Way back in late January of this year, world's largest hedge fund manager, Ray Dalio, warned that the casino was about to surge and anyone owning cash was a putz. The casino promptly surged lower -10%, the most in two years. This week he was out again, saying that there is no sign of a bubble or a recession. He has thereby confirmed that the only bubble left is the dumb money bubble:

"Global sales of smartphones to end users totaled nearly 408 million units in the fourth quarter of 2017, a 5.6 percent decline over the fourth quarter of 2016, according to Gartner, Inc. This is the first year-on-year decline since Gartner started tracking the global smartphone market in 2004."

"We're going to need another toy to keep the sheeple from rioting"

Apple is using higher unit revenue to paper over unit sales collapse.

It's a tried and true way to fail:

"Nokia waited too long in the days of Symbian. Palm waited too long. Motorola, Siemens, [BLACKBERRY/RIM] and other trend setters all gorged on profits and became too slow to react as sales and revenue fell away at an increasing rate. They were not saved by high marketing speeds, new innovations in product lines, or bolstering the existing offerings as a financial base to protect themselves against new entrants."

But here is where it gets interesting:

Good times.

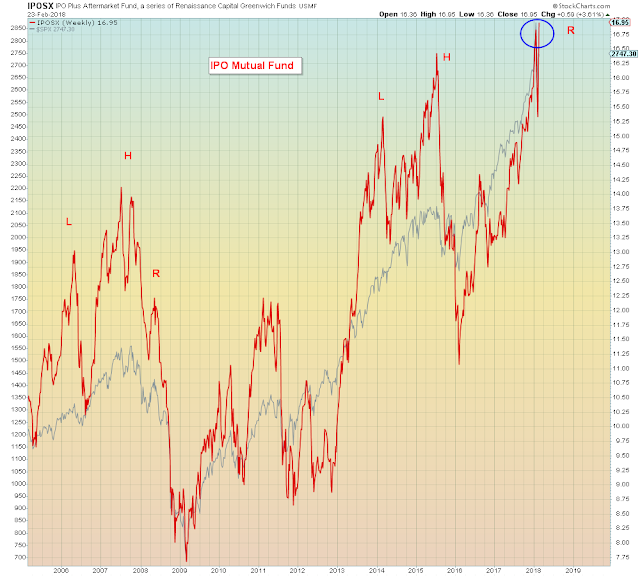

While we're on the subject of peak phoney, I noticed that the Anti-Social Media ETF made a new high this week:

Which is interesting because it peaked after the S&P in 2016 as well:

Which is all the more interesting because Kylie Jenner imploded Snapchat this week by saying that it's not cool anymore. Or something like that.

Recall that Snapchat went public exactly one year ago this coming week, and it was Wall Street's biggest fucking debacle since Alibabylon. Both of which tanked the S&P...

But who needs Snapchat when Twitter is going parabolic instead. I have news for people like Wally Buffett who think that the stock market has anything whatsoever to do with economic fundamentals: Skynet is an asset levitation program. And it doesn't give a flying fuck what pile of shit has to be moon launched to keep this circus going...

The Twitter safe haven doesn't work. Don't ask me how I know...

This low volatility dumb money trap was only ever about one thing.

Wall Street

"Dropbox has been one of the most anticipated tech IPOs for several years now"