The dunces who ignored and/or derided OWS, have assured Wall Street's collapse. Under the aegis of "careful what you wish for", the Idiocracy got its wish to leave Wall Street alone and otherwise maintain the status quo. Wall Street can't be saved from itself anyway - it's too corrupt, too powerful, too connected, but most importantly too greedy to be changed. Left alone it will continue on its merry path towards self-destruction...

I just read several articles on the status of the various "reforms" emanating from 2008, and suffice to say my only reaction is to be disgusted but not at all surprised. In a nutshell, the key provisions that would restrict gambling (proprietary trading) by regular banks aka. The Volcker Rule (formerly Glass-Steagall) are still being debated much less implemented. Suffice to say that the definition of "hedging" is so loose as to allow all forms of gambling. In the simplest example, imagine a "hedge" in which the delta (rate of change) of the hedge itself is constructed to be several magnitudes larger than the delta of the underlying investment being hedged. You get the idea. All of a sudden a hedge morphs into being an all in casino bet.

Meanwhile, I also learned that under-the-radar, and with largely bipartisan support, Congress is already trying to undo many of the derivatives reforms passed under the 2010 Dodd-Frank Wall Street "reform bill". You can't make this shit up. Most of the rules under Dodd-Frank haven't even been fully implemented and yet the corrupt morons in Washington are already looking for ways to weaken the rules. The goal now apparently is to move derivatives trading offshore to the least-regulated havens and thereby avoid the scrutiny and oversight of U.S. regulators.

Weapons of Financial Mass Destruction

All of this of course is just the usual rearrangement of deck chairs on the already sinking Titanic. The real root cause issue as always is being ignored at all costs. The bottom line is that Wall Street recruits the top math and computer science experts to develop ever more lethal forms of financial mass destruction. PhDs from the best schools are paid millions of dollars a year to invent increasingly leveraged financial instruments. These derivatives are described as reducing risk, by dispersing it across various economic constituents aka. "investors". However, of course being that there is never a free lunch, all these things really do is amplify systemic risk. The risk doesn't go away, it just gets dispersed in a way that it can no longer be properly recognized or even accounted for. Derivatives of course were at the heart of the 2008 financial collapse and by no surprise, there have been literally no major reforms to curb their use across Wall Street and the banking system.

Hedge Funds are Just Call Options

Weapons of Financial Mass Destruction

All of this of course is just the usual rearrangement of deck chairs on the already sinking Titanic. The real root cause issue as always is being ignored at all costs. The bottom line is that Wall Street recruits the top math and computer science experts to develop ever more lethal forms of financial mass destruction. PhDs from the best schools are paid millions of dollars a year to invent increasingly leveraged financial instruments. These derivatives are described as reducing risk, by dispersing it across various economic constituents aka. "investors". However, of course being that there is never a free lunch, all these things really do is amplify systemic risk. The risk doesn't go away, it just gets dispersed in a way that it can no longer be properly recognized or even accounted for. Derivatives of course were at the heart of the 2008 financial collapse and by no surprise, there have been literally no major reforms to curb their use across Wall Street and the banking system.

Hedge Funds are Just Call Options

On top of that, of course are the various banks and hedge funds that have very short-term incentives around profitability and are constantly looking for ways to maximize their one year return aka. "bonus" packet. So there is always a steady demand from the "buy side" to invest in these financials WMDs with their Bernie Madoff style rates of return. Therefore, these hedge funds and banks which are hedge funds in drag, have all morphed into call options. Heads the investment pays off and provides a big bonus. Tails, the investment blows up and the fund managers walk away leaving their investors and general public holding the bag. It's asymmetric risk - upside with no downside. This society apparently has no issue with these hedge fund managers making millions of dollars a year trading pieces of paper back and forth in a zero sum game, even as the minimum wage adjusted for inflation is 33% lower than it was in 1968. And that's on a good day. On a bad day, all of those pieces of paper implode the global economy and leave average citizens bailing out the greedbots for all of the bad fucking bets they made, while the hedge fund managers all walk away extremely wealthy and financially intact.

Deja Vu - Nothing Ever Changes In the Old Folks Home...

Way back in early 2007, I wrote that these exact same risks (and others) would lead to an inevitable melt-down. Not because I am in any way prescient, only because it was overwhelmingly obvious that Wall Street and the stooges in Washington were heading down an inevitable path of destruction. Then as now, the risks were well documented and fully obvious to anyone willing to face reality. In the event, after Lehman, we know that Bernankenstein went all in to prevent Wall Street from collapsing, and in doing so he and the other stooges in Washington and their global counterparts put what remains of the real economy at risk of total obliteration. Morons who don't learn from hard lessons are doomed to merely receive an even harder lesson in the future.

The Idiocracy Can't Be Saved From Itself

Just like Wall Street, the Idiocracy can't be saved from itself either. This infantile society first decides what it wants to believe in and then works backwards from there - on the economy, the environment, geopolitics, war etc. You can't convince these people to believe any part of reality that they've decided is inconvenient to their comfort-seeking existence of mass conformity and mass consumption. By bailing out Wall Street in 2008, the Idiocracy unwittingly sealed its own fate. Corporate profits were outsourced to the highest level in history to enrich Wall Street, global billionaires, and corporate insiders, which by itself proves that the aftermath of 2008 has been a colossal failure. In addition, Wall Street was given overwhelming incentive to continue with business as usual. The only two things standing between any society and economic depression, are confidence and capital. The Idiocracy foolishly expended what it had left of both of those resuscitating Wall Street. A fatal mistake.

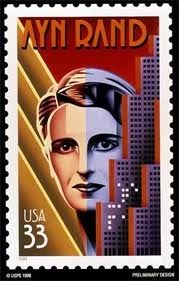

Ayn Rand Will Destroy Wall Street

The good news is that there is absolutely no way to save Wall Street from its own self-cannibalizing greed. Once it finally implodes there will be no need for reform, because there will be nothing left to reform except a smoking fucking crater. Then the entire world will finally wake up to the perils of worshipping false idols in the temple of greed. A day late and many dollars short...

Deja Vu - Nothing Ever Changes In the Old Folks Home...

Way back in early 2007, I wrote that these exact same risks (and others) would lead to an inevitable melt-down. Not because I am in any way prescient, only because it was overwhelmingly obvious that Wall Street and the stooges in Washington were heading down an inevitable path of destruction. Then as now, the risks were well documented and fully obvious to anyone willing to face reality. In the event, after Lehman, we know that Bernankenstein went all in to prevent Wall Street from collapsing, and in doing so he and the other stooges in Washington and their global counterparts put what remains of the real economy at risk of total obliteration. Morons who don't learn from hard lessons are doomed to merely receive an even harder lesson in the future.

The Idiocracy Can't Be Saved From Itself

Just like Wall Street, the Idiocracy can't be saved from itself either. This infantile society first decides what it wants to believe in and then works backwards from there - on the economy, the environment, geopolitics, war etc. You can't convince these people to believe any part of reality that they've decided is inconvenient to their comfort-seeking existence of mass conformity and mass consumption. By bailing out Wall Street in 2008, the Idiocracy unwittingly sealed its own fate. Corporate profits were outsourced to the highest level in history to enrich Wall Street, global billionaires, and corporate insiders, which by itself proves that the aftermath of 2008 has been a colossal failure. In addition, Wall Street was given overwhelming incentive to continue with business as usual. The only two things standing between any society and economic depression, are confidence and capital. The Idiocracy foolishly expended what it had left of both of those resuscitating Wall Street. A fatal mistake.

Ayn Rand Will Destroy Wall Street

The good news is that there is absolutely no way to save Wall Street from its own self-cannibalizing greed. Once it finally implodes there will be no need for reform, because there will be nothing left to reform except a smoking fucking crater. Then the entire world will finally wake up to the perils of worshipping false idols in the temple of greed. A day late and many dollars short...