Central Banks across the developed world have been attempting to use monetary liquidity to prevent the inevitable convergence of our standard of living with that of the Third World. Of course it's a futile task and suffice to say, that adjustment would have already taken place after 2008 if they hadn't intervened to prop up asset markets. Unfortunately, once the developed nations took the easy path of trading with countries that have no labour or environmental standards, the (downward) convergence in standards of living became inevitable. It didn't help that the developing nations suppressed their own currencies and otherwise recycled their profits back into developed world debt in order to sustain their competitive advantage, however artificially. All that strategy did was to temporarily subsidize our lifestyle gap while our nations' debt balances accumulated steadily. Of course, this strategy of using Central Banks to levitate the financial assets, even as workers and consumers fell ever further behind the solvency curve was a fool's errand of the highest order. It had no chance of ever fundamentally rebuilding the economy, much less generating inflation. All the money flowed straight into the stock market.

At this juncture it's important to see past all of these Central Bank interventions that are merely sound and fury signifying nothing. When viewed in the context of the long-term trend in wages and core inflation, it's overwhelmingly clear that Central Banks lost the real battle a long time ago...

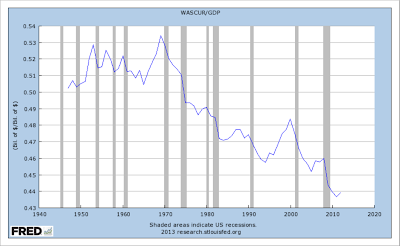

Wages Can't Get Off The Mat

This first chart shows wages as a % of GDP. Clearly, they are headed inexorably lower. This means of course that purchasing power and hence inflation expectations are trending down as well, no matter what else we are told. There is nothing on the table or even envisioned from a policy perspective that is going to reverse this trend, at least while the current set of buffoon policy-makers are in leadership. Sheila Bair in yesterday's missive said that Obama is concerned about the gap between the "haves and have nots". Total bullshit. He has done nothing for the have nots, other than get them more fucking food stamps.

This first chart shows wages as a % of GDP. Clearly, they are headed inexorably lower. This means of course that purchasing power and hence inflation expectations are trending down as well, no matter what else we are told. There is nothing on the table or even envisioned from a policy perspective that is going to reverse this trend, at least while the current set of buffoon policy-makers are in leadership. Sheila Bair in yesterday's missive said that Obama is concerned about the gap between the "haves and have nots". Total bullshit. He has done nothing for the have nots, other than get them more fucking food stamps.

Core Deflation Well Advanced; Asset Deflation is Next

And, below, as we see 100% correlated to wage deflation, is the thirty year treasury yield, also in an inexorable decline. Tracking the waning purchasing power (lack thereof) of the jobless consumer. Notice that for all of the hand wringing over Central Bank interventions, at best their interventions appear as mere squiggles in one gigantic downtrend. In fact, over the past year, yields have now fallen back down to the level they were at in 2009, despite ever more debt monetizations. Given that risk assets are at a six year high accompanied by similar lofty sentiment, then yields (aka. inflation expectations), have no where to go but down, which implies negative yields at some point in the future...

And, below, as we see 100% correlated to wage deflation, is the thirty year treasury yield, also in an inexorable decline. Tracking the waning purchasing power (lack thereof) of the jobless consumer. Notice that for all of the hand wringing over Central Bank interventions, at best their interventions appear as mere squiggles in one gigantic downtrend. In fact, over the past year, yields have now fallen back down to the level they were at in 2009, despite ever more debt monetizations. Given that risk assets are at a six year high accompanied by similar lofty sentiment, then yields (aka. inflation expectations), have no where to go but down, which implies negative yields at some point in the future...

The Fundamental Fatal Assumption of Our Time

Of course, there are those who would say, rightly so, that monetary policy was never intended to rebuild an economy on a long-term basis. I agree; however, by levitating asset markets, Central Bankers gave stooge politicians the excuse to stand around for four years and do nothing. After all, as long as the Romney class was fat and happy, who cared what was happening in the real world. More importantly, the fundamental flawed assumption of our age is that given enough time, the U.S. economy will heal itself. That may have been the case decades ago, but it's not the case in an era when the "economy" has been exported to China.