Trickle Down Collapse-O-Nomics:

Dow Casino (blue) with U.S. Labor Participation (red):

But let's not allow facts and data to get in the way of a good line of bullshit...

A Brief History of the Minimum Wage

Raising the minimum wage to $10.10 would almost get it back to where it was 45 years ago in 1968.

The red line is the minimum wage in constant (today's) dollars and as we see it's been falling for 40+ years straight. The blue line is the nominal (non-inflation adjusted) wage:

A Brief History of Supply Side Economics aka. Trickle Down Economics aka. Voodoo Economics aka. Reaganomics

The policy of Supply Side economics was intended as an alternative to the post-WWII standard policy of Demand-side economics aka. Keynesian-based economics. It's a set of policies intended to favour "suppliers" (aka. businesses) over "consumers" (aka. workers). When Nixon took the U.S. off of the gold standard in the 1970s, price inflation and economic stagnation resulted aka. "stagflation"; therefore the Friedmanites decided they had to eliminate the "structural rigidities" within the economy aka. unions, minimum wage indexing, export controls, labour protections etc.

The term "Voodoo economics" was coined by George Bush Senior during the 1980 Republican primaries when he ran against Reagan. When Bush was picked as Reagan's Vice President, oddly enough he stopped using the term. Meanwhile his own son GWB took the policy and put it on steroids with his tax cut for the ultra-wealthy, doubling of military spending, disregard for intellectual property exportation and total lack of financial industry oversight, culminating in the collapse of 2008. We still live in the post-GWB Supply-Side era when it comes to economic policy. Obama merely made it once-again palatable to the Faux Newstard masses.

By the end of Reagan's 8 year term, the U.S. had transformed from being the world's largest creditor nation to being the world's largest debtor nation. The Federal debt tripled in 8 years from $900 billion to $2.6 billion. Federal debt now stands at $16 trillion, a 9% compound annual growth rate over 33 years.

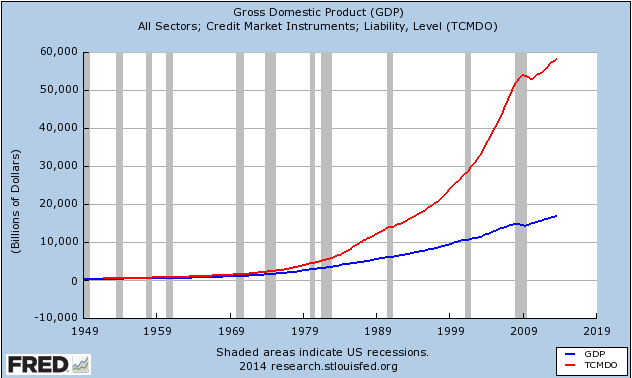

Empire of Debt

Total U.S. debt (red) (All sectors) v.s. GDP (blue)

In 1949 - right after WWII - this ratio was 128%. Today it's 400%

The consumption-oriented lifestyle is doomed:

Corporate Profits and Wages as % of GDP:

The term "Voodoo economics" was coined by George Bush Senior during the 1980 Republican primaries when he ran against Reagan. When Bush was picked as Reagan's Vice President, oddly enough he stopped using the term. Meanwhile his own son GWB took the policy and put it on steroids with his tax cut for the ultra-wealthy, doubling of military spending, disregard for intellectual property exportation and total lack of financial industry oversight, culminating in the collapse of 2008. We still live in the post-GWB Supply-Side era when it comes to economic policy. Obama merely made it once-again palatable to the Faux Newstard masses.

By the end of Reagan's 8 year term, the U.S. had transformed from being the world's largest creditor nation to being the world's largest debtor nation. The Federal debt tripled in 8 years from $900 billion to $2.6 billion. Federal debt now stands at $16 trillion, a 9% compound annual growth rate over 33 years.

Empire of Debt

Total U.S. debt (red) (All sectors) v.s. GDP (blue)

In 1949 - right after WWII - this ratio was 128%. Today it's 400%

The consumption-oriented lifestyle is doomed:

Corporate Profits and Wages as % of GDP:

Here, plain as day, we see the real reason why the minimum wage isn't allowed to go up. It's because wages (as %of GDP) are only allowed to go down in this country, whereas corporate profits are only allowed to go up.

Total Employment v.s. National debt

Obama's Pseudo-Recovery is the Biggest Lie Ever Sold

Despite U.S. debt (red line, right scale) doubling in 7 years, the total number of jobs (blue line) is lower than it was in 2007. Meanwhile there are 17 million additional people in the U.S. now. Is it any wonder the labor participation rate is plummeting? Fewer jobs yet more people.

$8 trillion in debt divided by 8 million *new* jobs equates to a cost of $1 million dollars per job. Unfortunately, half the jobs created last year pay $18/hour or less.

Turning Third World

Obama's Pseudo-Recovery is the Biggest Lie Ever Sold

Despite U.S. debt (red line, right scale) doubling in 7 years, the total number of jobs (blue line) is lower than it was in 2007. Meanwhile there are 17 million additional people in the U.S. now. Is it any wonder the labor participation rate is plummeting? Fewer jobs yet more people.

$8 trillion in debt divided by 8 million *new* jobs equates to a cost of $1 million dollars per job. Unfortunately, half the jobs created last year pay $18/hour or less.

Turning Third World

A "funny" thing happened decades ago. The U.S. labor market totally decoupled from productivity and output. The "residual" value accrued solely to corporate profits:

Below, as we see, productivity has been rising this entire time, however the benefits only accrued to corporate profits not to wages. Why? Commoditization of labour aka. Outsourcing aka. Trading with countries having a minimum wage of $.80.

http://www.epi.org/publication/ib330-productivity-vs-compensation/

http://www.epi.org/publication/ib330-productivity-vs-compensation/

Four Decades of Stagnant Wages

The inflation-adjusted median wages of what the typical male worker receives - removing any skew of highly compensated employees - has been stagnant for forty years, since 1973. Women's wages have been rising, during that time however are they are still below men's wages.

http://www.hamiltonproject.org/papers/the_uncomfortable_truth_about_american_wages/

Born In the U.S.A.

"These jobs are goin' boys and they ain't coming back..." - Springsteen (1984)

U.S. (Im)Balance of Trade:

A cautionary tale for any country tempted to trade with other nations not having a labour or environmental standard. It's called (industrial) arbitrage and the frat boyz are highly familiar with the concept, since they skim billions out of global financial markets using the same strategy i.e. buy in one market (low price) and sell in another market (high price) and repeat over and over again until they equalize in price (aka. wages).

The adults left the building in 1980 and haven't been seen since:

One Chart to Rule them All

Despite the ever-increasing number of two (and three) worker households - and people working two (and three) jobs - real U.S. Median Household income is now back where it was 19 years ago. Industrial arbitrage is working its "magic".

"Time,

Why you punish me?

Like a wave crashing into the shore, you wash away my dreams."

- Hootie and the Blowfish (1995)

At least Billionaires Are Better Off

http://en.wikipedia.org/wiki/Billionaire#Statistics

ALL IN @Dow Casino (Yes, Again)

Below the Dow (blue line) with total U.S. debt (red line) now at $60 trillion. Whatever "deleveraging" was supposedly happening after 2008, was just another widely accepted lie. But of course, as long as the Dow keeps rising, the Idiocracy can't be bothered about reality:

The third and last debt/monetary inflated bubble in a row. When this one implodes, it will be a lesson they never ever forget.

S&P 500 with Options Volatility (VIX)

Despite debt levels higher than 2007 and sovereign debt risks higher than ever, markets are massively complacent. The status quo is just assumed to be indefinitely sustainable.

.JPG)