In a nutshell, this past two week manic melt-up was low volume short-covering at the end of the financial cycle. As indicated by the S&P / Russell ratio (red). Amid IPO stocks playing catch-up along with left-for-dead retail junk:

You never want to see The Gap (Stores) leading the market. Because we've seen this movie before...

Central Banks have succeeded in totally divorcing the Financial cycle from the Economic cycle. EconoDunces who as a group have never once predicted the onset of recession, are now flying blinder than ever. Therefore, the word of the day is "Don't Fight the Idiocracy".

1) Monetary Policy drives the economy

2) Monetary Policy drives risk markets

3) The Economy drives stocks

In other words we challenge the belief that Central Banks have any remaining control over this disaster. However, worse yet, they have given the illusion of control while having none whatsoever...

Fallacy #1: Monetary Policy drives the Economy:

Not withstanding seven years of non-stop accommodation, Europe, Japan, and China are at maximum Monetary Easing. While the U.S. remains stuck at 0%.

This chart shows Global GDP growth (red line) with U.S. recession stocks. Clearly GDP is wholly unresponsive to Monetary stimulus. And U.S. stock market rotation is "end of cycle". More on that below...

Fallacy #2: Monetary Policy drives risk markets.

If this were true, then Japan would have the highest stock market in world history. Instead, the Nikkei is at 1986 levels in renewed bear market. China would be the next highest, instead of being down -45%. The European stock market would be the next highest, instead of being down -18%:

Fallacy #3: The Economy drives stocks

Here, EconoDunces are both right and wrong. They are right to draw the correlation, however, they are wrong in assuming that the economy leads stocks - it's ALWAYS been the other way around - stocks lead the economy. In this cycle, as recently noted on ZeroHedge, stocks are currently several decades ahead of the economy, and diverging with each passing day. Or, see first chart above, wherein U.S. recession stocks are the last leading sector while Global GDP is declining.

Meanwhile, according to the U.S. government, this year's deficit will be almost a full percentage point above GDP. The last time the deficit eclipsed GDP was 2008, the first full year of recession in the last cycle...

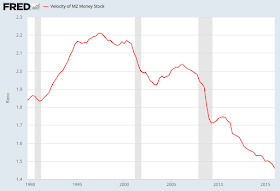

The inefficacy of Monetary Policy can be seen via the Velocity of Money, which has been falling for six years straight...