Last night, Steve Jobs' errand boy, Tim Cook, got roasted on 60 Minutes for tax evasion and mass outsourcing. His response as to why Apple outsources everything to China, is because they can't find the right skills in the U.S.

In other words, corporations outsourced all of the skills, and now they can't find any. It's human history's biggest circle of jerks:

Apple's profit margins are under a daily magnifying glass by armies of Wall Street analysts, with each minor change causing gyrations in the stock - and 99% of Tim Cook's compensation is tied to the stock. BUT, the cost advantage has nothing to do with it...sure:

Apple is currently trading like the brains behind the company left the building four years ago. When Steve Jobs died, the accountants took over, and they "invented" iPhoney6++:

As it is in the Energy industry right , corporate Mad Men still have literally no clue they are putting their own companies out of business en masse...Why? Because today's self-nominated "best and brightest", are the biggest dumbfucks on the planet.

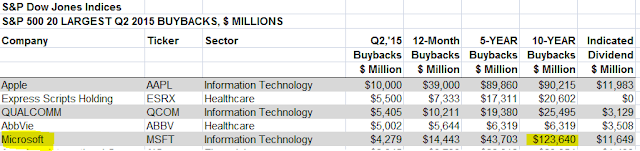

Corporate profits: