Only fools pay taxes. Elites on the other hand, spend them...

i.e. U.S. companies changing the fake address of their headquarters

Lawmakers gave Companies until 2015 to "adjust" to the closing of the "inversion" loophole. The politicians conveniently gave companies more than enough time to find a permanent workaround to the problem...

"In an inversion transaction, a foreign corporation is interposed between a U.S. corporation and its shareholders, typically to allow the U.S. corporation to distribute the untaxed earnings of its foreign subsidiaries to the shareholders of the new foreign parent, or to reduce its future tax liability through deductible payments to the new foreign parent, each without U.S. tax. "

Inversions, the new Corporate dismemberment:

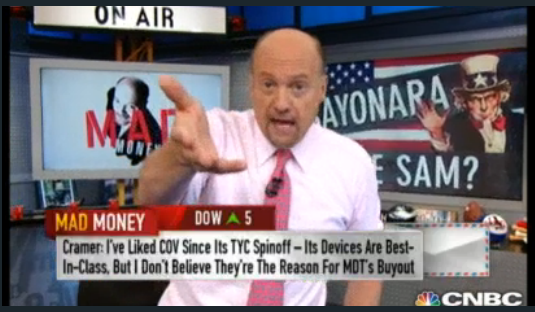

Via the Mad Man:

"...they can play with their money kept overseas. What a windfall. And then you can get out of paying the U.S. taxes. Wouldn't you love it if you could buy some real estate in say the Cayman Islands, pay your taxes there instead of here, even if you never actually spend anytime living in the Caymans? sadly that is not how it works for individuals. but the tax inversion strategy does work for companies"

"who else will be taken over at a big premium one down the road is Eaton, a terrific industrial company known for making fantastic products for everything from lighting to area and trucking. And you might have thought that it was the corporate pride of Cleveland, Ohio"

Medtronic is the largest firm to renounce U.S. tax status

"Minneapolis-based Medtronic joins some 44 American companies that have reincorporated abroad or struck plans to do so, including 14 in a recent wave of moves that began in 2012."

"Such transactions have begun to snowball within parts of the health-care and oil industries as companies still without a foreign domicile try to catch up with those that have gone offshore. Shareholders are pressing drugstore chain Walgreen Co. to get a Swiss address. Without a change in law, a congressional panel estimated last month, future deals will cost the U.S. $19.5 billion in tax revenue over the next 10 years."

and if the companies are moving, may as well move the executives as well...

Milking the Cows