You don't say.

The Chamber of Commerce is outraged at the new rules limiting corporate tax inversions. Basically, having plundered the U.S. economy of jobs, now these "non-citizen" multinational corporations want to change their headquarters so they can disgorge their cash hoards to offshore bank accounts at the lowest possible tax rate.

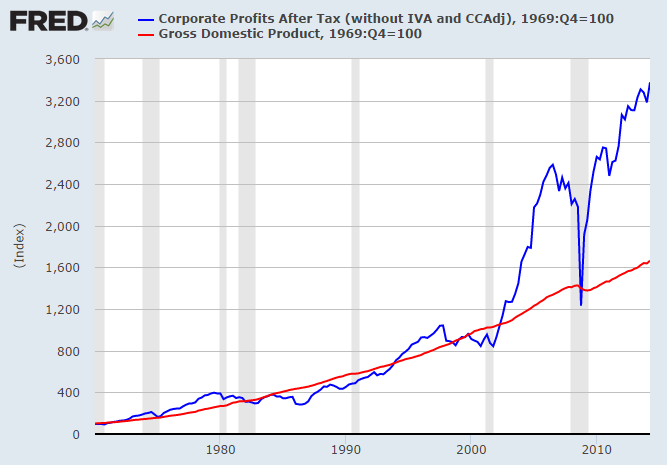

Of course, if the RomneyBots were not paying a mere 14% tax on their millions, then the corporate tax rate could come down. The Bush personal tax cut for the ultra-wealthy came at the "expense" of a lower corporate tax rate. That said, as we see below, after tax corporate profits are soaring well above GDP growth, so this entire argument is specious.

Of course, if the RomneyBots were not paying a mere 14% tax on their millions, then the corporate tax rate could come down. The Bush personal tax cut for the ultra-wealthy came at the "expense" of a lower corporate tax rate. That said, as we see below, after tax corporate profits are soaring well above GDP growth, so this entire argument is specious.

The Truth is Always Hiding Up the Ass of the Idiocracy:

After Tax Profits versus GDP: Only a total fucking psychopath would argue that the corporate tax rate is too high. And look at what happened to profits when GWB was elected and after 9/11. Profits had been tracking GDP for decades, and then...

Shock Doctrine Visualized:

Buying in one locale and selling in another, is arbitrage and it always converges prices aka. wages.

Multinational corporations should be encouraged to "leave" and then never allowed to sell back into the U.S. again. That's where this is all heading anyway whether the psychopaths realize it or not. This has all been an "interesting" experiment in "Fuck you Jack, I'm Ok" Ponzinomics.