The globalized economy is a colossal Ponzi Scheme in which the vast majority survive on the bread crumbs falling off the table. The possibility of 7 billion people achieving a consumption-oriented lifestyle is zero, so the World Bank conveniently set the poverty line at $1.25/day to legalize global slavery. As long as someone else's children are doing the suffering, it's "all good". Post-2008, this illusion was extended merely by plundering all future generations.

Monday, January 31, 2011

Friday, December 17, 2010

DEJA VU

There is no better example of the complete corruption and failure of U.S. leadership, than events of the past few weeks.

Like the stock market, the cycles of decision making stupidity are attenuating. The time it takes from the inception of a bad decision until realization of the bad outcome is now becoming inescapably immediate. Obama commissioned the Bipartisan Deficit Reduction Commission and yet before the ink was dry he had already completely ignored the recommendation. Meanwhile, Republicans who still pretend to be fiscal conservatives after decades of Supply Side profligacy, by no surprise, completely ignored the same findings and fully endorsed extension of the Bush tax cuts and the additional payroll tax cut. The Commission recommended a combination of reducing spending and raising taxes. So, what did the Government do, just days later? They passed a new bill to increase spending and lower taxes !!!

Welcome to the era of the Dumbest Generation. You can't make this shit up.

All the while, European countries such as Germany, often derided in the U.S. as "socialist", have exhibited far greater fiscal discipline for the past decade and to a stark degree since the financial debacle. So much for all of the "capitalist" propaganda and hollow sloganeering by Faux News.

While other countries are taking the bitter pill and undertaking BOTH fiscal and monetary belt tightening to remove the excesses leading up to the financial crisis, the U.S. is doing the exact opposite - raising spending, lowering taxes AND increasing monetary leverage (QE2) to ensure even more hot money is in the hands of short-term speculators. What a great fucking strategy; the U.S. economic Dreamliner is losing power and crashing towards earth, so the Morons of the Day just nosed down to increase the angle of attack. Why crash small time, when you can drill a fucking crater ?

Cynics would say that the U.S. Dealers (aka. Leaders) already have figured out what I explained recently, that the U.S. is already beyond the point of no return debt-wise, so why not just party-on a while longer. So either they are morons with bad math skills, or liars who understand the gravity of the situation and are just propagating the illusion of solvency - either way, the situation is not good.

Cynics would say that the U.S. Dealers (aka. Leaders) already have figured out what I explained recently, that the U.S. is already beyond the point of no return debt-wise, so why not just party-on a while longer. So either they are morons with bad math skills, or liars who understand the gravity of the situation and are just propagating the illusion of solvency - either way, the situation is not good.

What Else is Not New?

Since Bernanke's Fed enacted QE2 in November, the program of further "easing" borrowing costs has had the exact opposite effect. Over the past 5 weeks, the 30 year mortgage rate has risen from 4.17% to 4.83%. In addition, oil prices have increased, as have food prices. Meanwhile, core CPI has been stagnant and or falling. Core CPI tracks very closely to wages. Therefore, what has happened since QE2 was launched is that wages have stagnated, whereas the real cost of living has increased across every major dimension - food, energy and housing. This is by far the worst of all possible worlds for the U.S. economy (outside of Wall Street). This is Deja Vu, because we had the exact same scenario back in early 2008, as I wrote here. The Fed back then was a on a rate cutting bonanza to bailout banks and fund speculators all at the expense of average Americans. We all remember how that worked out.

Market Update

1)Prechter & Co got back on board the all-out bearish bus this week with the latest EWT. (After a brief flirt with bullish lunacy...)

2) The Arms Index (Trin), reached its most overbought reading in its 50 year history, despite the market still being 20% below its all time peak and unemployment at 10% !!!

3) Silver and Gold look to have put in a solid reversal on extremely high volume.

4) The Euro is impulsing lower.

5) Long-term treasury bonds look to have put in a decent bottom on a five wave impulse and massive volume.

6) Various other sentiment indicators ISEE/II/AAII at multi-year extremes; mutual fund cash balances at decade lows etc...

So...the risk trade is slowly but surely "coming off". Let's see if the Big Money boyz make it to 12/31, bonus time this year before the wheels come off for good, it's going to be very close...

Since Bernanke's Fed enacted QE2 in November, the program of further "easing" borrowing costs has had the exact opposite effect. Over the past 5 weeks, the 30 year mortgage rate has risen from 4.17% to 4.83%. In addition, oil prices have increased, as have food prices. Meanwhile, core CPI has been stagnant and or falling. Core CPI tracks very closely to wages. Therefore, what has happened since QE2 was launched is that wages have stagnated, whereas the real cost of living has increased across every major dimension - food, energy and housing. This is by far the worst of all possible worlds for the U.S. economy (outside of Wall Street). This is Deja Vu, because we had the exact same scenario back in early 2008, as I wrote here. The Fed back then was a on a rate cutting bonanza to bailout banks and fund speculators all at the expense of average Americans. We all remember how that worked out.

Market Update

1)Prechter & Co got back on board the all-out bearish bus this week with the latest EWT. (After a brief flirt with bullish lunacy...)

2) The Arms Index (Trin), reached its most overbought reading in its 50 year history, despite the market still being 20% below its all time peak and unemployment at 10% !!!

3) Silver and Gold look to have put in a solid reversal on extremely high volume.

4) The Euro is impulsing lower.

5) Long-term treasury bonds look to have put in a decent bottom on a five wave impulse and massive volume.

6) Various other sentiment indicators ISEE/II/AAII at multi-year extremes; mutual fund cash balances at decade lows etc...

So...the risk trade is slowly but surely "coming off". Let's see if the Big Money boyz make it to 12/31, bonus time this year before the wheels come off for good, it's going to be very close...

Thursday, December 9, 2010

In a Nutshell

Here is a guy telling it like it is:

http://www.youtube.com/watch?v=koY6kXhQDQo&feature=player_embedded

This gent raises some good points around who did and did not benefit from this ongoing fiasco. Apologists for the status quo (ardent crony capitalists, CNBS infotainers etc.) tell us that homeowners are equally responsible for having leveraged their homes to the maximum and otherwise taken too much risk.

All along these same jackass disinformers have been extolling the virtues of the (supply side) capitalist model based on incentives. So I find it a tad hypocritical to blame homeowners for taking advantage of cheap and abundantly available credit which at the height of things was shoved down their throats 24x7. No sooner did they respond to these "incentives" than the entire scheme started unravelling. In any other market, we are told that it is normal behaviour for consumers to respond to low prices by increasing their consumption i.e. the demand curve. Yet, in the case of capital demand, when the price (interest rate) was lowered substantially, we are told that households were foolish for having consumed more debt ! Is the average household now supposed to be a macroeconomic forecaster, able to predict the overall trend in housing prices and interest rates? Meanwhile, I have no doubt that the average economist has lost money via stocks or real estate during this fiasco.

Gut check. Let's review the distribution of impacts so far:

1) Government/Regulators:

Role in fiasco:

-Failure to regulate

-Easing of regulations to accomodate banksters (Glass Steagall repeal)

-Overlooking ongoing deficits and trade imbalances

Retribution: None - business as usual

2) Banksters:

Role in fiasco:

-Extension of credit to those who could not afford it;

-Outright fraud while securitizing garbage loans;

-Over-leveraging of banks

-Insider Trading on a pervasive scale

-Collapsed investment funds, leaving investors holding the bag

-Leading entire economy to brink of disaster

Retribution:

- Massive $10 trillion+ Industry bail out courtesy of Turbo Flat Tax

- Massive bonuses before, during ("retention" bonuses), and after crisis

i.e. business as usual

3) Federal Reserve:

4) "Irresponsible" households:

Role in fiasco: Overconsumption, overleverage on housing and other forms of debt

Retribution:

- Foreclosure/loss of personal residence

- Bankruptcy (divorce)

- Fund taxpayer bailout of banksters

- Top Ramen for Christmas dinner

Is this a great fucking system or what?

http://www.youtube.com/watch?v=koY6kXhQDQo&feature=player_embedded

This gent raises some good points around who did and did not benefit from this ongoing fiasco. Apologists for the status quo (ardent crony capitalists, CNBS infotainers etc.) tell us that homeowners are equally responsible for having leveraged their homes to the maximum and otherwise taken too much risk.

All along these same jackass disinformers have been extolling the virtues of the (supply side) capitalist model based on incentives. So I find it a tad hypocritical to blame homeowners for taking advantage of cheap and abundantly available credit which at the height of things was shoved down their throats 24x7. No sooner did they respond to these "incentives" than the entire scheme started unravelling. In any other market, we are told that it is normal behaviour for consumers to respond to low prices by increasing their consumption i.e. the demand curve. Yet, in the case of capital demand, when the price (interest rate) was lowered substantially, we are told that households were foolish for having consumed more debt ! Is the average household now supposed to be a macroeconomic forecaster, able to predict the overall trend in housing prices and interest rates? Meanwhile, I have no doubt that the average economist has lost money via stocks or real estate during this fiasco.

Gut check. Let's review the distribution of impacts so far:

1) Government/Regulators:

Role in fiasco:

-Failure to regulate

-Easing of regulations to accomodate banksters (Glass Steagall repeal)

-Overlooking ongoing deficits and trade imbalances

Retribution: None - business as usual

2) Banksters:

Role in fiasco:

-Extension of credit to those who could not afford it;

-Outright fraud while securitizing garbage loans;

-Over-leveraging of banks

-Insider Trading on a pervasive scale

-Collapsed investment funds, leaving investors holding the bag

-Leading entire economy to brink of disaster

Retribution:

- Massive $10 trillion+ Industry bail out courtesy of Turbo Flat Tax

- Massive bonuses before, during ("retention" bonuses), and after crisis

i.e. business as usual

3) Federal Reserve:

Role in fiasco:

-Lowered interest rates to engineer bogus "recovery" and create incentives for households to borrow way beyond their means;

-Provide leverage to speculators, under-regulate banks

-Turn blind eye to securitization frauds;

-Allow banks to become "too big to fail", requiring massive taxpayer bailouts

Retribution: None. No oversight whatsoever; now via Quantitative Easing finding new ways to increase systemic leverage

4) "Irresponsible" households:

Role in fiasco: Overconsumption, overleverage on housing and other forms of debt

Retribution:

- Foreclosure/loss of personal residence

- Bankruptcy (divorce)

- Fund taxpayer bailout of banksters

- Top Ramen for Christmas dinner

Is this a great fucking system or what?

Labels:

banksters,

CNBS,

Ponzi Scheme,

ponzi world

Friday, December 3, 2010

Dr. Bernanke or: How I Learned to Stop Worrying and Love the Bust

This week I observed a very rare Double Top fractal at three degrees of trend. A fractal is a repeating pattern - in this case a double-top. Each of these double tops attends extreme bullish sentiment towards the stock market and an inverted head and shoulders (triple) bottom between the tops:

By the way, for those who do not subscribe to EWI (literally or figuratively), their most recent "December Financial Forecast" sees as the most likely scenario higher prices going into year end, leading to a final top above current levels. For the most bearish of all published forecasters to have now switched from being full on bearish since April expecting the market to top out imminently, to now being bullish (at least intermediate) term, I regard that as capitulation. Maybe they will be right this time, but since they have been wrongly bearish for the better part of a year, I am not betting that they will now get it right. More likely they will be the last fools sucked in at the top, too focused on their ever-changing wave counts and ignoring all other flashing indicators including their own capitulation. Given that they alter their wave counts continuously after-the-fact, we can be confident they will be "right" eventually, that's guaranteed.

The graph below shows the numbered red lines indicating each double-top. Red up arrows show the head and shoulder bottoms (I only show the largest two fractal bottoms).

Extreme sentiment refers to the AAII and II sentiment surveys which are at similar extremes reached in October 2007 and April of this year. As well, the ISEE call/put ratio printed 183 yesterday, the highest level since April 15th (just prior to the top).

The below close up view of this year's action shows the (2) and (3) fractals:

To summarize, the first double-top rally (from 2003-2007) took ~5 years to reach extreme sentiment and a peak. The rally from March 2009 to April 2010 lasted just over one year and reached a similar extreme in sentiment and a market peak. The rally from the low this past August to this November's high, lasted 2.5 months, peaked, triple-bottomed earlier this week and is now straight vertical, having already again reached an extreme in sentiment.

Each rally is of shorter and shorter duration than the last yet attends the same level of investor enthusiasm. Why are investors equally bullish as October 2007 when the market is 20% lower? Why are they equally bullish as last April when the market has gone nowhere?

This effect is called attenuation, the same concept used in electrical engineering to describe a loss of signal. Or the term used in cardiology to denote the heart's pattern immediately prior to a heart attack...

By the way, for those who do not subscribe to EWI (literally or figuratively), their most recent "December Financial Forecast" sees as the most likely scenario higher prices going into year end, leading to a final top above current levels. For the most bearish of all published forecasters to have now switched from being full on bearish since April expecting the market to top out imminently, to now being bullish (at least intermediate) term, I regard that as capitulation. Maybe they will be right this time, but since they have been wrongly bearish for the better part of a year, I am not betting that they will now get it right. More likely they will be the last fools sucked in at the top, too focused on their ever-changing wave counts and ignoring all other flashing indicators including their own capitulation. Given that they alter their wave counts continuously after-the-fact, we can be confident they will be "right" eventually, that's guaranteed.

Dr. Bernanke in the house: When all you have is a hammer, everything starts to look like a nail

Meanwhile, in other news, today's jobs report was far worse than "expected". With 39,000 net new jobs created v.s. 150,000 expected and 250,000 minimum needed to offset new entrants to the labour force.

Copious disinformers still abound to support Bernanke's QE2 (Money printing) scheme, which has done nothing for the real economy to date (hence the v.2 nomenclature, soon to be 3,4,5...) Those supporting this scheme tend to be of the Wall Street ilk and thereby the primary beneficiaries of being able to borrow at 0% and lend at 4%, risk free - via the various carry trades enabled by this "policy" of basically giving out free money to select wealthy investors at the public expense. As we have seen before, all of this extra financial leverage makes for extremely spectacular busts when these carry trades are unwound.

Speaking of which, we learned this week that the Fed extended a total of $9 trillion in loans to the banks during the banking crisis - $9 fucking trillion ! Do you remember all of the hand wringing, Tea Partying, letters to Congressmen that abounded when the Treasury initiated the TARP program in Sept. 2008? Yet, for all that, the $700 billion TARP was less than 10% of what the Fed doled out - it was chump change. The Fed on the other hand, faced absolutely zero oversight or intervention while extending the U.S. balance sheet several times beyond historic levels.

2008 was a tremor, next comes the earthquake

What has the Fed done in the meantime to correct the imbalances and mal-incentives that led to the 2008 financial crisis? All they have done is to further leverage the system by inventing new ways (Quantitative Easing) to put money in the hands of leveraged speculators and thereby kicked the can a few yards down the road towards the next much larger catastrophe. The odds that the Fed can kickstart the economy and engineer a successful exit strategy by applying even more of the same easy money that caused the first crisis, is exactly fucking zero.

The Fed is run by a bunch of overeducated moronic stooges toiling feverishly at the behest of their moneyed puppetmasters on Wall Street. Harvard and the University of Chicago do not teach any courses on judgement and commonsense, which is why there are so many fucking morons in high places pissing all over themselves while the fire burns out of control.

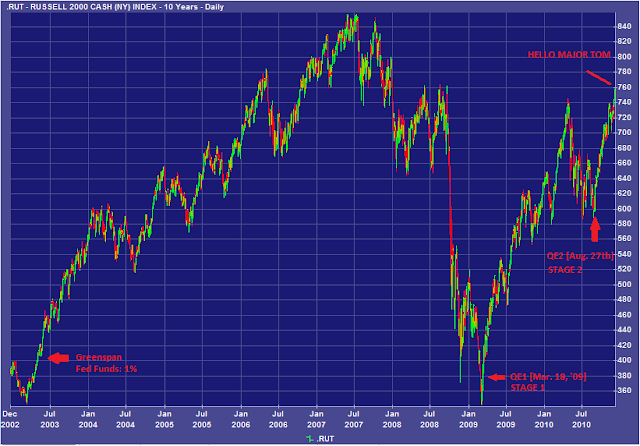

The stock market chart below illustrates the only true beneficiaries of Monetary Policy. On the far left, Greenspan's 1% interest rate policy [June 25th, '03] (at the time, the lowest in U.S. history), that propelled the 2003 "Mission Accomplished" rally and led to the parabolic housing boom that is still negatively impacting a large number of households. On the right side, Bernanke's Moon Shot showing Stage 1 [QE1], Stage 2 [QE2] and our current juxtaposition, once again in Outer Space. Oddly, charts like this don't make me optimistic:

2008 was a tremor, next comes the earthquake

What has the Fed done in the meantime to correct the imbalances and mal-incentives that led to the 2008 financial crisis? All they have done is to further leverage the system by inventing new ways (Quantitative Easing) to put money in the hands of leveraged speculators and thereby kicked the can a few yards down the road towards the next much larger catastrophe. The odds that the Fed can kickstart the economy and engineer a successful exit strategy by applying even more of the same easy money that caused the first crisis, is exactly fucking zero.

The Fed is run by a bunch of overeducated moronic stooges toiling feverishly at the behest of their moneyed puppetmasters on Wall Street. Harvard and the University of Chicago do not teach any courses on judgement and commonsense, which is why there are so many fucking morons in high places pissing all over themselves while the fire burns out of control.

The stock market chart below illustrates the only true beneficiaries of Monetary Policy. On the far left, Greenspan's 1% interest rate policy [June 25th, '03] (at the time, the lowest in U.S. history), that propelled the 2003 "Mission Accomplished" rally and led to the parabolic housing boom that is still negatively impacting a large number of households. On the right side, Bernanke's Moon Shot showing Stage 1 [QE1], Stage 2 [QE2] and our current juxtaposition, once again in Outer Space. Oddly, charts like this don't make me optimistic:

The other beneficiaries of Bernanke's doomed munificence are silver and gold investors, who will ride that bullet train until it crashes and burns:

So, do you feel lucky, punk?

These silver investors are seeking shelter from "inflation" even as the core CPI prints its lowest reading ever (since data collecting started in 1957). Check out this chart. Wow, that's inflation all right ! Silver investors tell us that core CPI is inaccurate and does not reflect true costs of commodities and precious metals.

Let's see, inflation is "going up", so buy silver. Silver is going up, therefore inflation is going up ! Buy more silver!

Hi Ho Silver, Away !!!!

Hi Ho Silver, Away !!!!

;-)

Labels:

Ponzi Scheme

Saturday, November 27, 2010

Point of no Return

This week's edition of the The Economist featured an article on Japan and its demographic (ageing) crisis.

Voodoo Economics

Definition of Recession is Totally Bogus

Officially, according to NBER, the U.S. is out of recession, and has been since June 2009. Of course, that is totally bogus because the "official" definition of recession does not take into account fiscal deficits, so it is meaningless. Whether, the deficit was at 0% or 10% of GDP (as it is now), the U.S. would still be deemed to be out of recession. Currently, as I write, GDP growth is running at ~2% year over year, so in reality, the true economy is running at a negative 8%. When a country can borrow 10% of its GDP and then declare that the economy is "growing" at 2%, that's the trifecta - bad math, denialism and stupidity all rolled into one.

Legacy of the Baby Boomers

That 14% represents the hole in the economy left behind by the most greed-addled, self-indulgent generation in world history. Not only are the Boomers spending the wealth inherited from their parents, they've underfunded and raided their own 401k retirement funds, bankrupted Medicare and Social Security, and on top of all that left A GAPING 14% SMOKING CRATER where the economy used to be, for their children and grandchildren to inherit.

Voodoo Economics

Not surprisingly, the article missed out on by far the most important point regarding Japan and a key point that is instructive for all nations currently running deficits. The point is that once a country starts running structural deficits to fund operating expenditures, it soon becomes mathematically and politically impossible to ever pay off the debt. Economists like to point to the ability of countries to "out grow" their debt and deficits via Supply Side Economics. A third grader is smart enough not to believe such a load of rubbish, but not so today's average economist/politician/bankster.

One can easily construct a financial model to indicate the impact to the Japanese economy were it to even attempt to start paying down its debt.

Assumptions:

- Current Federal debt at 200% of GDP (which it is)

- Average Duration of debt: 30 years (this is a VERY generous assumption)

- Average interest rate on debt: 1% (The rate on JGBs fluctuates, but is currently very low)

Now we see why it was so easy to ignore this problem in Japan for so long. With interest rates at 1%, the conventional wisdom is that "Debt Service Costs" are extremely low, so there is no harm in taking on more debt. Unfortunately for the purveyors of this "load", there is more to debt service than simply the current interest i.e. principal.

Plug the above figures into Excel and now assume that all of this debt needs to be paid off in 30 years time. In this model, we are solving for the Payment (a blend of principle + interest) i.e. the true debt service cost and the one that would have saved "The Economist" from devoting a lengthly article to evading the simple truth.

Over 30 years, as a percent of GDP, the payment is: 8% !!!

Wait, it gets worse. Obviously in order to pay down debt, a country needs to first stop accruing new debt i.e. first eliminate the annual recurring deficit. Japan's fiscal deficit for 2010? 10%

The Bottom Line for Japan:

In order for Japan to START paying down its current level of debt over a 30 year period it would have to incur a 16% hit to GDP immediately and that figure will only grow into the future. (NOTE: 2% of GDP is interest and already included in the deficit).

U.S. Example:

Variables for the U.S.:

- Current Federal debt at 100% of GDP

- Average Duration of debt: 20 years (average duration is currently 5 years, so this is very generous)

- Average interest rate on debt: 3%

- Current annualized deficit for 2010: 10%

Level of GDP that would be removed by paying off debt over 20 years:

[Ongoing debt service cost, amortized over 20 years: 6.7% of GDP]

Including 10% Deficit: ~14% (after taking out the 3% interest due to double-counting)

Keep in mind, both countries are applying unprecedented fiscal and monetary stimulus at this juncture and yet there is minimal growth in either country i.e. no sign whatsoever that either country could possibly remove the bulk of stimulus while at same time maintaining a positive economic growth rate MUCH LESS pay down a $1 of debt.

Definition of Recession is Totally Bogus

Officially, according to NBER, the U.S. is out of recession, and has been since June 2009. Of course, that is totally bogus because the "official" definition of recession does not take into account fiscal deficits, so it is meaningless. Whether, the deficit was at 0% or 10% of GDP (as it is now), the U.S. would still be deemed to be out of recession. Currently, as I write, GDP growth is running at ~2% year over year, so in reality, the true economy is running at a negative 8%. When a country can borrow 10% of its GDP and then declare that the economy is "growing" at 2%, that's the trifecta - bad math, denialism and stupidity all rolled into one.

Legacy of the Baby Boomers

That 14% represents the hole in the economy left behind by the most greed-addled, self-indulgent generation in world history. Not only are the Boomers spending the wealth inherited from their parents, they've underfunded and raided their own 401k retirement funds, bankrupted Medicare and Social Security, and on top of all that left A GAPING 14% SMOKING CRATER where the economy used to be, for their children and grandchildren to inherit.

As I have said before, GAME OVER, MAN. We just need Wall Street and the morons with the fancy degrees to wake up and smell the fucking napalm.

Labels:

Ponzi Scheme,

U.S. debt,

U.S. deficit

Saturday, November 20, 2010

Roadmap for Collapse Part II

In the first installment of the Roadmap, I discussed the market implications of the collapse. With this installment, I gaze further into the abyss to discuss the potential economic outcomes of the collapse. For this purpose, I created the hypothetical decision model (below).

As you see, I divided the map into three main areas: reflation (economic normalcy), deflation (price, asset, economic), hyperinflation (mainly price).

As far as assumptions, I suppose the fundamental assumption is that without Government stimulus (fiscal/monetary) the economy is not self-sustaining and therefore would quickly succumb to the deflationary forces of the total debt burden.

Therefore, the pollyanna scenario of a self-sustaining economy without ongoing fiscal and monetary intervention is not represented in this model, and I assume anyone reading this blog in the first place, gets that.

As you see, I divided the map into three main areas: reflation (economic normalcy), deflation (price, asset, economic), hyperinflation (mainly price).

As far as assumptions, I suppose the fundamental assumption is that without Government stimulus (fiscal/monetary) the economy is not self-sustaining and therefore would quickly succumb to the deflationary forces of the total debt burden.

Therefore, the pollyanna scenario of a self-sustaining economy without ongoing fiscal and monetary intervention is not represented in this model, and I assume anyone reading this blog in the first place, gets that.

Most likely scenario: Deflation then Hyperinflation

As depicted by the blue lines and as described vividly throughout my posts, I expect another even stronger market event than the one we experienced in 2008, which would be extremely deflationary. Those who believe it would not be deflationary, forget that both oil and gold tanked during the turmoil two years ago. Where I indicate that a policy is "blocked", I mean politically blocked. Given the newly elected Republican-dominated Congress, the likelihood of either the Gov't or the Fed continuing to add "stimulus" unfettered, is highly unlikely.

As you see, I have represented a "Default" scenario under which the U.S. Gov't repudiates its debts, as a potential scenario, given the new political backdrop - a scenario I thought highly unlikely until recently. I still think that an outright default is unlikely, making the "middle scenario" of MASSIVE fiscal stimulus combined with massive monetization, essentially devolving into de facto currency printing (via FDIC payouts, stimulus checks etc.), as the most likely scenario.

Less likely scenario: "Status Quo", leading directly to Hyperinflation

This is a very popular scenario these days, causing the big run up in gold. In order to believe this chain of events, you must make certain unlikely assumptions:

1) Assumes no adverse market "event" similar to 2008, which as indicated was extremely deflationary

2) Assumes that an inevitable backup in interest rates, would itself not cause the economy to stall and the markets to collapse

3) Assumes there would be no political intervention in the current stimulus trajectory and that fiscal and monetary stimulus would continue unfettered (seems very unlikely)

Pollyanna (impossible) scenario: Self-sustaining economy and removal of all stimulus

This scenario is extremely unlikely, given:

1) Overall magnitude of Government stimulus, now baselined into GDP

2) No sign of sustainable economic growth, especially in a low/no leverage environment

3) Massive outsourcing which has caused long-term secular unemployment and removed entire industries and skillsets from the U.S. economy i.e. the unemployed have skills that are no longer in demand in the U.S.

4) Massive debt overhang that will continue to put deflationary pressure on the economy

5) Unresolved Social Security and Medicare deficits

Threading the Needle->All paths lead to hyperinflation...Eventually

While, as indicated in the model, all paths lead to hyperinflation, it could take some time to get there. Keep in mind, there are a whole lot (most) of other countries that will go bust before the U.S., which in the "short-term " will increase deflationary pressures and demand for U.S. dollars as a safe haven. Any country that does not issue debt in its own currency (i.e. entire Euro area and Eastern Europe) will highly likely default.

A U.S. default, were it to eventually occur would "collapse" the U.S. dollar - relative to what, is the question i.e. other currencies would be similarly debased. Relative to gold and silver is the likely answer. Inevitably, what is left of the already-weakened banking system would be obliterated. That part of the economy supported by borrowing and lending would be gone, along with a substantial negative economic multiplier. Residual private debts and fixed contracts would be a crushing weight on the economy and likely lead to the "Weimar" scenario of printing currency to eliminate the residual debt burden. I do not believe any Government on the planet has the will power to keep from printing its way out of a deflationary depression on the order of magnitude we will face, while confronting mass social unrest on an unprecedented scale.

Printing and distributing enough physical currency to even partially offset the amount of derivative "money" in the credit-based system, will not be a trivial ordeal...As one would expect in our Fractional Reserve Banking Model, physical currency currently represents only about 10% of the total "money supply" (M3). So imagine a world where (even temporarily) the majority of money in circulation, is eliminated i.e. a cash-only economy - the Euro too, long since having been abandoned. In this scenario, inflation would build over time, likely very slowly initially and then accelerating.

Timing is Everything

All of this is highly speculative, as the scale of monetary collapse described above will be unprecedented and accompanied by substantial geopolitical strife and domestic anarchy. Sequence is hard enough, timing is impossible to predict accurately, however, I see the overall scale of the model below in the 3-5 year range, perhaps ten years maximum. Some things will likely occur faster than expected, whereas other phases will likely drag out much longer than expected.

Invest at your Own Risk

Therefore, given all of the potential paths and scenarios, it's not at all clear how one would successfully navigate a crisis of this magnitude. Surely some amount of hard cash, gold, rice and ammunition is in order. For the time being, I still like U.S. Treasuries (all durations) here. I would also view a (large) pullback in gold as an initial buying opportunity with the goal of scaling in to a substantial position eventually...

For those in Canada, I like 3+ year duration Government of Canada bonds, which you can buy through a brokerage account (NOT Canada Savings Bonds, which are totally illiquid - can't be traded).

For those in Canada, I like 3+ year duration Government of Canada bonds, which you can buy through a brokerage account (NOT Canada Savings Bonds, which are totally illiquid - can't be traded).

Friday, November 19, 2010

Waiting for Godot, in the Pet Sematary

"Clowns to the left, and jokers to the right...Stuck in the Middle with you"- Stealers Wheel

Ho Hum, just another week in the markets:

- Just another European economy on the brink of insolvency

- Just another brawl between Central Bankers regarding Mercantilist policies

- Yet again, the same fucktard Fed, excoriating U.S. Gov't deficits, while at the same time financing these deficits by printing more U.S. dollars. That is like a crack dealer telling his customer he has a drug problem.

- The Chinese angry at the U.S. over the fact that inflation is running between 4-10% (depending on who you believe), yet continuing to peg the Yuan to the U.S. dollar to ensure ongoing trade imbalances (guaranteeing inflation).

- And note the accompanying asinine comment from Faber, telling us that the underlying issue is [beleaguered] American consumers borrowing too much, even as their jobs and incomes are systematically being eliminated i.e. nothing to do with China's currency policy !

I could not make up this much self-contradicting stupidity if I sat down for hours and tried...

-----------------------------------------------------------------------------------------------

Overall, on the "left", we have the usual Tools and Fools trying to propagate the illusion of recovery via yet another Fed prop, QE2. We have had umpteen Fed actions these past few years now: interest rates at 0%, monetization of mortgage debt (MBS), no less than three rounds of monetizing public debt - QE1 was round 1, then the Fed started rolling MBS security repayments into Treasuries starting this past August, now another $600 billion just in time for Wall Street bonus season, what a coincidence! Nothing but desperate fools thinking that more cheap money can solve a debt problem brought on by cheap money. Let's see, if we can only make crack cocaine cheaper, then we could solve the drug problem...that's the ticket !!! Anyone who defends Monetary policy at this point is an Intellectually bankrupt jackass . Book smart morons, indicative of the comfort seeking class of Baby Boomers (not all, surely) who lack the intellectual honesty and courage to face reality, much less gaze into the fucking abyss.

On the right - well, you know, Palin & Co's. demented hillbillies, hellbent on creating the new Fascist state, that surely-be-to-God will rise from the ashes. An American Taliban that will dispense with the liberal nihilists and Limousine liberals with a sweep of the hand.

Wait for it! Be patient, it's coming....Rome was not burned in a day...

According to the latest EWT, the markets are at a sentiment extreme exceeding the 2007 high, despite being 20% lower in price and attending a punk, Pet Sematary version of the "Goldilocks" economy, that is rolling over by the minute...

Stuck in the Middle With You.

Ho Hum, just another week in the markets:

- Just another European economy on the brink of insolvency

- Just another brawl between Central Bankers regarding Mercantilist policies

- Yet again, the same fucktard Fed, excoriating U.S. Gov't deficits, while at the same time financing these deficits by printing more U.S. dollars. That is like a crack dealer telling his customer he has a drug problem.

- The Chinese angry at the U.S. over the fact that inflation is running between 4-10% (depending on who you believe), yet continuing to peg the Yuan to the U.S. dollar to ensure ongoing trade imbalances (guaranteeing inflation).

- And note the accompanying asinine comment from Faber, telling us that the underlying issue is [beleaguered] American consumers borrowing too much, even as their jobs and incomes are systematically being eliminated i.e. nothing to do with China's currency policy !

I could not make up this much self-contradicting stupidity if I sat down for hours and tried...

-----------------------------------------------------------------------------------------------

Overall, on the "left", we have the usual Tools and Fools trying to propagate the illusion of recovery via yet another Fed prop, QE2. We have had umpteen Fed actions these past few years now: interest rates at 0%, monetization of mortgage debt (MBS), no less than three rounds of monetizing public debt - QE1 was round 1, then the Fed started rolling MBS security repayments into Treasuries starting this past August, now another $600 billion just in time for Wall Street bonus season, what a coincidence! Nothing but desperate fools thinking that more cheap money can solve a debt problem brought on by cheap money. Let's see, if we can only make crack cocaine cheaper, then we could solve the drug problem...that's the ticket !!! Anyone who defends Monetary policy at this point is an Intellectually bankrupt jackass . Book smart morons, indicative of the comfort seeking class of Baby Boomers (not all, surely) who lack the intellectual honesty and courage to face reality, much less gaze into the fucking abyss.

On the right - well, you know, Palin & Co's. demented hillbillies, hellbent on creating the new Fascist state, that surely-be-to-God will rise from the ashes. An American Taliban that will dispense with the liberal nihilists and Limousine liberals with a sweep of the hand.

Wait for it! Be patient, it's coming....Rome was not burned in a day...

According to the latest EWT, the markets are at a sentiment extreme exceeding the 2007 high, despite being 20% lower in price and attending a punk, Pet Sematary version of the "Goldilocks" economy, that is rolling over by the minute...

Stuck in the Middle With You.

Labels:

Ponzi Scheme

Sunday, November 14, 2010

Roadmap for Collapse Part I

[Last Update: 11/14/2010]

We have all seen this movie before - Nasdaq 2000, the post-9/11 boom/bust (~2002/2003), the Housing market debacle (2005/2006), the Commodities melt-up/melt-down (2007), the Lehman/subprime fiasco (2008). Each of these debacles, was aided and abetted by trade imbalances and cheap money (Fed policy). In the aftermath of each crash, the Fed was able to rescue the economy by applying even more monetary stimulus than the last time (in conjunction with ever increasing government spending). Therefore, investors have been lulled into a sense of confidence that the Fed is infallible and can fix any economic problem. Yet, only a total fool would assume that they can keep the Ponzi pyramid intact forever. Applying additional monetary easing to solve a debt problem is like drinking to solve an alcohol addiction.

One should bear in mind that the vast majority of money managers are not concerned with the Fed's exit strategy. Their only concern is what happens between now and 12/31 bonus time. As for individual investors, everyone rides the market bullet train thinking they can be the first off before it crashes. Amazingly, even Bill Gross, Manager of the world's largest bond fund, admitted this week that the Fed's policies are "somewhat of a Ponzi Scheme !!!"

Why Bernanke is either really stupid, a Tool for Wall Street, or most likely both...

The Fed's hopeless goal right now is to propagate the illusion of recovery long enough for a real economic recovery to take hold, essentially the game plan for every recession since WWII. After all, when the stock market is going up, that gives the illusion of recovery. Aided and abetted by 30 years of outsourcing and globalization, the Fed has long been able to manipulate interest rates to encourage consumption and debt, without generating hyperinflation. Back in the 1950s total debt levels were at 50% of GDP, now total debt is at 360% of GDP i.e. 7 times higher. Unlike all of those previous economic recoveries we are now post facto millions of jobs having been outsourced while having overall debt levels at 360% of GDP, so this time, there is no underlying economic fuel (new businesses, jobs) to sustain the economy. Essentially, the Fed is just pouring gasoline on a dying fire. Yes, there is a short-term burst of monetary "stimulus" that juices the stock market, but the real economy just keeps rolling over. Only a delusional optimist assumes that the debt pyramid will continue to grow and that lenders will accept new debt for repayment of old debt (aka. Ponzi borrowing) indefinitely, into an imploding economy. When confidence collapses and lenders realize that the goal is return of capital (principal) not return on capital (interest), then the markets will collapse, DEFLATION will take hold BIG TIME, and the Fed will be totally impotent.

The Global Ponzi Scheme is Going SUPER NOVA

Under "QE2", The Bernanke Fed has committed an additional $600 billion to buy up Treasury bonds and further leverage the system. With each purchase, the Fed pushes investors further and further out on the risk curve. To that point, risk markets around the world - stocks, bonds, commodities, gold - went parabolic this week. The Hang Seng (Hong Kong) is gapping up vertically ! We are reaching end game. Like a dying sun, the global credit-based Ponzi Scheme is actually accelerating, as it goes SUPER NOVA, first expanding outward in one last gasp of frenzied speculation, only to ultimately collapse inward upon itself. It will be a crash heard around the world, as investors wake up to the fact that they are all on the same side of the boat holding too much risk.

Fool me Six Times, Shame on Me...Under "QE2", The Bernanke Fed has committed an additional $600 billion to buy up Treasury bonds and further leverage the system. With each purchase, the Fed pushes investors further and further out on the risk curve. To that point, risk markets around the world - stocks, bonds, commodities, gold - went parabolic this week. The Hang Seng (Hong Kong) is gapping up vertically ! We are reaching end game. Like a dying sun, the global credit-based Ponzi Scheme is actually accelerating, as it goes SUPER NOVA, first expanding outward in one last gasp of frenzied speculation, only to ultimately collapse inward upon itself. It will be a crash heard around the world, as investors wake up to the fact that they are all on the same side of the boat holding too much risk.

We have all seen this movie before - Nasdaq 2000, the post-9/11 boom/bust (~2002/2003), the Housing market debacle (2005/2006), the Commodities melt-up/melt-down (2007), the Lehman/subprime fiasco (2008). Each of these debacles, was aided and abetted by trade imbalances and cheap money (Fed policy). In the aftermath of each crash, the Fed was able to rescue the economy by applying even more monetary stimulus than the last time (in conjunction with ever increasing government spending). Therefore, investors have been lulled into a sense of confidence that the Fed is infallible and can fix any economic problem. Yet, only a total fool would assume that they can keep the Ponzi pyramid intact forever. Applying additional monetary easing to solve a debt problem is like drinking to solve an alcohol addiction.

One should bear in mind that the vast majority of money managers are not concerned with the Fed's exit strategy. Their only concern is what happens between now and 12/31 bonus time. As for individual investors, everyone rides the market bullet train thinking they can be the first off before it crashes. Amazingly, even Bill Gross, Manager of the world's largest bond fund, admitted this week that the Fed's policies are "somewhat of a Ponzi Scheme !!!"

Why Bernanke is either really stupid, a Tool for Wall Street, or most likely both...

The Fed's hopeless goal right now is to propagate the illusion of recovery long enough for a real economic recovery to take hold, essentially the game plan for every recession since WWII. After all, when the stock market is going up, that gives the illusion of recovery. Aided and abetted by 30 years of outsourcing and globalization, the Fed has long been able to manipulate interest rates to encourage consumption and debt, without generating hyperinflation. Back in the 1950s total debt levels were at 50% of GDP, now total debt is at 360% of GDP i.e. 7 times higher. Unlike all of those previous economic recoveries we are now post facto millions of jobs having been outsourced while having overall debt levels at 360% of GDP, so this time, there is no underlying economic fuel (new businesses, jobs) to sustain the economy. Essentially, the Fed is just pouring gasoline on a dying fire. Yes, there is a short-term burst of monetary "stimulus" that juices the stock market, but the real economy just keeps rolling over. Only a delusional optimist assumes that the debt pyramid will continue to grow and that lenders will accept new debt for repayment of old debt (aka. Ponzi borrowing) indefinitely, into an imploding economy. When confidence collapses and lenders realize that the goal is return of capital (principal) not return on capital (interest), then the markets will collapse, DEFLATION will take hold BIG TIME, and the Fed will be totally impotent.

The Financial Liquidators (America's "Best and Brightest")

Beyond the failed monetary and fiscal policy contributions to this ongoing fiasco, the deeper underlying root cause is apparently something no one wants to discuss let alone confront. Over the past ~30 years, a new culture of financial "liquidators" took control in the U.S. and securitized/monetized all aspects of the Supply Chain from design and engineering through manufacturing. These financiers who became ubiquitous not only on Wall Street but in every major Corporation, displaced the predominant culture of engineers and scientists who had presided over the ascendancy of the U.S. as a manufacturing and engineering powerhouse. The Financial Liquidators have neither the training nor the inclination to design, build or create anything. Instead they have presided over the fevered process of selling off the entire U.S. manufacturing base and the Middle Class along with it. Schooled (and willfully ignorant) in the Anglo/American pollyanna bullshit of Ricardian comparative advantage, and therefore conveniently naive with respect to export mercantilism, they were fully empowered by the fiat currency regime imposed by Richard Nixon and Milton Friedman. What would have happened had the gold standard been maintained, is that the recurring trade deficits would have brought about a run on gold reserves, thus preventing the Idiocracy of the day from outsourcing their entire fucking country. These were the key reasons - to accommodate ongoing trade imbalances, as well as to enable Friedman's Monetary policy to become the Ponzi scheme of choice - why the gold standard was dropped in 1971.

Essentially these short-sighted greedbots were not willing to accept lower returns on capital for even one millisecond to allow U.S. manufacturing to retool vis-a-vis foreign competitors. Leveraged buyouts, securitization, outsourcing, offshoring, union busting are the tools of the trade for the liquidators. A class of salesmen, and speculators v.s. engineers and investors. Self-nominated "dealers" of industry who have inevitably created a self-cannibilizing economic pyramid scheme. A pyramid scheme that has foolishly liquidated its own customer base. Clearly, America's current cohort of "Best and Brightest" are neither the best nor the brightest, nor have they been for quite some time. The self-aggrandizing schools that are spawning these newly minted jackasses need to be held accountable, to say nothing of the entire economics profession which is morally, intellectually, and soon-to-be, quite literally bankrupt.

Of course, this is what the average person in America already knows, so all we are doing is standing around waiting for Wall Street to realize the party is over. Will they make it to 12/31 bonus day before the day of reckoning? They did last year, but as we've been told - Past performance is no guarantee of future results...

For those looking to protect their assets through a deflationary credit collapse. I still recommend Treasuries, as explained here (invest at your own risk):

The Treasury ETFs:

SHY: 1-3 year maturities ("safest" with respect to interest rate movements)

IEI: 3-7 year - probably the best compromise between long and short-term

IEF: 7-10 year - these are the bonds the Fed is buying :-)

TLT: 20+ year - most volatile/speculative, but most upside if yields fall (i.e. deflation)

IEI: 3-7 year - probably the best compromise between long and short-term

IEF: 7-10 year - these are the bonds the Fed is buying :-)

TLT: 20+ year - most volatile/speculative, but most upside if yields fall (i.e. deflation)

-------------------------MARKET SUMMARY ------------------------------

Key fundamental Risks:

Fiscal AND monetary stimulus starting to wear off:

- The economy is slowing despite unprecedented Fiscal and Monetary intervention

- Fiscal and Monetary policy are now one and the same i.e. the Treasury writes a check and the Federal Reserve prints the money. There is no longer any difference between these two policy approaches.

- Yet despite all of this unprecedented "stimulus" the economy is still heading lower which can mean only one thing - the Ponzi scheme is ending.

Key technical risks:

1) Mutual fund cash levels at historic lows

2) Excessive speculation in Emerging Markets (Bombay Sensex), Metals (Silver/gold) and growth stocks Apple, Baidu, Netflix, TravelZoo...all in vertical blowoff mode

3) Market at most overbought level since October 2007 top (Based on the "Open Trin")

- Open Trin is a smoothed moving average of the Trin (ARMS Index)

4) Bullish investor sentiment (AAII) at highest level since October, 2007 all-time top

5) Stocks having highest correlation since 1987 (not a good time to be buying stocks)

7) "Safe" haven bonds uptrending (yields falling) - indicating flight to safety and liquidity

- 2 year Treasury yields at lowest level ever...

------------------------------------------------------------------------------

The below chart indicates the market's position from a long-term Elliot Wave standpoint. According to EW Theory, the market is viewed to be correcting the past ~80 years of rally since the 1932 low. Corrections generally take an a-b-c pattern. The "a" wave is the first wave down, in this case the decline from 2000-2003. The "b" wave is a correction of the "a" wave, in this case the rally that lasted from 2003-2007. Note it is very unusual for a "b" wave to actually retrace an entire "a" wave, however, when that occurs it is deemed to be particularly bearish for the "c" wave which as one would expect, comes as major surprise to those who believe that the worst is over. We are now in wave "c", which itself will be comprised of 5 wave segments (wave "a" and "b" were also comprised of 5 segments). Therefore, wave "1" down was the decline from 2007 that lasted through the Lehman crisis and bottomed in March 2009. Wave 2 is just now completing, as we see with a parabolic spike higher ~1200. That will bring to bear the third wave of wave "c" which will be the strongest wave of the entire secular bear market and eventually bring the market back down to multi-decade lows. After wave "c" a new stock market rally can begin.

As always, take market predictions with a grain of salt, especially with regards to timing. I am highly confident the above scenario (or something similar) will play out, but the timeframe for each of the declines and counter-trend bounces is highly speculative.

For those who deride Elliot Wave Theory as "financial astrology", I would be careful. Granted, their short-term charting is often too early on calling tops and bottoms, however, their overall thesis for a deflationary credit collapse is spot on and playing out entirely as expected.

In addition, EWI has been correct at anticipating the big picture stock market movements i.e. the "a" wave, the ensuing "b" wave rally and now the "c" wave decline, so far... Moreover, not withstanding the past year's rally, at this juncture, safe, low-yielding money market funds are still outperforming the stock market on a 12 year basis (back to 1998). By the time "c" wave bottoms out, short-term funds will have outperformed on a multi-decade basis.

For those who deride Elliot Wave Theory as "financial astrology", I would be careful. Granted, their short-term charting is often too early on calling tops and bottoms, however, their overall thesis for a deflationary credit collapse is spot on and playing out entirely as expected.

In addition, EWI has been correct at anticipating the big picture stock market movements i.e. the "a" wave, the ensuing "b" wave rally and now the "c" wave decline, so far... Moreover, not withstanding the past year's rally, at this juncture, safe, low-yielding money market funds are still outperforming the stock market on a 12 year basis (back to 1998). By the time "c" wave bottoms out, short-term funds will have outperformed on a multi-decade basis.

According to EWI, we are seeing an "All the Same Market" phenomenon similar to 2008 in which ALL risk assets (stocks, Corporate bonds, Municipal bonds, commodities, emerging markets) are becoming highly correlated to the downside, leaving few if any alternatives to U.S. Treasuries.

Labels:

collapse,

Ponzi Scheme

Sunday, October 3, 2010

Citizen Kane on China

We are constantly bombarded with propaganda regarding the Chinese economic "miracle". Just last week Bill Gates and Warren Buffett both went to China to tour the "miracle" in person. Also, this week there was an interview in Barron's pleading the case for why the U.S. should NOT impose trade or currency sanctions. If you read between the lines, this article in a nutshell, indicates why the China/U.S. "relationship" is a latent catastrophe, yet most of the "big boys" are too busy counting their millions and billions to notice.

I took the liberty of paraphrasing the interview, both to save time and to cut out all of the extraneous bullshit and get down to the key message. If you want to read the obfuscated (actual) version, it's here.

What you read below is FICTIONAL (Kind of). I changed the name of the interviewee to protect the "innocent"...

Barron's: Mr. CF Kane is an expert in Chinese affairs, having racked up 1.2 million frequent flyer miles observing the economy from 80,000 feet and from the comfort of the First Class Lounge at Shanghai International.

He also teaches at Yale, so he has his head firmly planted up his ass and therefore wears night vision goggles at all times...

Barron's: What is your overall thesis regarding China?

Mr. Kane: China has sucked America dry and now needs to find a new source of demand for its cheap junk

Barron's: A lot of Americans think the U.S. should force China to revalue its currency and/or impose trade sanctions

Mr. Kane: That won't fix anything. The problem for the U.S. is that consumers have too much debt and no jobs

Barron's: If the Yuan is raised and trade sanctions are imposed, won't that protect American jobs?

Mr. Kane: No. All of the jobs have already been outsourced, so that would be closing the barn door after the horses are out. Besides that would hurt "consumers" and WalMart

Barron's: Don't consumers need jobs in order to consume?

Mr. Kane: No. They just need credit cards and a strong inclination towards delusion. Listen, you are changing the subject. The bottom line is that we need to find a new country to buy all of this useless junk from China.

Barron's: Can't the Chinese buy their own junk?

Mr. Kane: Get serious. How stupid do you think they are anyway? Besides, they don't have a Middle Class that can be milked dry

Barron's: But what about those 8% economic growth rates for the past decades, didn't that create a middle class?

Mr. Kane: Of course not. That was 8% overall economic growth. Employment has only grown a measly .5% per year. China has 350 mega-billionaires and the rest live on 80 cents per day

The Chinese intentionally specialized in manufacturing so that they wouldn't have any labour issues and could swap out workers at will.

Barron's: So wouldn't raising the Yuan actually help the Chinese by increasing workers' purchasing power and helping to create a middle class? At the same time, wouldn't that reduce their reliance on exports and redress the trade imbalances with the U.S.?

Mr. Kane: Well, that's one way of doing it, but I don't endorse that method. After all, that would increase costs for the jobless U.S. consumers I was mentioning earlier, but worse yet, it could lower returns on investment and hence stock market prices. I prefer to hang my hat on this yet undefined and totally fantastical delusion that endogenous (internal) demand will appear out of nowhere.

Barron's: So, if there is no middle class, then why is there so much investment in infrastructure?

Mr. Kane: That's stimulus. After the 2008 debacle, it became clear the U.S. could no longer support the Chinese economy on its own, so the Chinese Government invested its trillions of reserves gained by manipulating its currency, on infrastructure.

You know - bridges to nowhere. repaving new roads. Similar to the Obama stimulus.

Barron's: And what happens when investors realize that there is way too much capacity in commercial and residential property units?

Mr. Kane: As long as no one runs for the exits, everything will be just fine. At the .5% growth in the labour market that I mentioned previously, it will only take about 25 years to work off the excess capacity, assuming the economy stays strong during that entire time..

Barron's: So remind us again why the U.S. should continue to sponsor the Chinese "miracle"?

Mr. Kane: Obviously, because if sanctions are imposed or the currency is raised, that would lead to the "nuclear' scenario:

1) Everyone will realize that the Chinese economy and the trade relationship with the U.S. is (one of) the biggest Ponzi Schemes ever created

2) The Chinese will stop buying dollars and Treasuries, the dollar will tank, and U.S. markets will collapse

3) Chinese markets will collapse, there will be mass unemployment and China will revert from Fascism back to Communism, which is not one of the "isms" America endorses

The worst part of course is that Wall Street won't get its full 2010 bonus...

Barron's: So basically China has a gun to America's head

Mr. Kane: No. China and America have economic ICBMs pointed at one another with enough delay to ensure Mutual Assured Destruction

Barron's: Is China an environmental catastrophe?

Mr. Kane: It's not as bad as it's made out to be. As long as you wear a fully enclosed gas mask with oxygen tank, a lead radiation shielding suit, eat only imported food, and sleep in a hyperbaric chamber, your chance of contracting severe carcinoma is roughly 45% over 5 years...

Barron's: What about all of these workers at manufacturing plants who are committing suicide. Does that concern you at all?

Mr. Kane: No, not at all. We gave everyone a 20 cents per day raise - which is 25%! Then we had trampolines installed around all of our manufacturing plants, so workers can no longer jump to their deaths. The bonus is that they have something fun to do during their 10 minute lunch break

Barron's: In all of your time in China, what surprised you the most?

Mr. Kane: The thing that surprised me the most was the breadth of the progress...

Barron's: But I thought they don't have a middle class and most people are wage slaves

Mr. Kane: Right. I meant the breadth of progress across the top .1% of wealthy University students

Barron's: So, to wrap up, in a nutshell what you are saying is that the politicians - Obama and company, should continue to ignore the trade and currency imbalances that have been accumulating for years, and pretend that everything will work itself out ok in the end?

Mr. Kane: Well, at least until December 31st, bonus time. I haven't really thought through what should happen after that...

Barron's: Alrighty then. Thanks for your time.

.

I took the liberty of paraphrasing the interview, both to save time and to cut out all of the extraneous bullshit and get down to the key message. If you want to read the obfuscated (actual) version, it's here.

What you read below is FICTIONAL (Kind of). I changed the name of the interviewee to protect the "innocent"...

Barron's: Mr. CF Kane is an expert in Chinese affairs, having racked up 1.2 million frequent flyer miles observing the economy from 80,000 feet and from the comfort of the First Class Lounge at Shanghai International.

He also teaches at Yale, so he has his head firmly planted up his ass and therefore wears night vision goggles at all times...

Barron's: What is your overall thesis regarding China?

Mr. Kane: China has sucked America dry and now needs to find a new source of demand for its cheap junk

Barron's: A lot of Americans think the U.S. should force China to revalue its currency and/or impose trade sanctions

Mr. Kane: That won't fix anything. The problem for the U.S. is that consumers have too much debt and no jobs

Barron's: If the Yuan is raised and trade sanctions are imposed, won't that protect American jobs?

Mr. Kane: No. All of the jobs have already been outsourced, so that would be closing the barn door after the horses are out. Besides that would hurt "consumers" and WalMart

Barron's: Don't consumers need jobs in order to consume?

Mr. Kane: No. They just need credit cards and a strong inclination towards delusion. Listen, you are changing the subject. The bottom line is that we need to find a new country to buy all of this useless junk from China.

Barron's: Can't the Chinese buy their own junk?

Mr. Kane: Get serious. How stupid do you think they are anyway? Besides, they don't have a Middle Class that can be milked dry

Barron's: But what about those 8% economic growth rates for the past decades, didn't that create a middle class?

Mr. Kane: Of course not. That was 8% overall economic growth. Employment has only grown a measly .5% per year. China has 350 mega-billionaires and the rest live on 80 cents per day

The Chinese intentionally specialized in manufacturing so that they wouldn't have any labour issues and could swap out workers at will.

Barron's: So wouldn't raising the Yuan actually help the Chinese by increasing workers' purchasing power and helping to create a middle class? At the same time, wouldn't that reduce their reliance on exports and redress the trade imbalances with the U.S.?

Mr. Kane: Well, that's one way of doing it, but I don't endorse that method. After all, that would increase costs for the jobless U.S. consumers I was mentioning earlier, but worse yet, it could lower returns on investment and hence stock market prices. I prefer to hang my hat on this yet undefined and totally fantastical delusion that endogenous (internal) demand will appear out of nowhere.

Barron's: So, if there is no middle class, then why is there so much investment in infrastructure?

Mr. Kane: That's stimulus. After the 2008 debacle, it became clear the U.S. could no longer support the Chinese economy on its own, so the Chinese Government invested its trillions of reserves gained by manipulating its currency, on infrastructure.

You know - bridges to nowhere. repaving new roads. Similar to the Obama stimulus.

Barron's: And what happens when investors realize that there is way too much capacity in commercial and residential property units?

Mr. Kane: As long as no one runs for the exits, everything will be just fine. At the .5% growth in the labour market that I mentioned previously, it will only take about 25 years to work off the excess capacity, assuming the economy stays strong during that entire time..

Barron's: So remind us again why the U.S. should continue to sponsor the Chinese "miracle"?

Mr. Kane: Obviously, because if sanctions are imposed or the currency is raised, that would lead to the "nuclear' scenario:

1) Everyone will realize that the Chinese economy and the trade relationship with the U.S. is (one of) the biggest Ponzi Schemes ever created

2) The Chinese will stop buying dollars and Treasuries, the dollar will tank, and U.S. markets will collapse

3) Chinese markets will collapse, there will be mass unemployment and China will revert from Fascism back to Communism, which is not one of the "isms" America endorses

The worst part of course is that Wall Street won't get its full 2010 bonus...

Barron's: So basically China has a gun to America's head

Mr. Kane: No. China and America have economic ICBMs pointed at one another with enough delay to ensure Mutual Assured Destruction

Barron's: Is China an environmental catastrophe?

Mr. Kane: It's not as bad as it's made out to be. As long as you wear a fully enclosed gas mask with oxygen tank, a lead radiation shielding suit, eat only imported food, and sleep in a hyperbaric chamber, your chance of contracting severe carcinoma is roughly 45% over 5 years...

Barron's: What about all of these workers at manufacturing plants who are committing suicide. Does that concern you at all?

Mr. Kane: No, not at all. We gave everyone a 20 cents per day raise - which is 25%! Then we had trampolines installed around all of our manufacturing plants, so workers can no longer jump to their deaths. The bonus is that they have something fun to do during their 10 minute lunch break

Barron's: In all of your time in China, what surprised you the most?

Mr. Kane: The thing that surprised me the most was the breadth of the progress...

Barron's: But I thought they don't have a middle class and most people are wage slaves

Mr. Kane: Right. I meant the breadth of progress across the top .1% of wealthy University students

Barron's: So, to wrap up, in a nutshell what you are saying is that the politicians - Obama and company, should continue to ignore the trade and currency imbalances that have been accumulating for years, and pretend that everything will work itself out ok in the end?

Mr. Kane: Well, at least until December 31st, bonus time. I haven't really thought through what should happen after that...

Barron's: Alrighty then. Thanks for your time.

.

Labels:

China,

Ponzi Scheme

Monday, September 27, 2010

A Clockwork Orange

"...our wisdom, too, is a cheerful and a homely, not a noble and kingly wisdom; and this, observing the numerous misfortunes that attend all conditions, forbids us to grow insolent upon our present enjoyments, or to admire any man's happiness that may yet, in course of time, suffer change. For the uncertain future has yet to come, with every possible variety of fortune..." - Solon

Amazing to believe that this incredibly astute and honest observation was from 2500 years ago. The majority of the "elite" running the present day Idiocracy never stop long enough to question the hubris of their own inane decisions - bad assumptions built on a pyramid of other bad assumptions. Similar to conditions that attended during the Dark Ages after the Fall of Rome, science and culture are now entering secular decline, as subjectivity and theology are on the rise. The only known antidote for anarchy is religion (i.e. mind control), and therefore we will soon receive both (anarchy/theology) in large doses.

We are on the verge of experiencing a monumental transfer of power from the 50+ Baby Boomer generation which has presided over the age of decadence, greed and hedonism that started in the late 1960s. Consider this last forty year period the Age of Greed. What we are now entering is the Age of Fear. What is needed in this new age is a set of tools far different than those found valuable in the prior age. Power in this age will be held by young men between the ages of 18 and 35 who have copious amounts of testosterone, an underdeveloped conscience, and tremendous cardio capacity, attributes amply exhibited in the UFC generation. Historically, these have been the Wild Boys who have ruled (violently) during ages of turmoil, for obvious reasons. The Boomers will quickly yield control albeit unwillingly, having long since grown soft and decadent. These 50-70 year old over-fed comfort seekers raised during the longest stretch of prosperity in human history will be no match for the new younger breed that ironically the Boomers themselves will have raised. In short, the Boomers were raised to believe in the triumph of optimism over reality, "vision" over commonsense. Poor qualities to bring to a knife fight.

Combined with the predilection towards messianism and religion described above, there will be new "Taliban" springing up everywhere across the globe. Be they Muslim, Christian, Sikh or otherwise, they will all exhibit very similar goals and methods. This process is already well underway not just in the Middle East, but here in the U.S. with the burgeoning militia movement.

The bottom line is that some people are prepared for what comes next, others, not so much...

Combined with the predilection towards messianism and religion described above, there will be new "Taliban" springing up everywhere across the globe. Be they Muslim, Christian, Sikh or otherwise, they will all exhibit very similar goals and methods. This process is already well underway not just in the Middle East, but here in the U.S. with the burgeoning militia movement.

The bottom line is that some people are prepared for what comes next, others, not so much...

Labels:

Anarchy,

Ponzi Scheme,

Taliban

Subscribe to:

Comments (Atom)