Beggar thy neighbour policy never ended, except at Harvard.

The days of the multinational profit extraction machine are numbered.

The days of the multinational profit extraction machine are numbered.

There's No Free Lunch

To the "Austrian School" economic theorists, a gold standard and "sound money" is the holy grail of a solid economy. And why not, after all there are many benefits to a gold standard:

To the "Austrian School" economic theorists, a gold standard and "sound money" is the holy grail of a solid economy. And why not, after all there are many benefits to a gold standard:

Eliminate monetary expansion

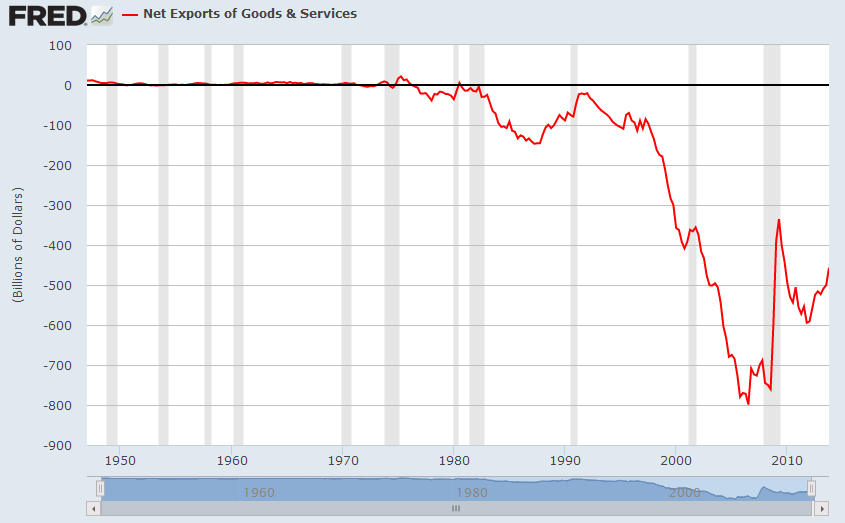

Eliminate the trade deficit

Eliminate the budget deficit

Raise the value of the currency

Reduce "inflation" (where it actually exists)

Eliminate debt-subsidized industrial arbitrage aka. buying in one locale and selling in another

Implode the banking cartel/Wall Street

However, as usual, only half the story is being told:

“Ideally, you’d have every plant you own on a barge to move with currencies and changes in the economy.” - Jack Welch

In a world awash in unlimited quantities of cheap labour and wherein Third World nations are continually attempting to bootstrap their economies via a race to the bottom for how cheaply they can make new products, the terms of trade are all-critical in retaining a balance of trade.

A gold standard would initially make exports less competitive vis-a-vis other countries that are willing to debase their currencies to make their exports more competitive. This would lead to reduced demand for local labour aka. mass unemployment and put extreme deflationary pressure on wages to correct the trade imbalance (far more deflationary pressure than we are already seeing under the current debt-supported paradigm).

Wages would eventually settle in line with Third World equivalents, reducing the current East-West subsidy that allows baristas in the West to make as much money as software programmers in the East. A gold standard would also raise real and nominal interest rates obliterating homeowners and any other debt holder.

In other words, no country can unilaterally adopt a gold standard while its trading partners are willing to debase their currencies. When a country unilaterally adopts a gold standard, then the overriding motivation of every other country is to get that gold by creating favourable terms of trade aka. suppressing wages and environmental standards. This is something people figured out hundreds of years ago.

Mercantilism is ALWAYS predicated upon a flow of "gold"

The willingness of countries to debase their currency and suppress their wages is always predicated upon gaining something in return. Today of course, currencies are not backed by gold, hence there is another far more valuable type of gold being exchanged. The real "gold" in any economy is denominated in terms of intellectual property, manufacturing capacity and engineering capability, something today's corporate Mad Men don't value. Therefore, they've been selling down this real gold for decades now in exchange for inflated corporate profits. As is the point of this blog, this East/West arbitrage is long overdue to implode due to its accumulated financial imbalances, so pining away for a gold standard is all a question of careful what you wish for, because these dwindling days when developed nations consume 10x more resources than the Third World are all predicated upon the status quo and inherent East/West wage/debt subsidy.

I highly doubt that those pining away for a gold standard fully understand what it means to our standard of living when the conditions are finally in place for the stable implementation of said standard i.e. open trade at Third World levels.

The Days of the Multinational Marketing Shell are Numbered

In a "free" economy, prices adjust to find equilibrium, so if an unlimited supply of labour is cheap somewhere, it eventually will be cheap everywhere. Therefore, after the obliteration of the status quo, ultimately only a global trade agreement that embeds minimum labour and environmental standards, would prevent extreme degradation of workers and the environment. Unilateral trade barriers are a proxy for the ideal, given that they indiscriminately restrict trade flow and lead to tariff escalation. Either way, the days of multinational industrial arbitrage are politically numbered.

The Low Wage Poverty Trap

As long as there are frat boys running around trying to put factories on barges, there will always be a need for trade barriers. And a gold standard would merely deflate wages sooner rather than later by removing debt from this equation. In a world awash in an unlimited supply of labour, without trade barriers or global labour standard, the marginal wage will be the limit approaching zero and we will all be Third World in perpetuity.

As long as there are frat boys running around trying to put factories on barges, there will always be a need for trade barriers. And a gold standard would merely deflate wages sooner rather than later by removing debt from this equation. In a world awash in an unlimited supply of labour, without trade barriers or global labour standard, the marginal wage will be the limit approaching zero and we will all be Third World in perpetuity.

The Needle and the Damage Done

This entire global realignment back towards de facto reality is already well-advanced and therefore we are merely waiting for the point of recognition and the widespread realization that most debts will never get repaid under the current paradigm. Something that Harvard and various other "schools of thought" will only learn after-the-fact.