A belief in corporate Disney World is a belief in nothing. Instant gratification is the only "value" this shrink-wrapped Idiocracy has the energy left to pursue...

Global capitalism can be summarized thusly: take from the poor, give to the rich. Robbing Peter to pay Paul. As Zerohedge points out, Republicans still believe in the "system", Democrats not so much. Mark that down to the power of exceptional brainwashing. Loyal defenders of the empty values. Recycling the exact same lies over and over again, each time expecting a different result. Now placing their fate in the hands of a known con man.

"50% of Republicans think the economy is fair to most Americans, but 82% of Democrats think it unfairly favors powerful interests."

BLS: Labor's Share Of The Economy Has Collapsed

"The labor share—the fraction of economic output that accrues to workers as compensation in exchange for their labor—was thought by some early-to-mid-20th-century economists to be relatively stable. Yet its decline during the second half of the 20th century and on into the early years of the 21st century has shown otherwise"

This collapse in labor's share of the economy is why I started blogging. After 9/11, corporate Shock Doctrine ravaged the U.S. economy, as real worker incomes were outsourced and replaced with debt. Instead of real prosperity, the American Dream was now based upon rented prosperity. After the housing crash, the bailout of financial malfeasance invited still more Shock Doctrine criminality. Each time, billionaires took a bigger chunk of the pie and lent it back to the masses. Debt has now been fully conflated with "wealth". Which is why a full decade later and financial prospects have not improved for the average American:

"More than a decade into the longest economic expansion on record, almost two-fifths of people said in a new Bankrate poll that their main financial priority was just keeping their heads above water on living expenses rather than saving money."

"This is the greatest economy in U.S. history"

Along with the empty promises come the empty values and empty way of life. Passed down to the children, merely to keep this morally bankrupt gong show going for a few years longer:

Continuous bailouts and tax cuts for the rich

Indentured servitude for everyone else

Debt as "GDP"

Printed money to inflate fake wealth

Non-stop lying to be "great again"

De-regulated corruption

Frat boys on the Supreme Court

Warehousing babies in cages

Rigging elections

Strip-mining social programs

Infotainment spectacle

Kardashian-emulated narcissism

Competitive consumption

Device addiction

Rampant obesity

Environmental desecration

Mass shootings

Biblical weather events

Opioid-assisted suicide

How did we get here? Bailouts for proven criminals and exceptional mythology, that's how.

Don't believe anyone who says the bailout was "paid back".

What has been paid so far is merely a down payment on what is owed for a belief in nothing. The carbon tax is due.

The globalized economy is a colossal Ponzi Scheme in which the vast majority survive on the bread crumbs falling off the table. The possibility of 7 billion people achieving a consumption-oriented lifestyle is zero, so the World Bank conveniently set the poverty line at $1.25/day to legalize global slavery. As long as someone else's children are doing the suffering, it's "all good". Post-2008, this illusion was extended merely by plundering all future generations.

Thursday, September 26, 2019

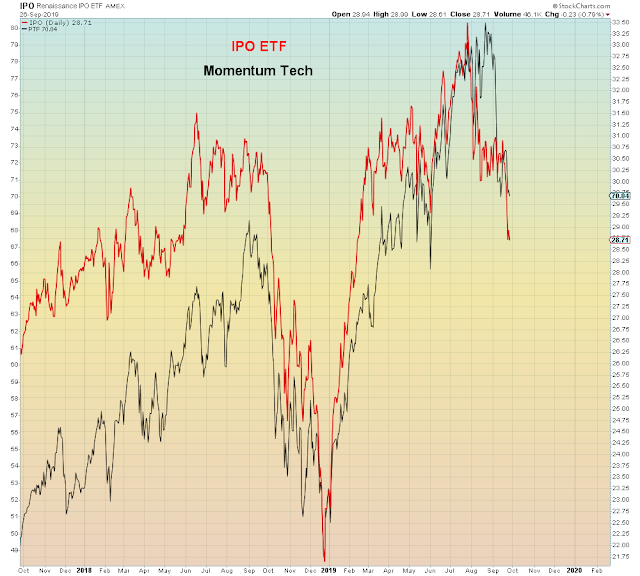

Apocalyptic Bearish: The End Of Disney World

It's quite a magic trick to keep the Dow pinned to all time highs while everything implodes under the surface. Now that the IPO market is breaking, no need to maintain this algo-fabricated illusion any longer. MAGA is this era's imagined reality. Those who didn't learn their lesson in 2008 have a much better lesson in store this time around...

Global coordinated easing on a scale last seen ten years ago has sent gamblers scouring the globe for yield. Making up stories as they go. $200+ trillion worth of lies, but who's counting. Every economist, stock analyst, and pundit who isn't pounding the table bearish right now is either a total fucking moron or a criminal accomplice. This is the inconvenient end of Disney World.

"Today there is no central bank stimulus program that our Disney markets will not consider to be successful"

For a decade straight, the masses have been guzzling central bank Kool-Aid by the gallon. To the point where recession itself is now viewed as a buying opportunity. After all, what can be better for "stocks" than a reduced discount (interest) rate. Leaving aside all risk of default.

Gamblers have been well-conditioned to front-run central banks. Now, no longer even pausing to consider what would happen if central bank stimulus fails to reflate the economy.

"WASHINGTON (Reuters) - A flurry of interest rate cuts by the U.S. Federal Reserve and a host of other central banks marks the broadest shift in global monetary policy since the depths of the financial crisis in 2009"

It’s the type of coordinated change that characterized how central banks responded to the financial crisis with across-the-board rate cuts, dollar swap lines extended by the U.S. central bank to other countries, and a series of other exceptional steps to keep the world economy afloat."

On the chart below we see the problem:

This has been a larger coordinated easing than what took place in 2016, yet German yields are still near record lows. European economic data continues to deteriorate. Meanwhile, gamblers have been front-running central banks all year long, whereas in 2016, they didn't start buying until the coordinated easing took place:

“Monetary policy has its limitations and we do not assume that this impulse will create additional investments, nor will it incentivize people to consume more,” he said. “Actually, it could result in a lot of uncertainty where people actually increase their savings and they will certainly not invest more.”

The amount of complacency right now is staggering, given the economic conditions, the trade war, and Brexit which reaches a critical deadline at the end of October:

"The House of Commons — one of the most venerated democratic institutions in the world — descended into an atmosphere of vitriol and disbelief, as enemies and allies alike condemned language used by Prime Minister Boris Johnson as he continues in his quest to take the United Kingdom out of the European Union by Oct. 31."

Risks have been accumulating steadily in the background. As the dominoes fall, the coiled spring winds tighter and tighter.

The burden of proof always on those of us who don't believe in money printing as the secret to effortless wealth.

Microsoft is now history's largest stock by market cap. And it's the only large Tech stock still "working"

Do you remember when Wall Street imploded the stock market in late September 2014 with the Alibaba IPO?

I do. And apparently Cramer remembers too.

Here is what he said in March of this year:

"If there isn't enough new capital that can be put into IPOs in the coming quarters, investors may start selling their existing holdings"

Ignored again.

It turns out that Jimmy Kunstler isn't the only one who is petrified of women wearing yoga pants.

He has good company with organized criminals:

"Under Trump, criminality was legalized"

Global coordinated easing on a scale last seen ten years ago has sent gamblers scouring the globe for yield. Making up stories as they go. $200+ trillion worth of lies, but who's counting. Every economist, stock analyst, and pundit who isn't pounding the table bearish right now is either a total fucking moron or a criminal accomplice. This is the inconvenient end of Disney World.

"Today there is no central bank stimulus program that our Disney markets will not consider to be successful"

For a decade straight, the masses have been guzzling central bank Kool-Aid by the gallon. To the point where recession itself is now viewed as a buying opportunity. After all, what can be better for "stocks" than a reduced discount (interest) rate. Leaving aside all risk of default.

Gamblers have been well-conditioned to front-run central banks. Now, no longer even pausing to consider what would happen if central bank stimulus fails to reflate the economy.

"WASHINGTON (Reuters) - A flurry of interest rate cuts by the U.S. Federal Reserve and a host of other central banks marks the broadest shift in global monetary policy since the depths of the financial crisis in 2009"

It’s the type of coordinated change that characterized how central banks responded to the financial crisis with across-the-board rate cuts, dollar swap lines extended by the U.S. central bank to other countries, and a series of other exceptional steps to keep the world economy afloat."

On the chart below we see the problem:

This has been a larger coordinated easing than what took place in 2016, yet German yields are still near record lows. European economic data continues to deteriorate. Meanwhile, gamblers have been front-running central banks all year long, whereas in 2016, they didn't start buying until the coordinated easing took place:

“Monetary policy has its limitations and we do not assume that this impulse will create additional investments, nor will it incentivize people to consume more,” he said. “Actually, it could result in a lot of uncertainty where people actually increase their savings and they will certainly not invest more.”

The amount of complacency right now is staggering, given the economic conditions, the trade war, and Brexit which reaches a critical deadline at the end of October:

"The House of Commons — one of the most venerated democratic institutions in the world — descended into an atmosphere of vitriol and disbelief, as enemies and allies alike condemned language used by Prime Minister Boris Johnson as he continues in his quest to take the United Kingdom out of the European Union by Oct. 31."

Risks have been accumulating steadily in the background. As the dominoes fall, the coiled spring winds tighter and tighter.

The burden of proof always on those of us who don't believe in money printing as the secret to effortless wealth.

Microsoft is now history's largest stock by market cap. And it's the only large Tech stock still "working"

Do you remember when Wall Street imploded the stock market in late September 2014 with the Alibaba IPO?

I do. And apparently Cramer remembers too.

Here is what he said in March of this year:

"If there isn't enough new capital that can be put into IPOs in the coming quarters, investors may start selling their existing holdings"

Ignored again.

It turns out that Jimmy Kunstler isn't the only one who is petrified of women wearing yoga pants.

He has good company with organized criminals:

"Under Trump, criminality was legalized"

Wednesday, September 25, 2019

October Crash, As Usual

September is on average the weakest month of the year for stocks, however, October is the month with all of the biggest crashes (1929, 1987, 1998, 2008)...

This week we're seeing an epic blowoff in criminality. High even by U.S. standards. Faux News bandits just flipped the script from "no collusion" to "collusion as usual". Because in America, the biggest criminals operate in broad daylight.

Which brings us to the final kill, because, who would warn them, fellow criminals? They don't trust anyone who can be trusted. To this profoundly cynical and crass Idiocracy, corruption can only be a fantastic buying opportunity:

This week we're seeing an epic blowoff in criminality. High even by U.S. standards. Faux News bandits just flipped the script from "no collusion" to "collusion as usual". Because in America, the biggest criminals operate in broad daylight.

Which brings us to the final kill, because, who would warn them, fellow criminals? They don't trust anyone who can be trusted. To this profoundly cynical and crass Idiocracy, corruption can only be a fantastic buying opportunity:

“Trump’s approval rating starts this impeachment process near a cycle high"

Indeed.

Speaking of organized crime, America's deathcare syndicate just reached $20k in employer premiums per year for a family. That's the equivalent of $10/hour in (lost) wages, for anyone wondering what happened to the middle class.

Indeed.

Speaking of organized crime, America's deathcare syndicate just reached $20k in employer premiums per year for a family. That's the equivalent of $10/hour in (lost) wages, for anyone wondering what happened to the middle class.

Back to the casino, the Dow has gone nowhere for an entire year, which can only mean one thing: new highs are yet to come:

Enter data mining, last refuge of all perma-bulls. Because the bull argument is that stocks MUST always rally double digits in the 12 months before they peak. Based upon a statistically insignificant seven prior observations.

Deflation is coming in for a hard landing

"Equities have always had a double-digit rally before the economy experiences a downturn.”

Attempting to predict the stock market by looking at the economy is like trying to drive forward by looking through the rear view mirror. Per my previous post, economists were a year late calling the last recession. By which time stocks had already collapsed. Meanwhile, even the data in the article shows that stocks peak ahead of the economy every time.

Only Utilities peak late in the cycle, coincident with the economy:

Only Utilities peak late in the cycle, coincident with the economy:

Enter data mining, last refuge of all perma-bulls. Because the bull argument is that stocks MUST always rally double digits in the 12 months before they peak. Based upon a statistically insignificant seven prior observations.

Here below we see that year over year the Dow is flat. Whereas year to date, the casino is up 20%. It all comes down to whether you see the glass as half full or about to explode. The less information you have before you make that call, the better it will appear to align with past history.

Because any blind man can see that this latest bounce off the 200 day (red line) is weaker than the others:

Oil peaked one year ago:

You wouldn't know there was an attack on the world's largest oil refinery this past week given that oil is ready to final implode. Just in time for human history's largest IPO:

Like the Dow and S&P 500, lower highs for the Tech heavy Nasdaq 100. Every failed test of the 50 day has brought a re-test of the 200 day. If that fails, look out below:

The Russell 2000 is already testing the 200 day, driving the Wednesday "rally"

The Nasdaq Hindenburg Omens were offset from the final decline by two months last year as well:

In the argument that stocks always have a big run prior to the top, really what are we owed?

This week appears to be some sort of an epic blowoff of organized crime:

"Peloton Interactive Inc.’s planned Nasdaq debut on Thursday extends this year’s run of IPOs by so-called unicorns—huge, money-losing firms like Uber Technologies Inc. and Pinterest Inc. The unprofitable members of the 2019 class of IPOs have already raised the most cash of any year since at least 2000"

“These types of names go completely out of favor in a recessionary environment.”

This week appears to be some sort of an epic blowoff of organized crime:

"Peloton Interactive Inc.’s planned Nasdaq debut on Thursday extends this year’s run of IPOs by so-called unicorns—huge, money-losing firms like Uber Technologies Inc. and Pinterest Inc. The unprofitable members of the 2019 class of IPOs have already raised the most cash of any year since at least 2000"

“These types of names go completely out of favor in a recessionary environment.”

Deflation is coming in for a hard landing

The Markets Will Impeach Trump

Unwinding 40 years of failed trade policy while keeping the Dow Twitter-pinned to all time highs is a fool's errand of the highest order. Hence, how Trump got the job. No one else was up to the task...

Trump was so emboldened by openly-accepted Russian election rigging that he recently coerced the Ukraine President into investigating his Democratic political opponent. That's what happens when corruption is left unchecked in a Banana Republican government. Be that as it may, impeachment is merely a slap on the wrist in a country as politically polarized as the U.S. Therefore it will be left to the markets to render final verdict on the MAGA Kingdom.

Trump was so emboldened by openly-accepted Russian election rigging that he recently coerced the Ukraine President into investigating his Democratic political opponent. That's what happens when corruption is left unchecked in a Banana Republican government. Be that as it may, impeachment is merely a slap on the wrist in a country as politically polarized as the U.S. Therefore it will be left to the markets to render final verdict on the MAGA Kingdom.

Like a hammer to the head.

Trump knows this full well, which is why he's tweeting 80 times a week in order to keep the Dow from final exploding. His fallback Twitter position is to claim that a trade deal is just around the corner. Something we've heard for 18 months now. Herein lies the problem for Trump - a trade deal is no longer going to cut it. If he wanted a mere trade deal he could have had one many times over by now. What he needs is a trade war victory, because anything less will be viewed as a political loss and an abject waste of time and money. Unfortunately, China will in no way hand Trump an outright trade war victory, as they view the terms as existentially unacceptable. They are fully ready and willing to drag this out until the election, thereby squeezing Trump under the growing weight of a flagging economy.

Yesterday at the United Nations, like clockwork, Trump turned the heat back up in the trade war. Publicly bashing Beijing just days ahead of the country's seventieth anniversary.

"The comments came during Trump’s long section on China, in which he accused the country of stealing America’s jobs and intellectual property and of stingily refusing to sign a long-sought trade deal with the US. It’s therefore no surprise Trump lumped in Hong Kong to further bash Beijing."

Which means his new comments could open up a further fissure between America and China"

The seeds of this disaster were sown decades ago with the conservative obsession over "Free trade". A mass delusion that Trump's own economic advisor Larry Kudlow supported right up until he got his new job. A failed policy that Trump has fully repudiated. Because in the end it was all merely industrial arbitrage to amplify corporate profit. Without free trade, corporate profits would be a fraction of their current level and U.S. wages would be substantially higher, as they are for example in Germany. The problem was that the U.S. is the only country in the world that actually ever believed in free trade - Japan, China, Germany, India, the Asian Tigers, are all trade Mercantilists:

"Mercantilism is a national economic policy that is designed to maximize the exports, and minimize the imports, of a nation. These policies aim to reduce a possible current account deficit or reach a current account surplus. Mercantilism includes a national economic policy aimed at accumulating monetary reserves through a positive balance of trade, especially of finished goods"

And yet, somehow the prevailing belief among all modern economists is that Mercantilism no longer exists, because it died out decades or even centuries ago. As we didn't learn in 2008, these people are not highly intelligent and even less honest, because the inconvenient fact is that mercantilism remains the prevailing economic ideology today. In a fiat-currency based global economy, what is now valued are not currency reserves, what is prized above all else is technology leadership and the high paying value-added jobs that go along with it. As opposed to burrito assembly lines.

The dangerously delusional belief among Trump acolytes is that the U.S. can't lose the trade war, because China is the sole beneficiary of this imbalanced trading relationshiop:

“This is about shifting the supply chain back to the U.S.”

This naive view ignores the capital flowing into the U.S. to fund Trump profligacy, and it ignores the profits flowing into corporate coffers. Somehow, this never-ending trade war has morphed from a concern over trade deficits a year ago, to a 5g Wireless Tech war earlier this year, to existentional hegemonic control over the planet now.

Sadly, yet inevitably, the workers getting hurt the most are the ones these Keystone Kops say they're trying to protect.

"Friday's jobs report represented another SOS from the manufacturing sector, hard hit by the trade war and slowing global demand. Already in a recession, manufacturers added just 3,000 jobs in August"

"The president came into office offering the hope that we'd see a resurgence of manufacturing in the United States. Now manufacturing is in trouble, and the reasons include trade disputes and tariffs"

Tuesday, September 24, 2019

The Last Bubble: Recession Stocks

First: The Twinkie-in-Chief and his loyal dregs of humanity had nothing better to do today than to troll a 16 year old climate activist with autism. People who treat their own bodies like toxic waste dumps will never give a damn about this planet. Fortunately, Judgment Day appears near at hand for the desecrators...

By the time economists acknowledge recession, the stock market will be substantially lower. In 2008 for example, the stock market was -55% lower...

December 2008:

"The NBER is a private group of leading economists charged with dating the start and end of economic downturns. It typically takes a long time after the start of a recession to declare its start because of the need to look at final readings of various economic measures."

It took a full year for EconoDunces to acknowledge what average Americans already knew. Which shows today's value of a PhD in Economics: $0

Aside from Google search trends, the leading indicator for recession last time was the fact that recession safe havens/low volatility bond proxies - Consumer Staples, Defense stocks, and Utilities were leading the market. Just as they are right now. Today's new highs list is almost entirely safe havens.

Here we see that the top in Utilities stocks peaked coincident with the beginning of recession:

Here we see that "low volatility" bond proxies are up 30% year to date in 2019:

Here we see Southern Company Utility up 45% year to date.

Here we see Tech momentum stocks just broke the 200 day on heavy down volume:

"Low volatility" is yet another example of misleading advertising merely designed to con the masses

Subscribe to:

Posts (Atom)