Too late. Our self-absorbed 'elites' are bumbling and stumbling towards the 'Minsky Moment' which will end this amoral age for good...and yes, there

Mission Accomplished: Belief in the Impossible Is Ubiquitous

According to Google Trends, Extend and Pretend has fooled the overwhelming majority. Search relevance for the term "financial collapse" is 22% of what it was in 2008.

Humanity is the Highest Form of Wealth

It's overwhelmingly sad and pathetic that the ever-escalating number of shootings are being generally ignored, yet it's fully to be expected. This is where the rubber meets the road. The boy-men and billionaires who invented this fabricated economy, are being forced to come to terms with the human catastrophe that their out-of-control greed created. Clearly they are reluctant to do so. These mass shootings were the inevitable outcome of treating human beings like disposable widgets and thereby creating a corporatized society denatured of all humanity. There is something profoundly sociopathic about a generation of frat boys who were able to exploit their fellow countrymen into abject poverty, without the slightest twinge of guilt.

Occupy the Psyche Ward: Mental Stability Now Controlled By the Almighty Dow

This fake society is so corporatized, that its mental health is now significantly correlated to the stock market. You can't make this shit up (I know - I say that a lot - I feel like a fiction writer). Small market drops cause anxiety attacks. Large drops cause heart attacks. And periods of low volatility that lead to significant market drops, have the greatest impact. In other words, negative "surprises" have double the normal psychological impact. Considering that we are right now in the longest period of artificially low volatility in stock market history (inside the log periodic bubble), that does not portend well for the mental health picture which is already collapsing amid escalating gunfire. Wall Street is now fully in control of the American psyche on a physiological level. No wonder Occupy Wall Street was ignored by Main Street, the Wall Street Borg merely mind melded the Dow worshippers to reject it. There was zero chance that the brain dead Zombies at large would do anything that would reform their corrupt Temple of Dow, even if it meant sacrificing the broader economy and their children's future. Full Borg assimilation.

"You will Ignore Occupy Wall Street. They want to 'fix' Wall Street"

"I know, I get those same memos: the free bailout fixed Wall Street. More imporantly, what did you do with the remote?"

Plausible Deniability is the Opiate of the Masses

There were rolling dislocations in various financial markets this week, but the overwhelming number of pundits just shrugged them off complacently, which is a necessary if not sufficient condition for a panic meltdown...

Here is how this game works - each financial "pundit" picks one indicator and then invents a specious narrative for why it's still within reasonable bounds. The trick is to ignore all of the other risk factors at the same time. Unfortunately, we don't just face one risk factor, we face a multitude of risk factors all of which have been accumulating in the background while policy-makers play extend and pretend:

Key Risk Factors:

1) Inflated stock valuations: This is the easiest variable to manipulate by using forward "estimates"

Stock market valuations are based on forward estimates which are totally subjective AND now based on profit margins which as a percent of GDP are at the highest level in U.S. history. Doug Short does a good job of explaining why market valuations are not predictive of the future.

2) NYSE Margin Debt All Time High: NYSE margin has been setting new all time highs all last year. High amounts of margin debt GUARANTEE sellers below the market as margin calls force stock to be sold at lower levels.

3) Fed Monetary Tapering: The Fed began tapering its monetary stimulus in December. They have signaled further tapering this week. Since they began the "taper", Emerging Markets have been seen major "hot money" outflows as the carry trades begin to get unwound "unevenly".

4) Carry Trade Unwinds: This was always the greatest risk we faced from Quantitative Easing. The hot money flowed from Central Banks out to the riskiest sovereign nations to buy up high yielding debt. Now the nascent declines in emerging market currencies and rising interest rates is signalling that the carry trade is ending. The Yen Carry trade unwind led to the Asian currency crisis in 1997. This time around, policy-makers used the same strategy just with 10x more leverage. What could go wrong?

5) Slowing Global Growth: The fall in the Canadian dollar is a key indicator of slower growth as well as the BRIC charts I show below. Slow global growth was the "key factor" blamed for Friday's sell-off.

All indications are that after 20 years of non-stop growth, the China juggernaut is staggering towards inevitable collapse.

6) Global Debt Levels: As I have shown many times, global debt levels have grown substantially since 2008 to fund Extend and Pretend. U.S. total debt is at an all time high of $60 trillion.

7) IPO Speculation: Twitter selling at a 75 price/sales ratio with negative earnings? I rest my case. The P/S on Apple is 3.

8) Total lack of hedging: Central banks have made it impossible to hedge, which I have shown many times, most recently here: Slowly At First, then All At Once

9) Low Trading Volumes and Persistent Glitches: I have shown many times that trading volumes are at a 15 year low. It took five years for investors to accumulate their shares and raise prices to these levels, slowly but relentlessly. On the way down, there will be more sellers than buyers hence reduced liquidity. As we saw on Thursday and Friday, prices will move a lot faster to the downside to say the least. This will lead to what I call " discontinuous price discovery" which is always followed by "soiling of the underwear". Worse yet, the rise of HFT bots to replace traditional market makers has further undermined market stability. There have been ongoing glitches throughout these past several years which have been totally ignored.

10) Mass Complacency: All of the sentiment surveys are off the charts bullish at this juncture. As EWI noted recently, the Investor's Intelligence bulls:bears ratio is at a 26 year high - the highest since 1987. And then of course there is the VIX/TRIN/VOLUME which I show below.

11) Sector Correlation: I have shown many times, that compared to 2003-2007 or any previous market rally, all of the sectors today are massively correlated, which is very unusual. Central Bank liquidity programs have created this lethal singularity which means all sectors are concurrently overbought. This will be another deadly factor as market participants all attempt to rotate to "cash" (aka. money market funds) at the same time.

12) Massively overbought: According to John Hussman, there has only been one 2.5% correction since June 2012, however relative to stock market average history, there should have been 8 declines of that magnitude or greater in that same timeframe. Hussman also comments on market valuation, indicating that even unadjusted for massively inflated profit margins, P/E ratios are the highest they've been since Y2K, and after that, 1929.

And in addition to all of the above risk factors, and worst of all, the underlying real economy which has been solely sustained by massive government borrowing, is weaker than ever, due to relentless outsourcing. The jobs market is still a total basket case five years into this "recovery".

The Shootings Will Continue Until Morale Improves

This past week saw three school shootings, one false alarm and one mall shooting.

That brings the 2014 total school shootings to 7 and it's still January. The historical average per year is below 3.

This fake society is so corporatized, that its mental health is now significantly correlated to the stock market. You can't make this shit up (I know - I say that a lot - I feel like a fiction writer). Small market drops cause anxiety attacks. Large drops cause heart attacks. And periods of low volatility that lead to significant market drops, have the greatest impact. In other words, negative "surprises" have double the normal psychological impact. Considering that we are right now in the longest period of artificially low volatility in stock market history (inside the log periodic bubble), that does not portend well for the mental health picture which is already collapsing amid escalating gunfire. Wall Street is now fully in control of the American psyche on a physiological level. No wonder Occupy Wall Street was ignored by Main Street, the Wall Street Borg merely mind melded the Dow worshippers to reject it. There was zero chance that the brain dead Zombies at large would do anything that would reform their corrupt Temple of Dow, even if it meant sacrificing the broader economy and their children's future. Full Borg assimilation.

"You will Ignore Occupy Wall Street. They want to 'fix' Wall Street"

"I know, I get those same memos: the free bailout fixed Wall Street. More imporantly, what did you do with the remote?"

Plausible Deniability is the Opiate of the Masses

There were rolling dislocations in various financial markets this week, but the overwhelming number of pundits just shrugged them off complacently, which is a necessary if not sufficient condition for a panic meltdown...

Here is how this game works - each financial "pundit" picks one indicator and then invents a specious narrative for why it's still within reasonable bounds. The trick is to ignore all of the other risk factors at the same time. Unfortunately, we don't just face one risk factor, we face a multitude of risk factors all of which have been accumulating in the background while policy-makers play extend and pretend:

Key Risk Factors:

1) Inflated stock valuations: This is the easiest variable to manipulate by using forward "estimates"

Stock market valuations are based on forward estimates which are totally subjective AND now based on profit margins which as a percent of GDP are at the highest level in U.S. history. Doug Short does a good job of explaining why market valuations are not predictive of the future.

2) NYSE Margin Debt All Time High: NYSE margin has been setting new all time highs all last year. High amounts of margin debt GUARANTEE sellers below the market as margin calls force stock to be sold at lower levels.

3) Fed Monetary Tapering: The Fed began tapering its monetary stimulus in December. They have signaled further tapering this week. Since they began the "taper", Emerging Markets have been seen major "hot money" outflows as the carry trades begin to get unwound "unevenly".

4) Carry Trade Unwinds: This was always the greatest risk we faced from Quantitative Easing. The hot money flowed from Central Banks out to the riskiest sovereign nations to buy up high yielding debt. Now the nascent declines in emerging market currencies and rising interest rates is signalling that the carry trade is ending. The Yen Carry trade unwind led to the Asian currency crisis in 1997. This time around, policy-makers used the same strategy just with 10x more leverage. What could go wrong?

5) Slowing Global Growth: The fall in the Canadian dollar is a key indicator of slower growth as well as the BRIC charts I show below. Slow global growth was the "key factor" blamed for Friday's sell-off.

All indications are that after 20 years of non-stop growth, the China juggernaut is staggering towards inevitable collapse.

6) Global Debt Levels: As I have shown many times, global debt levels have grown substantially since 2008 to fund Extend and Pretend. U.S. total debt is at an all time high of $60 trillion.

7) IPO Speculation: Twitter selling at a 75 price/sales ratio with negative earnings? I rest my case. The P/S on Apple is 3.

8) Total lack of hedging: Central banks have made it impossible to hedge, which I have shown many times, most recently here: Slowly At First, then All At Once

9) Low Trading Volumes and Persistent Glitches: I have shown many times that trading volumes are at a 15 year low. It took five years for investors to accumulate their shares and raise prices to these levels, slowly but relentlessly. On the way down, there will be more sellers than buyers hence reduced liquidity. As we saw on Thursday and Friday, prices will move a lot faster to the downside to say the least. This will lead to what I call " discontinuous price discovery" which is always followed by "soiling of the underwear". Worse yet, the rise of HFT bots to replace traditional market makers has further undermined market stability. There have been ongoing glitches throughout these past several years which have been totally ignored.

10) Mass Complacency: All of the sentiment surveys are off the charts bullish at this juncture. As EWI noted recently, the Investor's Intelligence bulls:bears ratio is at a 26 year high - the highest since 1987. And then of course there is the VIX/TRIN/VOLUME which I show below.

11) Sector Correlation: I have shown many times, that compared to 2003-2007 or any previous market rally, all of the sectors today are massively correlated, which is very unusual. Central Bank liquidity programs have created this lethal singularity which means all sectors are concurrently overbought. This will be another deadly factor as market participants all attempt to rotate to "cash" (aka. money market funds) at the same time.

12) Massively overbought: According to John Hussman, there has only been one 2.5% correction since June 2012, however relative to stock market average history, there should have been 8 declines of that magnitude or greater in that same timeframe. Hussman also comments on market valuation, indicating that even unadjusted for massively inflated profit margins, P/E ratios are the highest they've been since Y2K, and after that, 1929.

And in addition to all of the above risk factors, and worst of all, the underlying real economy which has been solely sustained by massive government borrowing, is weaker than ever, due to relentless outsourcing. The jobs market is still a total basket case five years into this "recovery".

The Shootings Will Continue Until Morale Improves

This past week saw three school shootings, one false alarm and one mall shooting.

That brings the 2014 total school shootings to 7 and it's still January. The historical average per year is below 3.

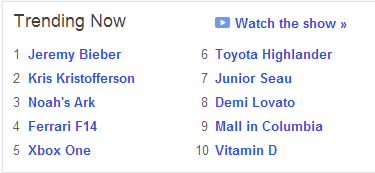

Trending Now: Mindless Bullshit

Speaking of complacency, these shootings are so common now that as of this writing, the Columbia, MD Mall shooting has been moved off of the front page of Yahoo, which at this late juncture still resembles the front page of the National Enquirer. This snapshot was taken 6 hours after the shooting. As we see, the Mall shooting is ranked #9 topic close to the level of Vitamin D and soon to be lower than Vitamin A.

Shitting a BRIC, literally

Which gets me to the point of this post. ZH has been warning us into late last week that all is not well in the Emerging Markets. Credit spreads have blown out and carry trades are coming off big time. The locus of risk, for now, is centered in Argentina, Venezuela, Turkey, and South Africa.

All of which made me realize that one of the biggest ignored risks to date centers on the so-called BRIC countries - Brazil, Russia, India and China. Anyone who was older than 12 prior to 2007 can remember that these countries were the star performers of globalization. They were the *new* growth leaders for the *new* global economy. Well a funny thing happened since 2008, all of them have basically decoupled from the so-called post-2008 "recovery" - now heading from upper left to lower right which is the wrong direction. The lower left to upper right black line is the U.S. stock market of course.

The best performer of the group (in green) is India (Bombay Sensex) which is only now reaching its high from 2007. Yes, just one more validation that the global "recovery" is no more than a widely accepted lie and globalization is failing the very people it's supposed to be "helping".

Bill Gates Has This All Figured Out

I've shown China before, but check out Brazil (Bovespa)

I've shown China before, but check out Brazil (Bovespa)

Basically, the entire "supplier-side" of the economy (ex-Multinationals) has decoupled from the global recovery. So it's now up to bankrupt Western "consumers" to carry the day - sure whatever...