We're surrounded by natural born deceivers, Globalization's main export. Sociopaths who will say anything to keep this shit show going, one, more day. Being honest was never an option for the human bulldozers...

"Great news, no economy"

The people at the top are the only voices that are heard, the people monetized by Globalization, don't exist. The role of survivor bias in this lurching cluster can't be overstated. The media exists in a bubble of fake optimism funded by capital which continually moves to ever-higher ground as the flood waters rise. Billy Gates tells us the "World has never been better" because his wealth is indexed to Central Bank balance sheets. He is "protected" by the Davos-connected Central Planning for Billunaires country club. The fate of the rest of humanity is of no concern to someone who makes every minute what most people make in a year, decade, lifetime... "Great news, no economy"

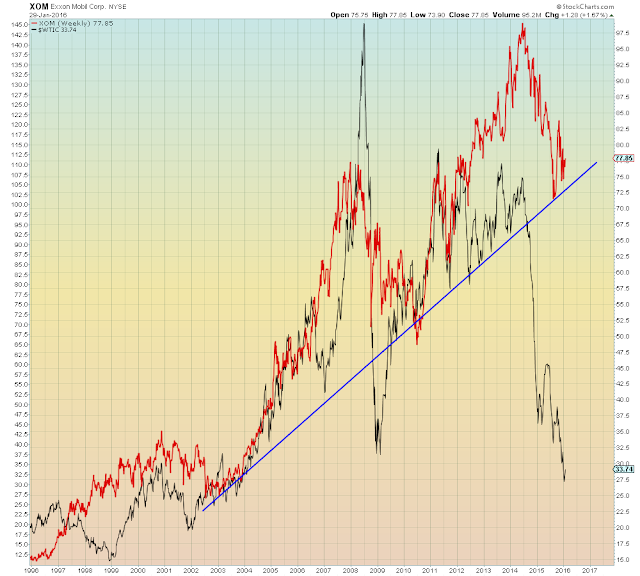

Nevertheless, this aura of fake invincibility has an aura of fetid inevitability. If the Central Banksters are infallible, then why are so many markets already in bear territory?

Jan. 21, 2016:

Why? Because the only way this could end is if the Bernie Madoffs at the top couldn't see it coming. Madoff didn't see it coming, they don't see it coming. This is not 2008's Big Short, this is The Big Long. We are all being tempted to bind our fate 100% to Third World poverty which is now flooding the planet...Negative interest rates are just a bigger noose.

China:

Hang Seng (Hong Kong):

Canadian stocks:

Japan Nikkei

To believe the deceivers, the world was just "saved" by Japan...

Because Japan's main export for 25 years has been fake optimism...