For the past decade, the U.S. stock market had a party of one while the rest of the world went nowhere.

The world puked back all Trump's bullshit in 2018

The S&P is carving out a lopsided head and shoulders top, deja vu of ROW 2008:

Corporations have used stock buybacks to prop up stocks during the post-2008 fake recovery, allowing insiders to cash out at public expense. Now, a full decade later, various politicians in both parties want to put a stop to this pump and dump scheme. Because what the wise man does at the beginning, the fool does at the end.

First some perspective:

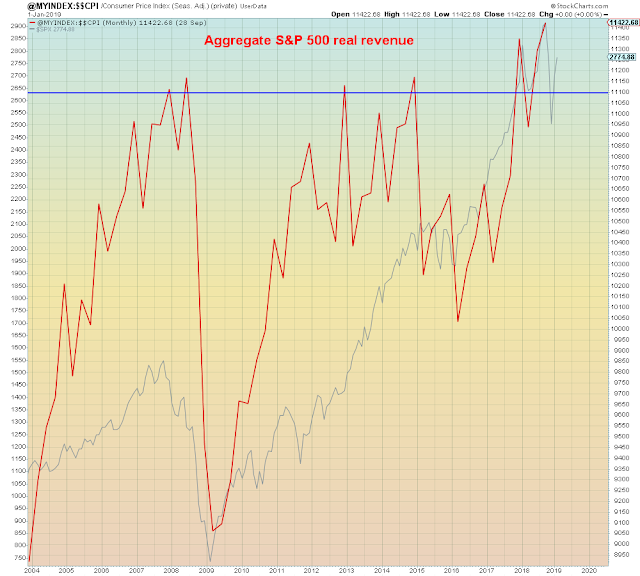

No real recovery means no real revenue.

Real (inflation-adjusted) aggregate S&P 500 revenue has been stagnant for a decade, only breaking out since the tax cut:

Aggregate revenue is per share S&P 500 revenue * S&P divisor

Since there was no real revenue, the only way to expand profit per share was to buy back stock and increase profit margins via continual "right sizing". Squeezing the middle class into oblivion.

Here we see S&P net profit margins calculated as earnings per share / sales per share. Again, big breakout compliments of the tax cut:

CEOs know that their historically unprecedented plundering of the U.S. economy is ending. So their window of opportunity to get out is closing. What to do but max out stock buybacks.

The rats are leaving the sinking ship:

"Companies announced repurchases totaling just over $1 trillion in their own stock during 2018."

Bank of America Merrill Lynch estimates repurchases are up 91 percent year over year"

What the fool does at the end of the cycle:

"Stock buybacks are deeply cyclical in nature, so the fact that their size has finally drawn DC's attention is a worrying sign of a corporate profit top"

Apple is a reminder why no amount of buyback alchemy can offset falling sales. Apple alone accounted for 10% of S&P 500 buybacks during 2018, yet finished the year lower:

Record stock buybacks in 2018 yielded the worst year for the market since 2008:

CEOs top ticked the market in September, nailing the head of the head and shoulders top:

The neckline indicates a decline to the 2016 lows. That is not a prediction, merely an observation.

I personally predict a far larger decline. Unwinding 10 years of fraud and alchemy.

Human history's largest pump and dump is ending.

It appears that Donny's shutdown delayed some data releases.

Just now catching up:

https://fred.stlouisfed.org/graph/?graph_id=543128