Modern finance theory can't explain why nominally intelligent people keep making the same mistakes over and over again, each time expecting a different result. It all comes down to three things: greed, greed, and more fucking greed...

Recession safe havens (Utilities/Bond proxies)

A cogent mind would ask how do we break this monetary-fueled gambling addiction and otherwise restore sanity to real investment? It all comes down to breaking perverse incentives. As always, greed and instant gratification are at the heart of the problem. Which explains why Wall Street analysts are almost always uniformly bullish on stock market prices. There is no upside from downside, hence better to be blindly optimistic.

The current instant gratification model asymmetrically rewards short-term performance over long-term results and protection of capital. This asymmetry is embedded in the annual Wall Street bonus model. It's at the heart of what drove otherwise moderately intelligent people to buy up insolvent subprime CDOs in the weeks before they imploded. After that they returned to bagging groceries where they belonged in the first place.

It's what drives Hugh Hendry's "imagined realities". It's the monetization of useful idiots.

"There are times when an investor has no choice but to behave as though he believes in things that don't necessarily exist. For us, that means being willing to be long risk assets in the full knowledge of two things: that those assets may have no qualitative support; and second, that this is all going to end painfully. The good news is that mankind clearly has the ability to suspend rational judgment long and often."

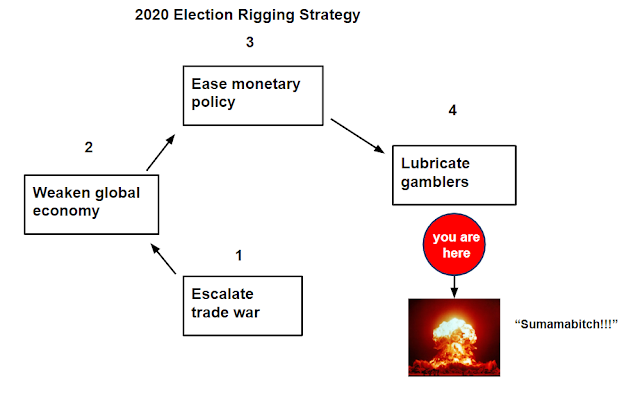

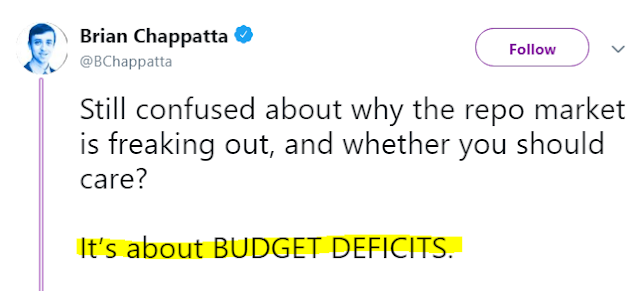

Clearly, central banks have successfully reverse engineered this endemic greed addiction via their stimulus programs. The trickle down fake wealth effect never fails to place this society in a state of blissful narco-coma, however temporary. Central banks are subsidizing rampant speculation. In a sane society not otherwise obsessed with zero sum gambling, the central bank incentives would drive economic investment in the real economy. Which would mean ending the self-destructing perverse addiction to low interest rates. In a society over-flowing with capital, the cost of capital is not the problem, the lack of real return is the problem. The fact that we need ever-cheaper capital to make this model appear to work, is the key sign that this model is no longer working.

In the meantime the downward spiral continues. What we notice from Disney markets is the vast amount of market manipulation taking place on and around options expirations. The vast amount of market manipulation taking place at the end of each month. And the even greater amount of market manipulation attending the end of each quarter when bonus accrual takes place.

The abiding academic belief that these are still "random markets" is a patent falsehood. These are heavily manipulated markets using free money and leveraged derivatives to achieve short-term performance benchmarks. Today's financial curriculum has in no way caught up with the modern day alchemy of money-printed markets.

Here we see via the Biotech sector that algorithmic risk-seeking peaks at the end of quarters. Although this latest quarter (Q3) has been a bit of a struggle, indicative of collapsing liquidity:

Add-in record leveraged stock buybacks and the amount of market manipulation taking place right now is unprecedented. Again, all part of the obligatory deception to drive abiding belief in the status quo. Markets must never fully price in underlying risk.

One year ago, a few pundits warned that the impending stock buyback blackout period would lead to significant volatility. They were right.

“Buybacks provide a tremendous amount of support to the market, and with blackout season coming, we won’t have that added measure of support”

What could go wrong?

Again.

September 27th, 2019:

In the Information Technology sector, 29 companies have issued negative EPS guidance for the third quarter, which is nearly 45% above the 5-year average for the sector of 20.1. If 29 is the final number for the quarter, it will mark the highest number of companies issuing negative EPS guidance in this sector since FactSet began tracking this data in 2006."

The Information Technology sector is expected to report the second highest (year-over-year) earnings decline of all eleven sectors at -10.1%. At the industry level, four of the six industries in this sector are projected to report a decline in earnings: Semiconductors & Semiconductor Equipment (-30%), Technology Hardware, Storage, & Peripherals (-14%), Electronic Equipment, Instruments & Components (-9%)"

Again.

September 27th, 2019:

In the Information Technology sector, 29 companies have issued negative EPS guidance for the third quarter, which is nearly 45% above the 5-year average for the sector of 20.1. If 29 is the final number for the quarter, it will mark the highest number of companies issuing negative EPS guidance in this sector since FactSet began tracking this data in 2006."

The Information Technology sector is expected to report the second highest (year-over-year) earnings decline of all eleven sectors at -10.1%. At the industry level, four of the six industries in this sector are projected to report a decline in earnings: Semiconductors & Semiconductor Equipment (-30%), Technology Hardware, Storage, & Peripherals (-14%), Electronic Equipment, Instruments & Components (-9%)"

China's markets are closed for the remainder of this week and through October 9th for "Golden Week", so who will put a fake bid under their markets is anyone's guess.

Needless to say, it won't be Trump:

Speaking of central bank muppets, gold is getting shellacked during Golden Week. Just the latest momentum traders taken to the woodshed:

"Gold speculators sharply raised their bets this week for a 2nd straight week and by the most in the past seven weeks. The boost in bullish bets brings the current standing to the highest level since July 5th of 2016"

Which leaves only one bubble still standing...