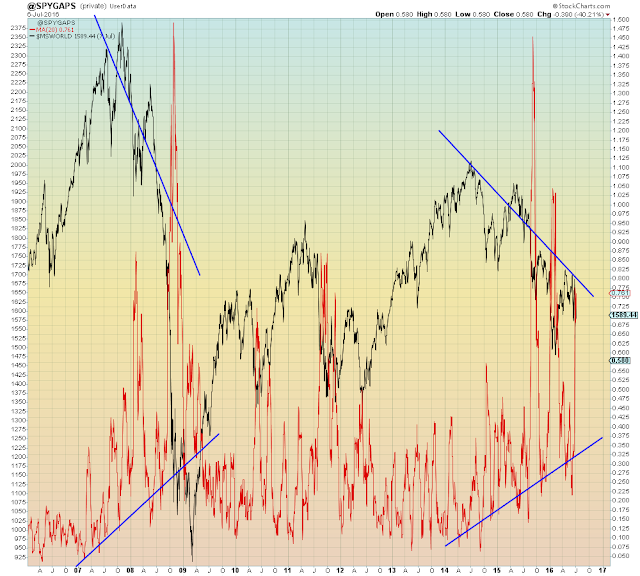

S&P (red) with Global Dow:

Is it harder to believe that crash will happen or won't?

"CasinoNomics is an idiot feedback loop, until the last fool is found"

We learned today that overnight risk imported from other regions is "bullish" for the S&P, because what else could it be?

"It’s an open-and-shut case: The stock market’s near-term prospects are good."

All of the risks from Asia, Europe, oil, Global Financials, Global slowdown, deflation, and Brexit coalesced this week. So gamblers took refuge from extreme risk, in the S&P 500. Because "there is no alternative..."

The Yen is strengthening at a rate last seen post-Lehman and prior to that, the Asian Financial Crisis.

That's all...

This week the Yuan weakened the most since the January and August meltdowns. Closing far below both of those levels.

The Chinese government made good on last week's promise to weaken the Yuan towards 6.8 by the end of the year, by covering half that distance in one week...

Aussie / JPY broke to new lows showing the strain being put on China capital outflows...

China's FX reserves miraculously increased in June, all due to the rise in value of the Yen aka. currency translation...

We've seen this movie before (two weeks ago):

The last time Financials led the market, the casino imploded due to "Brexit"...

This time we only have Carry trades, European banks, oil, and China to worry about...

And U.S. Banks

Transports are also leading, sort of...

Again, perspective is key

This what's known as "Dow Theory Mega Non-Confirmation"

Oil followed deflation lower, as usual...

The global hunt for yield went full retard...

Amazon went parabolic this week:

Whereas Sears tracked Deutsche Bank, Global Trade, U.S. Treasuries, and Credit spreads into the dirt...

All very bullish of course...

Biotech played catch-up

And so did Natural Gas

The German Dax bounced off of its 200 week moving average again today, closing 1.8% above it (not shown):

Black Swan diving into pavement visualized...

This can only end one way, and the timezone has already been established...when Etrade is closed for business...

Mind the Gaps

S&P ETF opening downside gaps (20 dma)

With World ex-U.S.:

"It’s an open-and-shut case: The stock market’s near-term prospects are good."