All support has been eliminated from the cheap tent...

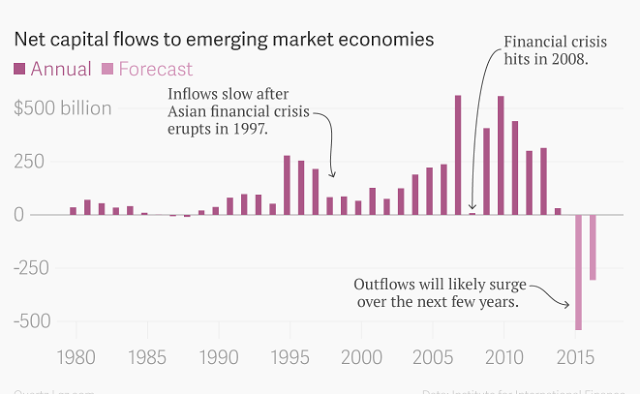

Shit companies have been hiding behind stock buybacks while earnings growth was falling, now that charade is ending, amid tanking revenue and profits:

"stocks with the highest buyback ratios have been falling behind the broader market. Underperformance of this index coincided with a market top before two market crashes"

Skynet is hiding in the last few mega-caps as it did in July...

S&P equal cap weighted / market cap weighted

And remember this asinine situation...

Walmart versus Amazon?

One has profits without revenue growth. The other has revenue growth without profits i.e. the one going vertical...

Then I showed Kohl's, Macy's, Sears, JCPenny also tanking...

Via: "Use discretion when picking consumer stocks"

This is what is happening across the entire retail sector ex-Amazon, Home Depot and other mega-caps:

Equal weight retail / market cap weighted retail:

Versus Amazon