[WTF Comment #1]

"What’s wrong with bubbles?"

"bubbles in obscure, isolated markets are nothing to worry about"

[WTF Comment #2]

"Subprime loans were a small part of the economy, and Greek sovereign debt was even smaller, but those bubbles were dangerous because they engulfed larger, systemically important institutions."

[WTF Comment #3]

"The Federal Reserve recently opined that, in general, valuations of equities and real estate were within historical norms."

Profit Margins as % of GDP: All Time U.S. High (150% higher than in Y2K)

No bubble here...

[WTF Comment #4]

"Of course, plenty of people disagree with the Fed about whether the stock market as a whole is bubbly. I’ve written before that I think the stock market is getting bubbly."

[WTF Comment #5]

"the stock market crash of 2000 hurt the economy, because so much of that spending and investment underpinned the strong economic growth. [Whereas today] Business investment is relatively weak [because] companies are borrowing money to buy back shares to boost stock prices, not to invest in their company operations." [Now see next comment about leverage...]

[WTF Comment #6]

"The housing bubble had something else we don’t have today: massive growth in leverage. When the bubble popped, that leverage exposed the financial system to trillions of dollars of losses. Loan growth is tepid today"

Corporate Debt:

Well as long as companies are "borrowing money to buy back shares to boost stock prices versus investing in company operations", I suppose this is all good then. This is just new debt to buy back stock, versus invest in sustainable business:

Global Debt: "No bubble here"

U.S. Federal Debt Per Person: $55k (doubled since 2007, tripled since 2000)

(Stock) Margin Debt: All Time High

No "leverage" here either

Data from: NYSE

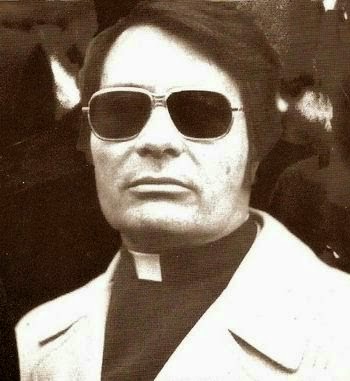

We don't need lies. We have psychopaths instead.