The ludicrous gyrations in Bitcoin (aka. BitCasino) are a timely warning for what can happen to any asset class when price is disconnected from the underlying fundamentals solely due to liquidity and speculation. The Dow, which is the only asset class that has not corrected in the past two years, is more than primed for its own spectacular performance. The past five year phony levitation in U.S. stocks was based solely upon artificial liquidity injections from the Fed which stoked speculation in a self-fulfilling cycle until stocks became wholly disconnected from the stagnant economy. As we see with BitCasino, speculative liquidity driven rallies on low volume are violently reversed when volume picks up to the downside. It's all just a timely preview for what we can expect for the Dow which has been disconnected from reality for years now...

BitCasino: A Cautionary Tale...

"Protects the holder from loss of dollar purchasing power"

Here it is losing half of its own purchasing power in less than 12 hours

It's a "safe haven" only the Idiocracy could love...

[Update: Nov. 19th, 2013]

The "Animal Spirits" are Running Wild

At the high ($900), it was up ~9,000% in one year. Up 1.6 million percent since it started trading (I'm not kidding, it started trading at 5 cents back in 2010).

Look at the lower pane showing how overbought it is relative to its upper Bollinger Band. The horizontal line at "1.0" marks two standard deviations from the 20 DMA

Data from: http://bitcoincharts.com/

While most people are totally oblivious that we are even in a bubble, the current debate among active speculators is only how long will it last and how to make as much money as possible, before, during and after the collapse. The age of Ponzi capitalism is winding down amidst speculators attempting to make as much money as possible from its demise. As always, you can't make this shit up...

Not a Bubble, a Mega-Bubble

We live in history's largest financial and economic bubble without comparison. The status quo consumption-oriented lifestyle is at the epicenter of the multi-decade borrowing binge, so the vast majority of people just assume that it's indefinitely sustainable. This doomed ponzi scheme was well on its way to collapsing in 2008 when sock puppet policy-makers stepped in to rescue it from its own bloated decadence.

The Wealthy Borrow from the Poor

The fundamental imbalanced nature of this multi-decade consumption binge has wealthy nation consumers borrowing from Third World wage slaves to buy cheap crap, using unsecured loans that can never possibly be paid back. Millionaires and billionaires then take the massive profits thrown off by this human exploitation machine and reinvest these back into financial assets hence keeping the asset bubble inflated. As I showed recently, total debt levels have increased by $33 trillion since 2008, so the League of Extraordinary Central Banksters saved history's largest bubble, based on totally unsustainable trade flows, only by making it much bigger.

The Only (Real) Question on the Table: How Much Longer?

Therefore, the only bet on the table is between those like myself who believe that this unholy mega-bubble is way overdue for collapse, versus those who explicitly or implicitly believe that this bubble can continue to grow inexorably into the indefinite future. Those looking around for an "alternative currency" such as Bitcoin, gold etc. are de facto in the latter camp. Because a true deflationist believes that the collapse of the status quo, fundamentally implies a collapse in the supply of money, hence a pending shortage of money. In other words, it only makes sense to identify an alternative currency to the dollar, once the trillions in legacy debts have been defaulted and the money supply collapses. Only then can the true intrinsic dollar value of alternative currencies properly be evaluated. In the meantime, any alternative currency will only be another inflated artifact of the current asset bubble, as we are seeing with Bitcoin.

Bitcoin: A bubble within a bubble

Bitcoin is a new digital currency that is at the leading edge of attempting to profit from the demise of the status quo dollar-based global economy. Like everything else in this age, it's now going parabolic. Apparently, some of the biggest buyers of Bitcoin are Chinese where demand is deemed to be "boundless". Looking back on my past 15 years of investing history, including both the Dotcom boom and the 2007 asset bubble, I can find no other asset that comes close to the parabolic gains made by Bitcoin, most of which came in just the past few weeks.

Gold and Silver were the last anti-dollar trade. They both peaked in 2011 exactly when the stock market peaked that year.

Here is Gold. It went up a mere 600% in 10 years:

Y2K Deja Vu

Which stock went parabolic in Y2K and now?

Priceline.com. It's up up 4400% over 7 years and is still ascending. The first company to break $1,000 in the S&P 500, Google the second, both just in the past several weeks. A good indication of where we are in the current bubble. (The S&P 500 is silhoueted in the background).

Apple also went up 4400% over 8 years, peaking in 2012

Crude Oil Peaked Right Before Lehman

Crude Oil Went up 1400% in 8 years, peaking in 2007 - but is breaking down big time now and is right at the long-term trend line. Another widely ignored sign of deflation.

Apple also went up 4400% over 8 years, peaking in 2012

Crude Oil Peaked Right Before Lehman

Crude Oil Went up 1400% in 8 years, peaking in 2007 - but is breaking down big time now and is right at the long-term trend line. Another widely ignored sign of deflation.

You get the idea. Bitcoin is in a league of its own and a key indication that we are once again in the very latter stages of yet another speculative asset bubble. Speaking of asset bubbles, below I reiterate the case for monetary deflation.

Happy Anniversary Federal Reserve

This year marks exactly the 100th anniversary of the Federal Reserve. During the past century, Fed policies accommodated a massive continuous expansion of the money supply. During the era of the various ever-diluted gold-based mechanisms lasting until the early 1970s, the money supply grew slowly at first. Once the gold exchange was lifted by Nixon 1971-73, then the money supply went out of control. However, the money supply has never consisted primarily of dollar bills and currency, it consists primarily of debt and credit. All of which means that the money supply is a massive house of cards supported merely by (over) confidence in the status quo.

Money Supply Since 1960: http://mises.org/content/nofed/chart.aspx

The first major inflection point was the early 1980s with Reaganomics (Voodoo Economics), then another inflection point in 2001 after 9/11 and of course the latest inflection point in 2009.

Value of $1 over 100 Years: i.e. now 4 cents in 1913 dollars

http://www.usinflationcalculator.com/

Quantitative Easing in Long-term Perspective:

http://research.stlouisfed.org/fred2/graph/?s%5B1%5D%5Bid%5D=AMBNS

Deflation - Least Expected, Most Likely

One would naturally assume that with 95% debasement of the U.S. dollar over 100 years and now the largest monetary expansion in world history, that the dollar would be really tanking. However, that is not the case. Per the deflationary hypothesis, the world economy is in a state of deflation, hence policy-makers are merely pushing on a string by trying to force more debt into an already over-indebted economy. The ultimate collapse in risk assets will bring a collapse in credit markets and hence the money supply. The dollar will rise significantly, causing further major dislocations.

Exhibit A Deflation: Treasury Yields are Falling Again

Interest rates went up (bond values fell) every time the Fed initiated another QE monetization. Which is the exact opposite of what everyone believes is happening - everyone believes that the Fed is propping up bond values. Meanwhile, despite unprecedented monetary stimulus, interest rates are still lower than they were in 2011 and starting to roll over. WTF?

Exhibit B Deflation: Velocity of Money

There is a lot more money for banks to lend, but no one in the real economy wants it. It's a classic liquidity trap - the marginal propensity to borrow is going down...

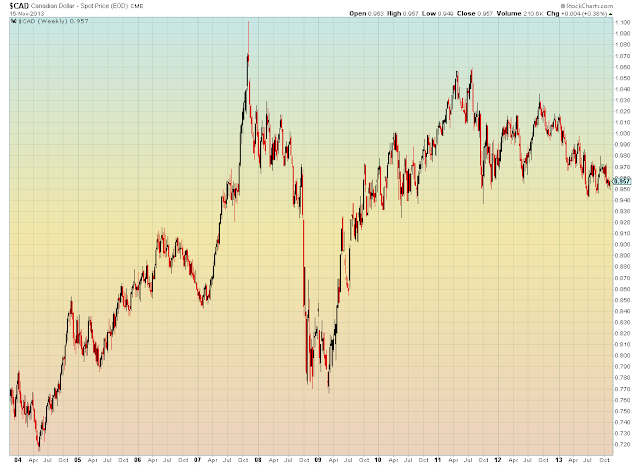

Exhibit C Deflation: Canadian dollar (and other commodity currencies)

Since the Fed is printing $85 billion per month, the U.S. dollar should be losing major ground against all other currencies. However, here we see below, the Canadian dollar is losing ground relative to the U.S.$. CAD is highly sensitive to commodity demand and hence the global economy:

I read this article recently that said due to the indefinitely delayed Fed "Taper", the currency carry trade is "heating up again". The reality is not quite as depicted in the article. Below is yet another significant indication of diverging risk appetite. The red line is an ETF that is long high yield currencies and short low yielding currencies. Currently it's long Aussie, Kiwi, Norwegian Kronor - short Euro, Yen, Swiss Franc:

Major Disconnect:

Exhibit E: This is the Fed's measure of core inflation. Now once again going down. This tracks wages and spending power very closely, which no surprise are going down, not up.

Bubblicious

The only people still willing to borrow, are hot money speculators. Below is the S&P 500 (black line) with NYSE margin debt (red) i.e. money borrowed to buy stocks, now at a new all time record high...

Elliot Wave Theory and the Daily Shootout Report

Major Disconnect:

Exhibit E: This is the Fed's measure of core inflation. Now once again going down. This tracks wages and spending power very closely, which no surprise are going down, not up.

Bubblicious

The only people still willing to borrow, are hot money speculators. Below is the S&P 500 (black line) with NYSE margin debt (red) i.e. money borrowed to buy stocks, now at a new all time record high...

Elliot Wave Theory and the Daily Shootout Report

While by no means a full blown proponent of EWT, I think that social mood is definitely a major factor in the overall markets equation. That said, I view this entire five year monetary-sponsored vacation as a test to see what happens when social mood is artificially manipulated via the markets to totally unsustainable levels. In other words, instead of social mood driving the markets, the markets have been driving social mood. None of this can ever be fully proven of course, so it's a good line of business. However, given that consumer sentiment, jobs, commodities, real estate and now carry trades etc. all peaked years and months ago, it's not hard to believe that social mood has been artificially rigged higher via the Fed's Dow levitation Jedi Mind Trick. If so, then the collapse in social mood can be expected to be as equally savage as any stock market collapse. We are already getting a foreboding preview of what is in store for the future, with an ever-increasing rise in mass shootings showing that there is not enough Prozac to paper over the mental illness gaps thrown off by the human disposal machine known as ponzi capitalism. If there was ever a warning sign that social mood has peaked and is now falling it can be found in the daily shootout report. And to think that the Dow-induced sugar buzz is still lingering at all time highs and the Idiocracy is still fat and happy as evidenced by this next report from Fantasy Island...

What Stocks Should I Buy In History's Largest Bubble? Who Will Tell Me When To Sell?

I recently read this parlour game debate going on over on Marketwatch as to whether or not this is the biggest stock market bubble of all time, or not. Actually the debate isn't whether or not it is currently the largest bubble, it's whether or not it will eventually become the biggest ever bubble. Most of the comments are Full Retard and a very good anecdotal gauge of the zeitgeist of the moment. Five years ago after Lehman, you couldn't convince people to own stocks, now the only question on the table is how long this will continue, and what stocks to buy to take full advantage of the latest bubble. To even entertain such a ludicrous debate when this latest bubble is sustained solely by the Fed pumping $85 billion of newly printed cash into the markets on a monthly basis while the real economy fades away with each passing day, shows how overwhelmingly desperate people are to believe in the impossible. Were it not for this society's overwhelming compulsion to bankrupt the children and grandchildren via recurring Federal deficits, the economy would have never exited recession in the first place. It's a morally bankrupt stock market rally for a morally bankrupt society. One glance at the NYSE margin chart above puts a quick end to any dunced debate as to whether this is the largest stock market bubble in history. It's a sign of the times that the vast majority of people today are totally oblivious that they live in history's largest credit bubble without any comparison even as the handful of people who actually are aware, are fixated on figuring out how to trade the bubble for maximum profit, all while the underlying economy withers with each passing day. No jobs? No economy? No problem. We have pieces of paper called stocks and bonds instead. History's era of abject greed was inevitably going to end with most people at the shopping mall or sports game while the speculator-set was preoccupied with monetizing the collapse.

I recently read this parlour game debate going on over on Marketwatch as to whether or not this is the biggest stock market bubble of all time, or not. Actually the debate isn't whether or not it is currently the largest bubble, it's whether or not it will eventually become the biggest ever bubble. Most of the comments are Full Retard and a very good anecdotal gauge of the zeitgeist of the moment. Five years ago after Lehman, you couldn't convince people to own stocks, now the only question on the table is how long this will continue, and what stocks to buy to take full advantage of the latest bubble. To even entertain such a ludicrous debate when this latest bubble is sustained solely by the Fed pumping $85 billion of newly printed cash into the markets on a monthly basis while the real economy fades away with each passing day, shows how overwhelmingly desperate people are to believe in the impossible. Were it not for this society's overwhelming compulsion to bankrupt the children and grandchildren via recurring Federal deficits, the economy would have never exited recession in the first place. It's a morally bankrupt stock market rally for a morally bankrupt society. One glance at the NYSE margin chart above puts a quick end to any dunced debate as to whether this is the largest stock market bubble in history. It's a sign of the times that the vast majority of people today are totally oblivious that they live in history's largest credit bubble without any comparison even as the handful of people who actually are aware, are fixated on figuring out how to trade the bubble for maximum profit, all while the underlying economy withers with each passing day. No jobs? No economy? No problem. We have pieces of paper called stocks and bonds instead. History's era of abject greed was inevitably going to end with most people at the shopping mall or sports game while the speculator-set was preoccupied with monetizing the collapse.

"There is no means of avoiding the final collapse of a boom brought by credit expansion" (Ludwig Von Mises)

Let's see - $100k per household of new Federal debt; $3 trillion in newly printed Fed money; $33 trillion in global stimulus plus 520 global interest rates reductions; the worst job market since the Great Depression due to the fact that the job market has been moved to China (but since no one wants to admit it, we will all just pretend it's not true). And most importantly, the most bullshit in the history of the world. Is this the largest stock market bubble ever? Let me close my eyes and give it some more thought...

BTFATH