I'm seeing a trend here. Economists now see nominal interest rates rising. Ever since the Fed tapering began in December, interest rates have been falling, confounding all predictions.

In the context of a debt to GDP ratio of 370% placing the economy under MASSIVE deflationary pressures, REAL interest rates are rising every single day...

In the context of massive debts and stagnant wages, then sectors like healthcare, college costs, gasoline, childcare etc. that keep rising are robbing purchasing power from every other sector. It's a zero sum game. Unlike the 1970s, there is no wage-price inflation, so money that goes to pay for one thing, has to come from somewhere else. Which means that indirectly, debt service burdens keep rising with each passing day.

Ponzi Borrowing 101

Meanwhile, this fantasy that nominal interest rates will rise without tanking the economy, is the biggest asinine delusion on the planet. Despite the lowest interest rates in U.S. history, this year, the U.S. deficit of $500 billion will just barely cover the U.S. interest costs of $400 billion. Meanwhile, as I just showed, the entire "growth" rate of 2.7% is deficit-borrowed money. All of which means that if U.S. nominal interest costs rise, then the growth rate will fall into recession unless the U.S. borrows still more money. Ponzi Borrowing.

The Biggest Lie Ever Sold

This is all just an econo-dunce parlour game anyway, because as the charts below will show, the Obama "recovery" is the biggest lie ever sold.

Bonfire of the Insanities

U.S. Median Household Income

Now at a 20 year low. For the stunned dunces who were questioning the goals of Occupy Wall Street, right here is why that movement existed. Because all real human beings know that this shit show is collapsing in real time. Only the dumbfucks at the top keep telling us that "By almost any measure, things have never been better".

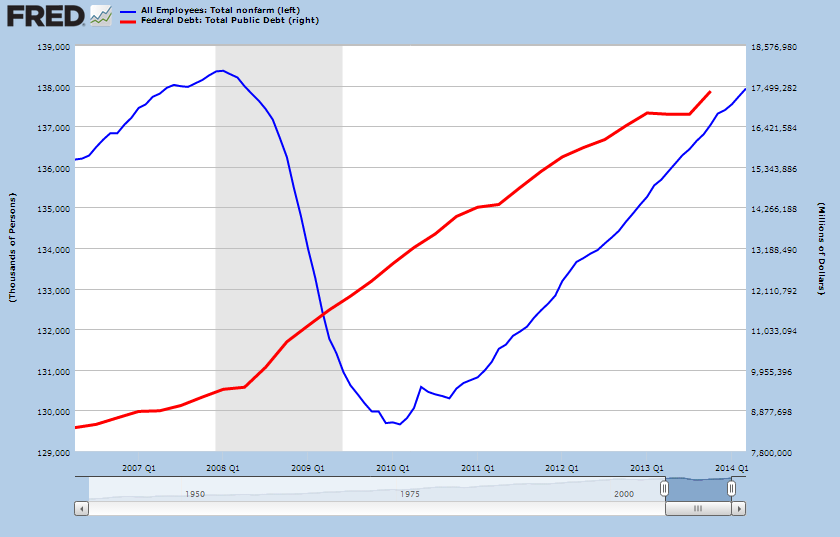

Total Jobs (left scale, millions) Versus Federal Debt (right scale, millions)

Jobs are still below where they were in 2008 and Federal debt has almost doubled. Those are million dollar jobs ($8 trillion divided by 8 million)

Real GDP Per Capita

GDP adjusted for inflation, deficits and population growth

Unlike the past 50 years, this time, there has been no recovery whatsoever

Total Jobs adjusted by the total population

The U.S. population has grown by 12 million people since 2008; put that in the context of 8 million new jobs. Like the labor participation rate, this has been going down since Y2K

Got Deleveraging?

After 2008, the key goal was to reduce debt and otherwise "deleverage" the economy

Here is total debt as a ratio of real GDP

The real "kicker" is that the cost per household of the above 5 year delusion was roughly $100,000 as a share of Federal debt.