

Monday, February 23, 2015

The Soylent Idiocracy: Disposable Corporate Batteries

An unquestioning Borg, at one with the machine

Fake recovery, fake economy, fake stock market, fake leaders, fake political system, fake religion, fake news, fake wars, fake food

Fake future

All by and for fake people. iGadgetized zombies at one with their fabricated Social Media Matrix.

Disposable corporate batteries, approaching end of use.

Disposable corporate batteries, approaching end of use.

Never Cry Wolf of Wall Street

Capitulation: It's Lonely At the Top

CNBC: Feb. 23rd 2015

CNBC: Feb. 23rd 2015

"After years of underperforming the market, hedge funds have gotten hot on stocks. Allocations in the $3 trillion industry have turned to their most bullish positions ever"

"hedge funds again are hitching their hopes to Apple"

"fund managers have increased bullish positions on the Nasdaq index at the "strongest pace in more than a year."

ALL IN Visualized: Rydex asset allocation

Nasdaq New 52 week Highs Lies

WAY back in Y2K, Cisco was the most valuable company in history with a market cap of $500 billion+. Now, it's worth $150 billion. Fast forward and Apple is now the most valuable company in history, with a market cap of $770 billion. Since January 2nd, Apple's market cap has increased by $150 billion - i.e. one Cisco added in 7 weeks.

"One trillion dollars. That's how much at least one analyst believes Cisco Systems Inc. will be worth in a few years--and you'd be hard pressed to find anyone to disagree."

Unfortunately, 69% of Apple's revenue comes from the iGadget du jour aka. the latest Crackberry

w/Nasdaq in background:

This is the set-up we've been waiting for, but as is wholly necessary prior to collapse, no one is around to see it. There's no shorting subprime now, so from a Wall Street point-of-view this will make 2008 seem like a fucking picnic.

Too bad the sheeple have to get fleeced all over again by the same psychopaths as last time. And the time before...

Too bad the sheeple have to get fleeced all over again by the same psychopaths as last time. And the time before...

Wednesday, February 18, 2015

Straight to the Crash: Skip the Foreplay This Time

Like 2008 never ended. Because it didn't.

MW: Feb. 17, 2015

In the past six weeks, earnings expectations for this current quarter (ending March 31st), have dropped 7.7%

MW: Feb. 18, 2015

Stocks and Economic data are diverging like they did prior to the last two recessions

Low oil prices were good for Transports all last year. But not anymore. Who needs low energy costs, if there is nothing to transport?

Transports / Energy Sector Ratio:

Baltic Dry Index down another four percent today to a new all time low going back to 1986:

There are no buyers waiting underneath this shit show.

Unlike 2007/2008, money printing central planners have conveniently decided we don't need any warning this time.

Growth:Value ratio:

MW: Feb. 17, 2015

In the past six weeks, earnings expectations for this current quarter (ending March 31st), have dropped 7.7%

MW: Feb. 18, 2015

Stocks and Economic data are diverging like they did prior to the last two recessions

Low oil prices were good for Transports all last year. But not anymore. Who needs low energy costs, if there is nothing to transport?

Transports / Energy Sector Ratio:

Baltic Dry Index down another four percent today to a new all time low going back to 1986:

There are no buyers waiting underneath this shit show.

Subscribe to:

Comments (Atom)