We are now going Full Retard across the board - the economy, the ecology, science, geopolitics - all in...

The epidemic of comfort-seeking denialism continues to spread out of control. Forget about silver, gold and oil, the market for denialism and bullshit is levitating to the sky and beyond. Amazingly, the purveyors of denialism cover the socioeconomic spectrum - from the "blue haired" ladies of conservative lore, to the 35 year old Xbox addled boy-men, too soft to face their own pathetic circumstances, much less anything going on around them. And my favorite variant- the self-consumed Baby Boomer nihilists that come in two equally repugnant flavours: the drug addled hippy turned limousine liberal or the drug addled Born Again Neocon hypocrite - take your pick. Even more frightening, is the all too common occurrence of the over-educated moron - people with not one but two or three degrees, who despite (or as a result of) their lofty education, can't seem to find their ass with both hands. I guess this list covers about all of us...

The epidemic of comfort-seeking denialism continues to spread out of control. Forget about silver, gold and oil, the market for denialism and bullshit is levitating to the sky and beyond. Amazingly, the purveyors of denialism cover the socioeconomic spectrum - from the "blue haired" ladies of conservative lore, to the 35 year old Xbox addled boy-men, too soft to face their own pathetic circumstances, much less anything going on around them. And my favorite variant- the self-consumed Baby Boomer nihilists that come in two equally repugnant flavours: the drug addled hippy turned limousine liberal or the drug addled Born Again Neocon hypocrite - take your pick. Even more frightening, is the all too common occurrence of the over-educated moron - people with not one but two or three degrees, who despite (or as a result of) their lofty education, can't seem to find their ass with both hands. I guess this list covers about all of us...

Too many Westerners live in a fuzzy cocoon, insulated from the harsh everyday reality facing the majority on this planet. A cocoon built wholly upon illusion and temporary circumstance, propagated solely by wishful thinking and sponsored by the dying vestiges of a once strong economy; an economy now in final liquidation by a generation of salesmen.

"You want the truth? You can't handle the truth"

The greatest irony is the fact that never before in the history of mankind have we had so much information and data at our disposal. The advent of the internet and the digital age has put unprecedented volumes of information at our fingertips, far beyond what any other society has enjoyed. Clearly, it's not just the quantity of data that matters, but also the quality of data and the way in which that data is processed.

In commonsense terms, the progression of usable intelligence requires that facts and data become constantly refined into ever greater quality. The first step is the distillation of various facts and data into knowledge. From knowledge, judgement is required to appropriately discern possibility from probability. Finally, discipline is needed to take what is learned and put it into practice.

The weak link in this daisy chain seems to be judgement. All too easily, judgement is derailed by subjectivity, greed, fear and delusion - all modes of thinking that today are commonly accepted, when they should be roundly derided. Similarly, discipline is easily derailed by laziness and inertia i.e. I know exercising is good for me, but...

In commonsense terms, the progression of usable intelligence requires that facts and data become constantly refined into ever greater quality. The first step is the distillation of various facts and data into knowledge. From knowledge, judgement is required to appropriately discern possibility from probability. Finally, discipline is needed to take what is learned and put it into practice.

The weak link in this daisy chain seems to be judgement. All too easily, judgement is derailed by subjectivity, greed, fear and delusion - all modes of thinking that today are commonly accepted, when they should be roundly derided. Similarly, discipline is easily derailed by laziness and inertia i.e. I know exercising is good for me, but...

According to this commonsense-based model of intelligence, discipline is the highest form of intelligence and the one least commonly attained. Without discipline, all forms of higher level theorizing are just mental masturbation - academic parlour games, in the end pointless.

Never Go Full Retard...

The range of issues currently in denial covers a broad spectrum. I don't pretend to be a scientific expert on each of these subjects and yet I am constantly amazed by the 1+1=3 conclusions drawn by many of those deemed to be experts in their field. In many cases this is a function of the direct financial incentives provided to lure scientists from reality and truth to propagate obfuscating opinions. Although, it's usually just a comfort-seeker far too afraid to stare into the abyss, so he pretends the cliff is 1000 miles away rather than next to his feet.

1) Peak Oil

Peak oil doesn't mean we will run out of oil tomorrow. It means that the marginal cost of oil will continue to rise as discoveries of oil become smaller and harder to obtain. It also means that ever-increasing demand combined with exhausted supplies will outstrip the rate of new discoveries. Eventually we will hit a wall at which there is no supply "buffer" and the price of oil will become extremely volatile. Thirdly, the supply of oil has shifted to geopolitically unstable regimes that cannot be counted on to sponsor the Western consumption-oriented fantasy propagated by low oil prices. Fourth, the cost of capital to support drilling projects that take years to develop, may not remain artificially low indefinitely.

Lastly, my primary assertion is that oil has been and continues to be under-priced. Supply of oil in today's lexicon refers to daily production rates i.e. the size of the straw. Whereas, supply with respect to pricing should take into account the reserves of oil in the ground i.e. the size of the milkshake...

2) Peak Credit

The basic notion that we can't continue to borrow our way to prosperity. In their infinite wisdom our so called leaders shifted the debt burden from the foundering financial sector to the general public (government) sector. This propagated the illusion of solvency and allowed creditors to avoid losses on their ill advised investments, shifting all losses to the Middle Class Taxpayer. One gets a sense, that should "something" untoward cause this Ponzi-based economy to come unglued again, another shifting of liabilities will not obtain politically...

3) Peak Pollution/Environmental Degradation

80 Million barrels of oil per day going into the atmosphere... Fortunately, Faux News tells me man made Climate Change is a big hoax propagated by Al Gore. Ok then, back to American Idol. Such is the level of thinking of today's average comfort-seeker, far too lazy to face their own self-inflicted personal issues (diet, health, financial etc.), let alone anything on a global scale. We as a society have become a 400 pound fat man who can't get out of his own fucking way.

On the bright side, I see Peak Oil doing battle with Global Warming to put an end to over consumption of fossil fuels - Godzilla v.s. King Kong. Of course if Peak Oil wins, it will only because we will be living in caves, fighting the Taliban with sticks and rocks, so careful what you wish for...

The cold hard reality is that our consumption oriented lifestyle enjoyed by the 20% of the world's population who are consuming 5x as much resources as the rest of the world, is coming to an end sooner rather than later, whether we can handle that fact or not.

4) Peak Military/Geopolitical Illusion of Stability

We live with the illusion of security sponsored by hundreds of global military bases, a dozen aircraft carrier groups, two ongoing wars of occupation and a military budget that at $700+ billion is more than the combined budgets of every other country on the planet !

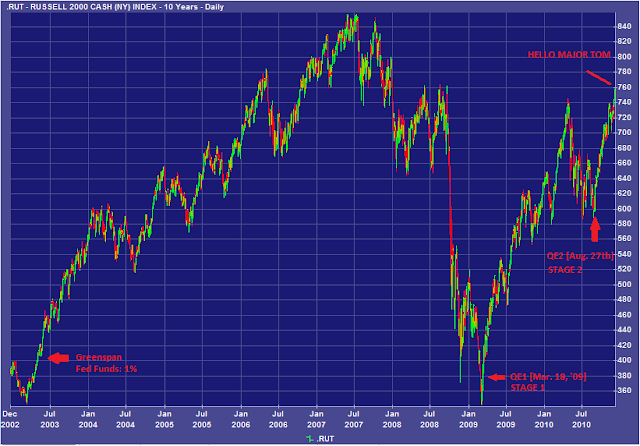

That is all well and good, except that the return on investment from all that spending is extremely low and heading negative in terms of long-term security that we obtain i.e. The Middle East is not getting any safer these days. Moreover, that rate of expenditure is totally unsustainable. The U.S. Federal Government now borrows $.30 of every dollar it spends. Under QE2, the Federal Reserve now prints (monetizes) $.20 of those borrowed dollars. Quickly doing the Ponzi math in my head...nevermind, I was wrong, it looks like we just need to print another $.10 on the dollar and everything will be A-Fucking OK ! It just makes me wonder why the Founding Fathers of the U.S. never thought of "Quantitative Easing" (printing money) ?

5) Peak Bullshit

The endgame is Peak Bullshit and it's here big time. Objectivity is as dead as a door nail. It's bad enough when you lie to someone else, but when you start lying to yourself, it's game over man...

---------------------------------------------------------------------------------

Ironically you could argue that my above argument itself is polemic and therefore largely unsubstantiated by hard data. Granted the raving lunatic diatribe is one of my guilty pleasures, however, I feel no more moved to cite sources for the above imminent realities than to cite a scientific finding on the olfactory properties of manure when I assert that "shit stinks". Lack of valid citations are a necessary, but not sufficient condition to prove an argument false. For my part, as always, I am more than happy to let history and reality be the final arbiter. I write this blog simply as a time capsule to the future - a time when archaeologists will dig down through 10,000 feet of debris to find the remains of our collapsed civilization and wonder - "what the fuck were they thinking?".